If you want to truly excel in the cryptocurrency contract space and possess a correct logic and method for opening and executing trades, then you are in luck today. This method can help you truly excel in contracts.

If you only have 5000 yuan in capital and want to reach the million threshold through rolling positions, this article will dismantle the specific path — not relying on luck, but on a combination of 'adding to positions with floating profits + low leverage + strict discipline', with every step having replicable operational details.

First, understand this: rolling positions is not 'leveraging to gamble', but rather 'using profits to snowball'.

Many people understand rolling positions as 'fully invested with leverage', which is a fatal misunderstanding. The core of rolling positions is summed up in 8 words: adding to positions with floating profits, locking in risks.

Simply put: Use profits earned from your principal to expand your position, and your principal remains safe. It's like rolling a snowball: First, push with your hand (the principal) to get the snowball moving. Once it builds momentum (and creates unrealized profits), you let the snow (the profits) stick to it. The snowball grows bigger and bigger, but your hand (the principal) never gets sucked in.

For example:

With a 5,000 yuan capital and 10x leverage in isolated position mode, only 10% of the capital (500 yuan) is used as margin to open a trade, effectively using 1x leverage (500 yuan x 10x = 5,000 yuan, equivalent to the principal). With a 2% stop-loss, the maximum loss is 100 yuan (5,000 yuan x 2%), which has minimal impact on the principal.

If you earn 10% (500 yuan), your total capital will be 5,500 yuan. You can use another 10% (550 yuan) to open a trade, still using 1x leverage, and set a 2% stop-loss (a loss of 110 yuan). Even with this stop-loss, your total capital will be 5,500 - 110 yuan = 5,390 yuan, a profit of 390 yuan compared to your initial profit.

This is the underlying logic of rolling positions: using profits to cover risks, ensuring the safety of principal. High leverage, "pseudo-rolling" with principal added to positions, is essentially gambling and will eventually lead to a margin call.

2. Three life and death lines for rolling positions: Hit one and 5,000 can turn into millions

The key to rolling over isn't how quickly you make money, but how long you can survive. I've seen people roll 5,000 yuan to 800,000 yuan, and I've also seen people roll 100,000 yuan into a negative number. The core difference lies in three disciplines:

1. Leverage must be "ridiculously low": 3x is the upper limit, 1-2x is more stable

"The higher the leverage, the faster you make money"—this is the most common pitfall for beginners. In 2022, I met a retail investor who used 20x leverage to roll over a 5,000 yuan capital position. He made 3,000 yuan on the first roll. After adding to his position a second time, he encountered a spike and his position was wiped out.

Remember: rolling over relies on "compounding," not "single exorbitant profits." 3x leverage means a 33% fluctuation before liquidation, combined with a 2% stop-loss, offers significant margin for error. Meanwhile, 10x leverage could trigger forced liquidation at just 10% fluctuation, making it difficult to withstand the normal fluctuations of the cryptocurrency market.

My suggestion: Use 1-2x leverage in the early stage. After making profits for 5 consecutive times and having a stable mentality, increase it to 3x. Never touch more than 5x.

2. Only use "floating profits" to increase your position: the principal is your trump card and must not be touched

The essence of rolling a position is "making money with the market's money." For example, if you have a 5,000 yuan principal and your first profit is 1,000 yuan, your total capital will become 6,000 yuan. At this point, you can only use a maximum of 1,000 yuan of the floating profit to increase your position, and your 5,000 yuan principal will not be touched.

This way, even if you lose money on your increased position, you will only lose your floating profit, and your principal will remain safe. On the other hand, if you invest all your 5,000 yuan, a single mistake will put you right back to square one, and all your previous efforts will be wasted.

It’s like a fisherman fishing: he uses the fish he caught as bait, and even if he doesn’t catch any new fish, he won’t lose his fishing boat.

3. Stop-loss must be “iron and cold-blooded”: 2% is the red line, cut it when it reaches that point

"Wait a little longer, maybe it'll rebound"—this statement can ruin any rolling plan. When rolling, the stop-loss for each trade must be strictly controlled within 2% of the total capital. For a 5,000 yuan capital, this is 100 yuan, and for a 100,000 yuan capital, it is 2,000 yuan. Cut losses immediately at that point. No excuses.

