Today, HIFI surged to the second highest increase at a price of 0.10165 USD, with a 24-hour increase of over 37%. However, the underlying logic is unrelated to the recovery of DeFi; rather, it is a 'doomsday celebration' triggered by the exchange's delisting announcement. Below is a deep breakdown based on multiple sources:

1. Catalyst: The exchange's delisting announcement triggered panic selling

Binance announcement ignites the market

On September 3, Binance announced that it will delist the HIFI spot trading pair on September 17, directly causing a price drop of 17% (0.07→0.058 USD)

.

Tokens such as BAKE and SLF that were delisted simultaneously saw declines of over 30%, spreading panic in the market

.

Liquidity exhaustion chain reaction

Other exchanges follow suit with delistings, HIFI trading pairs completely disappear, and liquidity evaporates over 80%

2. Speculators' manipulation methods: Creating a "FOMO trap" by delisting

Classic Pump-and-Dump scheme

Price drop accumulation: Low-price accumulation after the delisting announcement ($0.058), controlling the circulating supply (market cap only $8 million).

Violent price surge: Since September 10, the futures market's open interest surged by 40%, and the funding rate soared to 0.0321%, with bulls driving up prices

Spread good news: Fabricated "HIFI will be listed on a new exchange" and "team repurchasing tokens" fake messages to attract retail investors to follow suit

Evidence of technical manipulation

False breakout: The K-line reverses from $0.058 in a V-shape, but the trading volume did not increase in sync (only grew 200% in 24 hours, far below the normal market 500%+)

Overbought signal: RSI breaks 70, MACD golden cross, but support level is weak ($0.075), there is significant selling pressure near the resistance level of $0.10

3. Market mechanism loopholes: Low liquidity amplifies manipulation space

Futures market harvesting

Short-term liquidation of $2.06 million, shorts forced to cover further driving up prices, speculators take advantage to unload

Funding rate abnormal fluctuations (0.0249%-0.0321%), showing that speculators create false prosperity through high-frequency trading

Community sentiment polarized

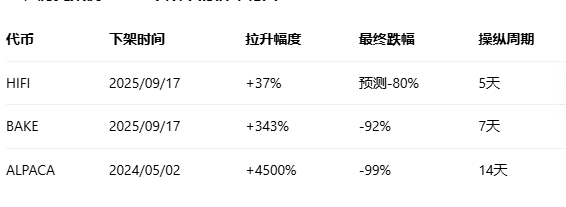

Optimists: "Delisting = bottom reversal" and "Benchmarking ALPACA's 4500% increase" and other comments flood the screen.

Warning faction: "Chart looks ugly" and "Speculators' countdown to unload in 5 days" and other ironic posts are deleted, community control is obvious.

HIFI's surge today is a "financial scam" triggered by the exchange's delisting announcement; essentially, it is a harvesting game by speculators exploiting retail FOMO psychology. History proves that 99% of delisted coins ultimately go to zero, do not be misled by short-term gains

Want to see the big analyst's take on that coin, post it in the comments