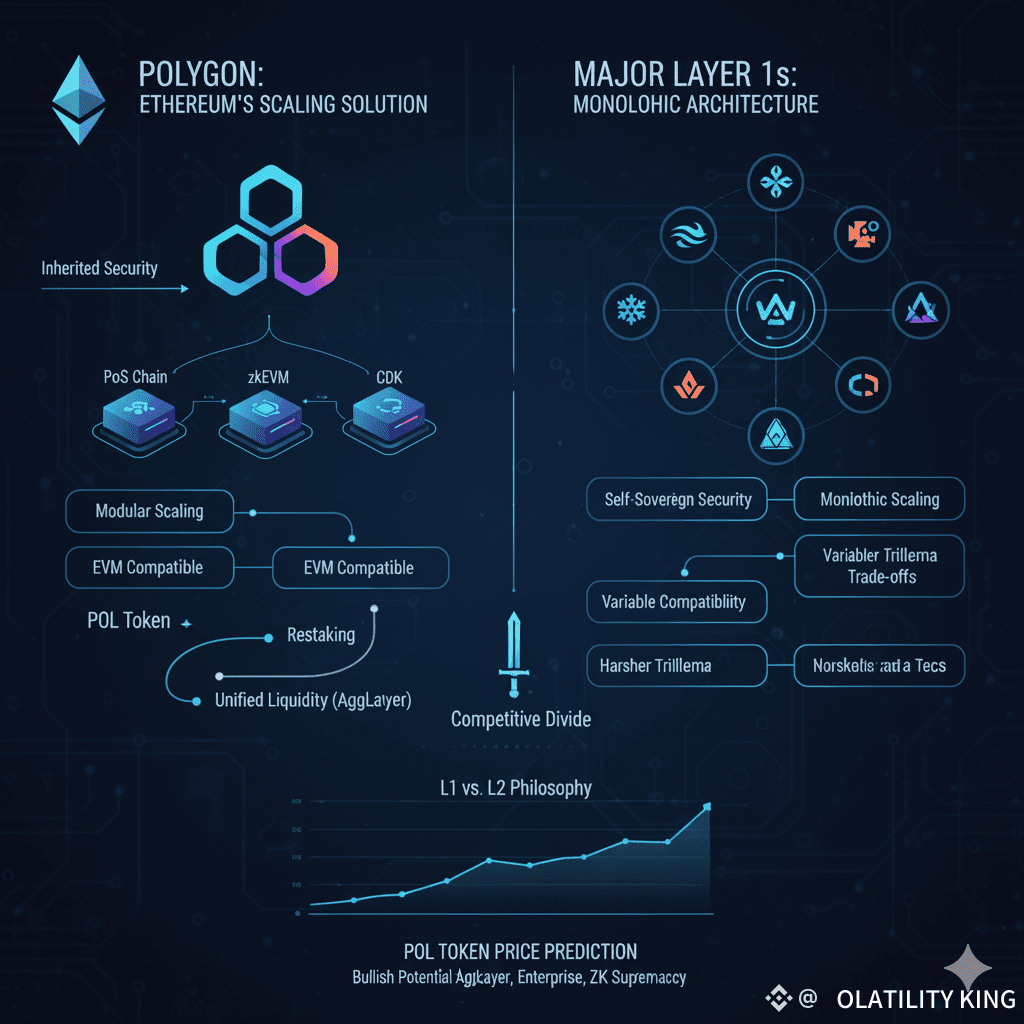

Position & Core Strategy

Polygon has cemented itself as a key player in blockchain by enhancing Ethereum rather than competing with it. As an Ethereum Layer 2 (L2) solution, it focuses on scaling while maintaining Ethereum’s security and decentralization. In contrast, major Layer 1 (L1) chains like Solana, Avalanche, and Cardano aim to achieve scalability through self-contained ecosystems that do not rely on Ethereum.

Philosophical Divide: L1 vs. L2

The competition highlights a crucial difference in design philosophy — the Blockchain Trilemma of Security, Scalability, and Decentralization.

Security: Polygon inherits Ethereum’s battle-tested security, while L1s must secure themselves through independent validator networks, which can become centralized.

Scaling: Polygon adopts a modular approach using multiple scaling tools like zkEVM, CDK, and AggLayer. L1s rely on monolithic designs focused on optimizing a single layer for speed.

EVM Compatibility: Polygon is fully EVM-compatible, making migration easy. Some L1s like Avalanche’s C-Chain are EVM-ready, but others like Solana use entirely new languages such as Rust.

Ecosystem & Adoption Advantage

Developer Ecosystem: Polygon benefits from Ethereum’s vast developer network, accelerating innovation and dApp deployment.

Enterprise Integration: Partnerships with major brands give Polygon an edge in enterprise adoption, offering low-cost and scalable Web3 access.

Unified Liquidity via AggLayer: The upcoming Aggregation Layer connects Polygon’s various chains into one ecosystem, rivaling Cosmos and Polkadot in multi-chain connectivity.

Technological Edge

ZK Innovation: Polygon’s $1B investment in Zero-Knowledge technology and zkEVM rollout positions it as a leader in next-gen scaling.

Security Over Speed: While Solana achieves extreme speed, Polygon emphasizes Ethereum-level trust and stability.

Reliability: Polygon’s architecture has shown stronger uptime than many fast but outage-prone L1s.

💰 POL Token Outlook

Bullish ($3.50–$5.50 by 2027): Strong AggLayer adoption and enterprise growth.

Neutral ($1.50–$2.50): Moderate L2 competition, slower zk adoption.

Bearish (Below $1.00): Security issues or Ethereum’s own scaling negating L2 need.

Conclusion

Polygon’s mission isn’t to replace Ethereum—it’s to make Ethereum unstoppable. Its modular vision and Ethereum-aligned strategy could redefine scalability and keep it far ahead of monolithic rivals.