In 2023, Bitcoin surged from $30,000 to $40,000. I rolled my position with 1x leverage, using three stop-loss orders, each resulting in a loss of 1,000-2,000 yuan. However, the six profits ultimately tripled my total investment. If I had held onto my position during one of these stops, I would have been wiped out by the volatility and missed the subsequent uptrend.

3. From 5,000 to 1,000,000: Three-stage rolling strategy with specific operations for each step

To grow from 5,000 yuan to 1 million yuan, you need to advance in stages, with different goals and strategies at each stage. It's like climbing a staircase: if you take three steps at a time, you'll fall. Only by taking one step at a time can you reach the top.

Phase 1: 5,000 → 50,000 (accumulating start-up capital and gaining experience)

Core goal: Use spot trading + small leverage to familiarize yourself with the rhythm and accumulate the first amount of "stress-free funds".

First, use 5,000 yuan to do spot trading: buy BTC and ETH at the low point of the bear market (for example, when BTC falls to 16,000 in 2023), and sell them when they rebound by 10%-20%. Repeat this 3-5 times and roll the funds to 20,000.

Use 1x leverage rolling: When BTC breaks through key resistance levels (e.g., 20,000 or 30,000), open a long position with 1x leverage. If you achieve a 10% profit, use your floating profit to add another 10% to your position. Set a 2% stop-loss. For example, with a 20,000 yuan capital, open a 2,000 yuan position. After a 200 yuan profit, add another 200 yuan to your position, keeping your total position below 10% of your principal.

Key: Don’t pursue speed at this stage. Focus on practicing the muscle memory of “stop loss + increase position with floating profit” and complete at least 10 profitable trades before entering the next stage.

Phase 2: 50,000 → 300,000 (capture the trend and maximize profits)

Core goal: Increase the frequency of rolling positions in a clear trend and speed up by "band compounding".

Only trade during a "deterministic trend": For example, when BTC's daily chart stabilizes above its 30-day moving average and trading volume increases by more than 3 times, confirm an upward trend before rolling over. After the BTC ETF is approved in January 2024, it will be a typical trending market, suitable for rolling over.

Increase your position: For every 15% profit, add 30% of the floating profit to your position. For example, if your initial capital of 50,000 yuan increases by 15% to 57,500 yuan, add 2,250 yuan (30% of the floating profit of 7,500 yuan) to your position, keeping your total position within 20% of your initial capital.

Profit-taking strategy: For every 50% increase in the stock price, take 20% of the profit. For example, if your stock price goes from 50,000 to 100,000, withdraw 20,000 in cash and keep the remaining 80,000 rolling. This locks in profits while avoiding the psychological collapse of "profit-taking."

The third stage: 300,000 → 1,000,000 (relying on the big cycle trend to earn the "era dividend")

Core goal: seize the big market trend of bull-bear transition and complete the transition with a big trend.

Waiting for a "historic opportunity": For example, when Bitcoin rises from a bear market bottom (e.g., $15,000) to a mid-bull market (e.g., $60,000), this 5x trend can magnify returns by more than 10x. During the 2020-2021 bull market, some people rolled from $300,000 to $5 million, leveraging this megatrend.

Dynamically adjust your position: Initially, maintain a 10%-20% position, increase it to 30%-40% in the middle of a trend, and then reduce it back to 10% in the later stages. For example, if BTC rises from 30,000 to 60,000, start with a 30,000 position, increase it to 60,000 when it reaches 40,000, and then reduce it back to 30,000 when it reaches 50,000. This way, you don't miss out on the main uptrend while mitigating risk at the top.

The ultimate rule: Stop rolling your position when your funds reach 800,000 yuan. Take out 500,000 yuan and deposit it in stablecoins, leaving the remaining 300,000 yuan for continued trading. Remember: the goal of rolling your position is to "get your money in the bag," not to "keep it rolling forever."

4. The Most Easily Overlooked Thing: The “Mental Moat” of Rolling

To turn 5,000 yuan into a million, skill is only 30% and mindset is 70%. I've seen too many people who have good skills but fail because of two mindset traps:

1. Don’t be greedy for the “perfect increase”: it is better to miss it than to increase it incorrectly

Some people often worry about adding too early or too little. For example, they plan to add to their position when their profit reaches 10%, but rush to add when it reaches 9%, or wait for a correction when it reaches 15%. In reality, rolling doesn't require precision; as long as you add to your position within the "profit range," you're not wrong.

Just like farming, as long as you sow in spring, it doesn’t matter if you sow a few days earlier or later, it is better than missing the sowing period.

