🚨 Everyone’s Screaming “RATE CUTS COMING!” — But WTF Does That Even Mean? 💸📉

Let’s cut the noise. Every corner of Crypto Twitter is buzzing about the Federal Reserve (aka the Fed) and “rate cuts.” But real talk — most people don’t even know what the Fed actually does, or why it matters for your bags.

After a deep dive (yes, 19 hours down the rabbit hole 🐇), here’s the breakdown:

---

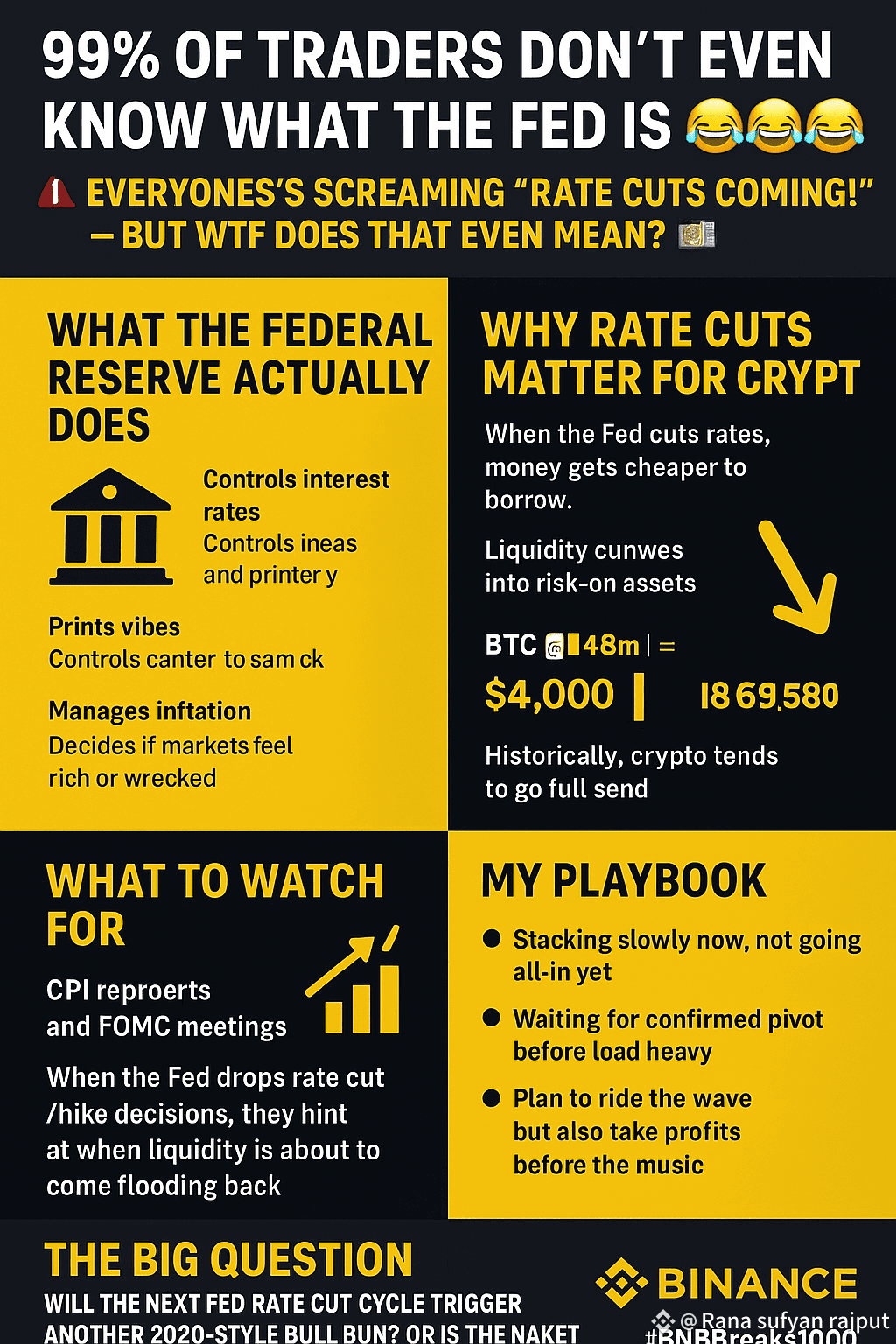

🏦 What the Federal Reserve Actually Does

Think of the Fed as the U.S.’s money boss:

Controls interest rates → decides how cheap or expensive it is to borrow.

Prints vibes → literally and figuratively controls liquidity.

Manages inflation → if prices are going crazy, they hike rates. If the economy’s choking, they slash rates (rate cuts).

In short: the Fed decides if markets feel rich or wrecked.

---

📉 Why Rate Cuts Matter for Crypto

When the Fed cuts rates, money gets cheaper to borrow. That extra liquidity often flows into risk-on assets — like Bitcoin, ETH, and your favorite altcoins.

Look at 2020: rates slashed + stimulus checks → BTC went from $4K to $69K. Not a coincidence.

Rate cuts = more liquidity → historically, crypto goes full send.

If cuts arrive in 2026, we could see:

BTC eyeing $150K+

ETH breaking $10K

Altcoins? Straight madness.

---

🔑 What to Watch For

Don’t just trade on hopium. Keep your eyes on key signals:

CPI reports → tells you where inflation’s heading.

FOMC meetings → where the Fed drops rate cut/hike decisions.

These hint at when liquidity is about to come flooding back.

---

📊 My Playbook

Stacking slowly now, not going all-in yet.

Waiting for the confirmed pivot before loading heavy.

Plan to ride the wave, but also take profits before the music stops.

Because here’s the catch: rate cuts aren’t always bullish. Sometimes they mean the economy is cracked. So stay sharp.

---

🤔 The Big Question

Will the next Fed rate cut cycle trigger another 2020-style bull run? Or has the market matured enough to avoid a repeat?

Drop your thoughts 👇