2. Accept “imperfect stop loss”: stop loss is a cost, not a failure

During a rollover, it's normal to have 3-4 stop-loss orders out of 10 trades. In 2023, I rolled my SOL positions and had stop-loss orders on 2 of 5 trades, but the remaining 3 trades were profitable, increasing my total capital by 80%.

Think of stop loss as "buying a ticket" - if you want to enter an amusement park, you have to buy a ticket. If you occasionally encounter an unfun project, you cannot get a refund, but it will not affect your enjoyment of other projects.

5. 3 practical examples of rolling over 5,000 yuan: Don’t fall into the traps others have fallen into

Positive Case: 5,000 yuan → 780,000 yuan, relying on the "stupid method"

From 2022 to 2024, someone started with 5,000 yuan in spot trading, buying ETH (at $880) during a bear market and selling it when it rose to $1,200, earning a 40% profit. He then rolled over his position using 1x leverage, adding another 10% every time he made a 10% profit, with a 2% stop-loss. Over two years, his profit reached 780,000 yuan. His secret: trading exclusively in ETH, avoiding altcoins and never switching between currencies. His success hinged on a combination of focus and discipline.

Bad Case: 100,000 to 500 yuan, death from "leverage addiction"

In 2023, a retail investor rolled over their 100,000 yuan position with 5x leverage. After making 50,000 yuan in the first two trades, they increased their leverage to 10x. However, BTC plummeted, leaving them with only 30,000 yuan. Undeterred, they added another 10x leverage, only to lose everything a week later. They had committed the cardinal sin of rolling over: using their principal to increase their position, increasing their leverage.

Key conclusion: The essence of rolling is "trading time for space"

Going from 5,000 yuan to 1 million yuan requires at least two to three cycles of bull and bear markets (three to five years). Those who dream of achieving it in one year will eventually be taught a lesson by the market. The secret to wealth in the cryptocurrency world has never been "fast," but rather "stable and long-term."

Finally: The enlightenment of rolling warehouse to ordinary people

Can 5,000 yuan be rolled into 1 million yuan? Yes, but three prerequisites must be met:

Use spare money to operate, and losing it all will not affect your life;

Spend at least 6 months practicing your skills and complete 100 simulated trades;

Accept "slowness" and don't pursue overnight wealth.

Rolling isn't a myth; it's a tool for ordinary people to achieve success through discipline. It's like climbing a staircase: each step may seem ordinary, but if you persist for 1,000 steps, you can reach heights that others can't reach.

If you only have 5,000 yuan now, don’t worry, start with the first profit of 100 yuan and start rolling it up - the snowball of wealth always starts with a small snowball.

Master these 9 rules of the cryptocurrency world and become a cryptocurrency millionaire!

1. Invest with spare money: When investing in cryptocurrencies, only use the money you have on hand. Never borrow money or take out a loan to speculate in cryptocurrencies, as this is too risky.

big.

2. Carefully select value coins: When choosing investment projects, carefully select those "value coins" with potential and formulate a reasonable funding plan.

Allocation plan. This is the so-called "Yanyang Investment Strategy +", which makes your investment more stable.

3. Intervene in batches to deal with callbacks: After entering the market, it is normal to encounter price fluctuations or callbacks. Therefore, allocate your funds reasonably.

Buy in batches to reduce risk.

4. Diversify investments to reduce risks: Do not operate with a full position, allocate funds to different projects, so that even if a project has problems,

Other projects can also help you share the risk.

5. Stay informed: Always pay attention to the latest news in the cryptocurrency circle and the latest financial and economic developments so that you can capture investment opportunities more quickly.

Yes, you can make money faster.

6. Follow the trend, don't fight it head-on: When investing, don't fight the dealer or the market trend head-on.

In order to better seize investment opportunities.

7. Use contracts with caution: If you choose to play contract trading, you must pay attention to controlling the leverage multiple. It is recommended to use 20 to 50 times leverage.

Don't use 100x leverage lightly. Steady profits are king.

8. Strictly control positions and do not operate randomly: Position control is the key to investment. Do not operate arbitrarily under uncertain circumstances.

This means there is no risk and no loss of money. At the same time, regularly check your assets to ensure they are managed properly.

9. Stay calm and have a clear entry and exit strategy: It is very important to keep a calm mindset during the investment process. You need to know when to enter the market.

When is the right time to quit? The experience in the cryptocurrency circle will allow you to continue to grow, and your mentality is more important than your operation.

To make $1 million in the cryptocurrency world, you either have to rely on a bull market and hold on, or you have to bet on a lucky coin, or you have to use high leverage to bet on the right direction. But most people lose money, so don’t just rely on the get-rich-quick stories; first determine how much risk you can tolerate.

After 10 years of cryptocurrency trading, I've personally tested this method: the 20 EMA. A powerful 15-minute short-term trading tool: a high-probability trend strategy even for beginners. In trading, you don't always need an extremely complex or specialized approach to succeed. Instead, you just need an effective strategy. And utilizing one of the oldest and simplest trading tools—moving averages—might be a good place to start.

If you're a scalper or employ other short-term strategies, using moving averages on the 15-minute chart is highly recommended. The 20-day EMA (Exponential Moving Average) is the most effective moving average for the 15-minute chart because it most accurately tracks price movements during multi-day trends. In other words, it allows you to easily identify trends.

How does the 20 EMA strategy work?

The main advantage of the 20 EMA trading strategy is that it is easy to use even for novice traders. The only tool you need is the 20 EMA, and it works on any currency pair and any timeframe.

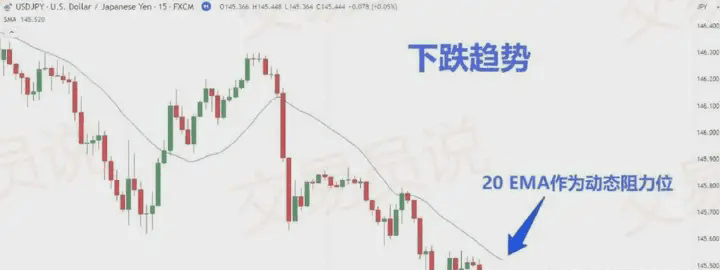

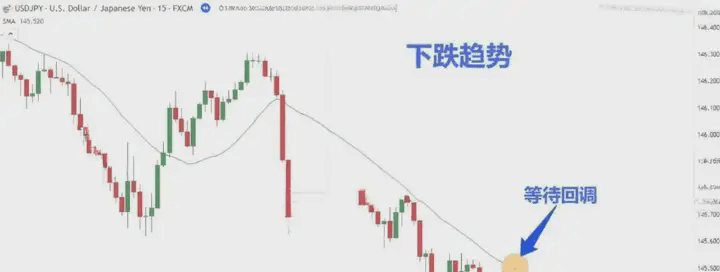

In a downtrend, prices are generally expected to move lower. However, at some point, you may see prices reverse direction and test the 20 EMA. If the downtrend is strong enough, the 20 EMA will push prices back below it. This phenomenon is called a "retracement," and it may occur once or several times until the 20 EMA is finally broken.

Therefore, the core function of the 20 EMA strategy is to act as a "rebound line" for the candlestick. As a trader, you should wait for and take advantage of the moment when the price retraces to the 20 EMA line.

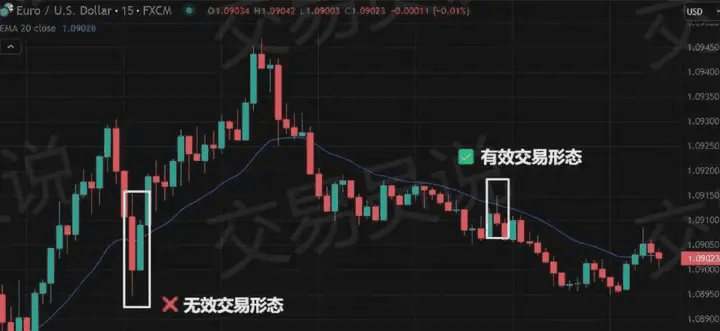

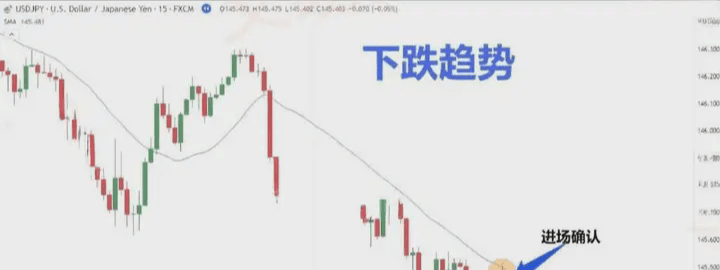

There's a key detail to note here: You only need to focus on one very specific candlestick—the one that first returns to and touches the 20 EMA after a period of separation. Remember, if the next candlestick continues to move close to the EMA, it's not a good signal. Once you catch the correct signal, it's a good time to enter a position.

For example:

The basic principles of the 20 EMA strategy are as follows:

➡️ When the price closes above the 20 EMA, the market is in an uptrend; when the price closes below the 20 EMA, the market is in a downtrend.

➡️ The first candlestick that touches the 20 EMA after the trend changes direction is called the signal candlestick. You only need to focus on this candlestick, as your entry point is determined by the high and low of this signal candlestick.

➡️ During an uptrend, you should place a buy stop order 1–2 pips above the highest point of the signal candlestick. If the next candlestick does not trigger your order, you should cancel it.

➡️ On the contrary, during a downtrend, you should place a sell stop order 1–2 pips below the lowest point of the signal candlestick. If the next candlestick does not trigger the order, it should be cancelled.

➡️ In a long trade, the stop loss should be set a few pips below the lowest point of the signal candlestick (at least 5–10 pips, depending on the timeframe you are using); in a short trade, the stop loss should be set a few pips above the highest point of the signal candlestick.

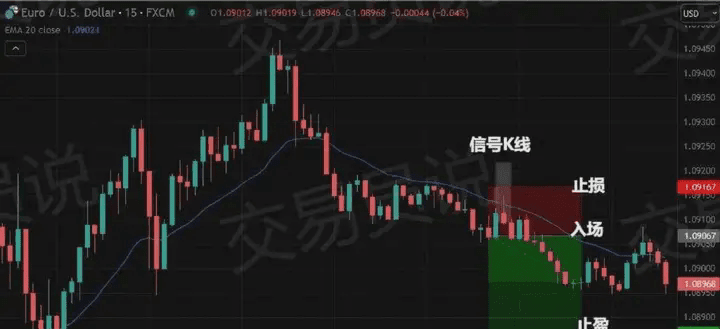

Here is an example of opening a short position based on the previous chart:

In the above image, on the EUR/USD 15-minute chart, the signal candlestick's low was 1.09087, so a sell stop-loss order was set two pips below it. The next candlestick continued its decline, so the order was triggered at 1.09067. According to the rule, the stop-loss should be set 10 pips above the signal candlestick, at 1.09167. As for the take-profit, in this case, a 1:2 risk-reward ratio was used, so the take-profit was set 20 pips below the entry price, at 1.08867.

Identifying the Primary Trend Using the Daily Chart

You don't want to risk losing money by jumping into a trade when the trend isn't clear, which is why some traders choose to filter the market by switching to other timeframes. They want to identify the trend ahead of time and make sure it's strong enough. Once they've confirmed the price's direction on the daily chart, it becomes much easier to find entry points on the 15-minute chart.

What to do?

First, to identify a trend, you need to set a few rules on your chart. The goal is to identify the direction the price is moving. Don't worry, these rules apply to both uptrends and downtrends, and they work equally well across different timeframes:

Make sure the price has been rising or falling for several consecutive days and has at least one higher low (HL) in an uptrend and at least one lower high (LH) in a downtrend.

◎ In an uptrend, the 20 EMA line should show an upward angle of 2 o'clock or steeper; in a downtrend, the 20 EMA line should show a downward angle of 4 o'clock.

◎ In an uptrend, the price should significantly break through the resistance level; in a downtrend, the price should significantly fall below the support level.

After this, switch to the 15-minute chart and focus on the following two potential buy conditions on the uptrend:

1. Support/Resistance Breakout on the Daily Chart

If the price is clearly moving along the 20 EMA, it means it is in an ideal trading position.

2. Large fluctuations in support/resistance areas

This is a relatively safer situation because the price has confirmed its momentum and continues to move in the expected direction. Therefore, when the price touches and stabilizes near the 20 EMA, it is a good entry point.

How to use the 20 EMA to find quality entry points

Using the 20 EMA (Exponential Moving Average) to identify a good entry point is relatively simple. First, identify the trend, find support and resistance levels, and then enter the market when the price pulls back to these levels.

1. Identify trends

The process of identifying a trend using the 20 EMA indicator is fairly straightforward. You simply observe the position of the EMA line relative to the current price action.

If the EMA line is below the current price, it indicates an uptrend.

Conversely, if the EMA line is above the current price, it indicates a downtrend.

2. Find support or resistance

Once you have identified the current trend, the next step is to identify important support or resistance levels. As previously emphasized, we focus on the dynamic support and resistance coming from the 20 EMA line.

◎ In a downtrend, the 20 EMA line acts as a resistance level.

On the contrary, in an uptrend, the 20 EMA acts as a support level.

3. Wait for callback

Next, we need to wait patiently for the price to pull back to the support or resistance level, or to pull back to around the 20 EMA line.

This stage is very important and is often overlooked by many novice traders who may think that they can enter the trade immediately once the trend direction is clear.

However, in practice, even if the trend direction is clear, we still need to wait patiently for a retracement. This waiting time is crucial to optimizing the risk-reward ratio of the trade setup.

4. Admission confirmation

There are two ways to confirm your entry: using price action or technical indicators.

Price action confirmation: Observe chart or candlestick patterns. Common chart patterns include double tops/bottoms, head and shoulders tops/bottoms, and triple tops/bottoms. Common candlestick patterns include engulfing patterns, pin bars, and inside bars.

◎ Technical indicator confirmation: You can use tools such as stochastic indicators, relative strength index (RSI), MACD, etc.

When using this trading strategy, it is important to focus on the following aspects:

1. Enter the market only when it is trending

Entering a trade during a clear, established trend significantly increases the probability of a successful trade. Prices are more likely to continue in their current direction, which helps traders capitalize on existing momentum. Conversely, attempting to trade during trendless or volatile market conditions can lead to unpredictable price movements and potentially unfavorable trading outcomes.

2. Avoid trading against the trend

Trading against the trend carries a higher risk. Trading against the trend means traders are essentially betting that the market will reverse its current direction, which requires precise timing and strong reversal signals.

3. Enter the market during active trading hours

Active trading hours often coincide with major market overlaps, such as when the London and New York markets are open simultaneously. Trading during these hours offers better opportunities due to higher volumes and price volatility, which translates to tighter bid-ask spreads, less slippage, and better trade quality.

Conversely, trading during low activity periods, such as the Asian session, weekends, or holidays, may result in wider spreads and lower liquidity, making trade execution more difficult.

Is the 20 EMA suitable for day trading?

The answer is yes. The 20 EMA is suitable not only for scalping but also for day trading. However, in day trading, you usually need to wait for a specific pattern to appear before entering the market. Once you find such a pattern, you need to use support and resistance levels for confirmation. This pattern is actually very easy to identify.

You should see a strong up or down move within the first two hours, followed by a pullback to the 20 EMA. Remember, for this strategy to be effective, you need to confirm the trend direction on higher timeframes. If the trend on the higher timeframes is consistent with the earlier move, the probability of a price reversal near the 20 EMA is very high.

Will the 20 EMA strategy fail? Backtesting results will tell you

Like any trading strategy, the 20 EMA isn't perfect and can break down. Sometimes, the price will reach a support or resistance level but continue to move sideways. It might even ignore the 20 EMA and fluctuate back and forth. If you encounter this situation, it's best to pause your trade and wait patiently for the next opportunity, as these market conditions are full of uncertainty.

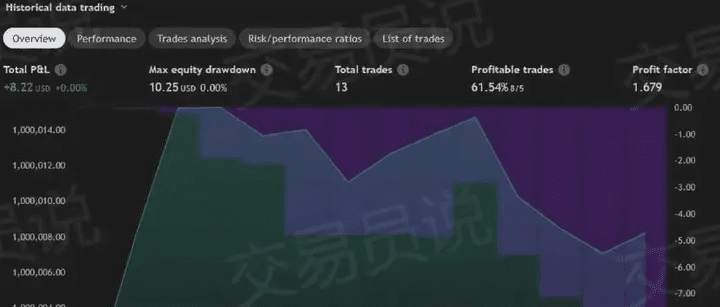

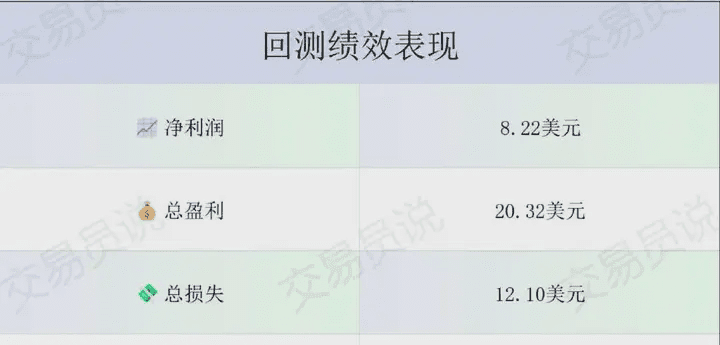

The 20 EMA strategy for day trading was backtested for one week from March 5, 2025, to March 12, 2025. The results showed that although the strategy failed in some cases, it still achieved positive returns overall.

The details are as follows:

A total of 13 trades were executed over the seven-day period, validating the 20 EMA strategy's value as a day trading system. More importantly, the strategy achieved a 61.54% win rate and generated a total profit of $8.22.

in conclusion

The 20 EMA trading strategy is a simple yet powerful one. Compared to the SMA (Simple Moving Average), the EMA (Exponential Moving Average) follows price fluctuations more closely, resulting in more accurate "bounce lines" on the chart.

This strategy is simple enough for even novice traders to pick up quickly, and it's quite effective when used for short-term trading on the 15-minute chart. However, it's best to confirm the trend on the daily chart first, and keep an eye on support and resistance areas.

Even if the 20 EMA strategy fails at times, you can improve your odds by analyzing multiple timeframes and adding more tools to your charts. Furthermore, if you trade in the direction of the confirmed major trend on the daily chart, your overall probability of profitability remains high.

While it may take some time to fully master this method, it is definitely worth a try. More importantly, you should test the strategy in a demo account before applying it to a live account.

Develop profitable investment habits in 21 days and teach you how to build your own trading system!

Creating a system isn't that hard. What's hard is following the rules you set when you created the system.

Goals of a trading system

When you build your system, you have two very important goals:

1. Your system should be able to identify trends as early as possible.

2. Your system must be able to protect you from two-way losses.

If your trading system can achieve the above two points, your chances of success will increase.

What makes these goals difficult to achieve is that they are contradictory.

If you have a system that is characterized by the ability to catch trends quickly, then there is a high probability that you are catching a false trend.

On the other hand, if your system places a heavy emphasis on avoiding losses, you may be late in trading or miss out on many trades.

Your task in developing a mechanical system is to find a compromise between these two goals: to identify trends as quickly as possible while distinguishing between false trends and true ones.

Six steps to develop a trading system

In the long run, a good trading system will have the potential to help you make a lot of money.

Step 1: Time Frame

When developing a trading system, the first thing you need to determine is what type of trader you are.

Are you a day trader or a swing trader? Do you look at charts daily, weekly, monthly, or yearly? How long do you like to hold your positions?

This will help you determine the time frame you will be trading on. Even if you are looking at multiple timeframes, this will determine the time frame you will primarily use to identify your trading signals.

Step 2: Find indicators that help you identify new trends

Since your goal is to identify a trend as early as possible, we need to use indicators that can achieve this goal. Moving averages are one of the most popular indicators used by traders to identify trends.

Using two moving averages (one fast and one slow), and then waiting until the faster one crosses over or moves below the slower one, is the basis of the Moving Average Crossover system.

In its simplest form, the Moving Average Crossover system is the fastest way to identify a new trend. It is also the easiest way to spot a new trend.

Of course, traders have many other ways to identify trends, but moving averages are one of the easiest to use.

Step 3: Find indicators that help you identify this trend

The second goal of our trading system is to avoid double losses, that is, we do not want to be trapped in the wrong trend. The way we avoid double losses is that when we find a signal of a new trend, we can use other indicators to confirm whether it is true or not.

There are many indicators that can be used to confirm a trend, but we prefer the Moving Average Convergence/Divergence (MACD), Stochastics, and the Relative Strength Index (RSI). As you become more familiar with various indicators, you can find ones you like and incorporate them into your system.

Step 4: Identify your risks

When creating a trading system, it is important to determine how much you can afford to lose on each trade. Not many people like to discuss losses, but the truth is, a good trader thinks about how much they are willing to lose before they think about how much they can make.

The amount you're willing to lose will differ from others. You need to determine how much breathing room you need in your trades while not risking too much on any one trade. In later lessons, you'll learn about money management. Money management has a huge impact on how much you risk on each trade.

Step 5: Identify your entries and exits

Once you have determined how much you are willing to lose on a trade, the next step is to figure out where to enter/exit the trade to maximize your profits.

Some people like to enter a trade as soon as their indicators match up and give a good signal, even if the candlestick hasn't closed yet, while other traders wait until the candlestick closes before entering a trade.

One trader said that he believed waiting until the candlesticks closed before entering the market was the best option. He had entered the market many times before the candlesticks closed and all the indicators aligned, only to find that at the close, the trade went exactly the opposite of what he expected.

It's just a matter of trading style. Some traders are stronger than others and eventually you will find out what kind of trader you are.

In terms of exiting a trade, you have a few options. You can move your stop loss so that if the price moves X points in your favor, you move your stop loss by X points.

Another approach is to set fixed targets and exit the market when the price reaches them. How you calculate your target is up to you. Some people choose to use support and resistance levels as their targets.

Some people set the same pip amount for every trade. No matter how you calculate your target, make sure you stick to it. Don't get out of the market no matter what happens. Stick to your system! After all, you created it.

Another way to exit a trade is to have a set of criteria, and when those criteria are met, you exit the trade. For example, if your indicator retraces to a certain level, you exit the trade.

Step 6: Write down the rules of your trading system and follow them

It is a necessary trait for a trader, therefore, you must act according to the trading system. If you do not follow the rules, your trading system is useless, so remember to stick to the principles.

Did we mention you need to stick to your principles?

How to Test Your Trading System

The quickest way to test your trading system is to find a charting software platform that allows you to backtrack past price movements and move candlesticks individually. Each time you move one candlestick forward, trade according to your trading system.

Keep a record of your trading system and be honest with yourself! Record your gains, losses, average gain, and average loss. If you are satisfied with the results, you can move on to the next round of testing: live trading with a demo account.

Trade your system in a demo account for at least two months. This will allow you to understand how your system will perform when the market moves. Trust us, there's a huge difference between live trading and backtesting.

After trading on a demo account for two months, you will know whether your system can hold up in the market. If you are still getting good results, you can choose to start trading on a live account.

However, you must be very confident in your trading system and be able to trade without hesitation.

Cryptocurrency contract advice and suggestions,

1. Risk Awareness: Cryptocurrency futures trading carries a high level of risk, and market volatility can lead to the complete loss of your principal. Be aware of your risk tolerance and avoid investing beyond your means.

2. Learning and Preparation Before entering into contract trading, fully learn relevant knowledge, including technical analysis, leverage principles, stop-loss and take-profit strategies, etc. Do not blindly follow the trend to avoid losses due to information asymmetry.

3. Control leverage. While high leverage can magnify gains, it can also exacerbate losses. Beginners are advised to use low leverage and consider increasing it after gaining experience.

4. Strictly enforce stop-loss orders. Set reasonable stop-loss points to avoid emotionally driven losses. The market is volatile, and strictly enforcing stop-loss orders is key to protecting your principal.

5. Diversify your investments. Don't concentrate all your funds on a single contract or currency. Diversifying your investments can reduce risk. Avoid frequent trading to minimize transaction fees.

6. Stay calm. Market sentiment can easily affect your judgment. Greed and fear are the biggest enemies of trading. Regardless of profit or loss, you must remain calm and analyze market trends rationally.

7. Be wary of scams. The cryptocurrency world is full of mixed baggage. Beware of fake platforms, scams involving lead generation, and pyramid schemes. Choose a legitimate exchange to protect your account and funds.

8. Long-term planning: Contract trading is not a shortcut to wealth; it's more of a high-risk gamble. It's recommended to use your primary funds for stable investments, using contract trading only as a supplementary tool. In summary: Cryptocurrency contract trading is a double-edged sword, capable of both high returns and significant losses. Only by approaching it rationally and within your means can you survive in the market for a long time.

If you're looking to join me in planning and profiting from the market makers, come find me! I'll bring you into the community with no barriers to entry. We'll analyze market strategies and recommend high-quality coins every day, including those with positive news so you can invest in them early. We'll also occasionally broadcast live market analysis for community members! If you have any questions, you can also consult in the group, and we'll provide the best answers!

A single tree cannot make a boat, and a single sail cannot sail far! In Erquan, if you don’t have a good circle and first-hand information about the cryptocurrency circle, then I suggest you follow Lao Wang, who will help you get ashore for free. Welcome to join the team!!!