The seas are vast and the sky is high!

If you don't want a one-day tour, read this article carefully. Turning 3000 into 1 million, let me share something practical! See how I did it in one month.

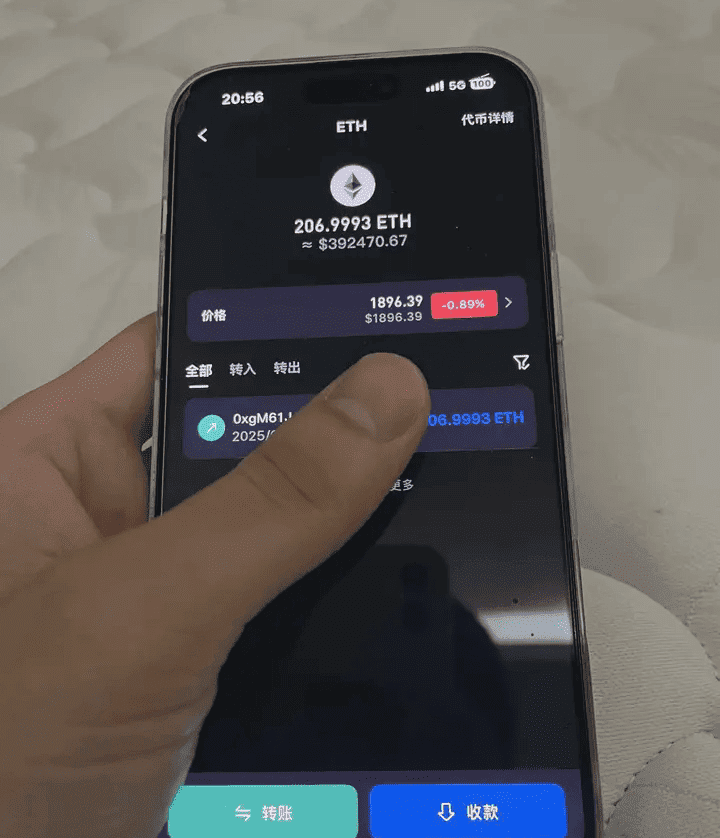

Contract rolling compound interest +: from over 1100 U, equivalent to 8000 RMB, earning a million!

The core is summed up in one sentence: leverage contract trading to amplify profits!

Many people start trading contracts with only 10,000 funds (approximately 1400 U), thinking, 'It's a small principal, just do it.' But the truth is: the smaller the fund, the more you need position management.

Large funds can rely on time, while small funds depend entirely on discipline. Otherwise, a single liquidation will require recharging your 'faith'.

The following set of methods is suitable for contract players with capital between 5000 and 20000 yuan. The goal is not to double in one day, but to have low drawdowns and steady growth.

1. Core goal: not to get rich overnight, but to steadily compound

Small funds doing contracts are not to earn a BMW per trade, but to earn a phone case each month, and after 12 times it becomes an iPhone.

Compound rhythm:

Monthly target return: 10%~20%

Control the maximum single loss to not exceed 2% of the total account funds

Swing positions, allowed to hold for 1 to 5 days, with intermediate stop loss adjustments

2. Four-step method for small fund position management

Step 1: Account segmentation, define the 'battle fund pool'

Account: 10000 yuan ≈ 1400U

Divide into 4 trading segments, each segment 350U

Only use one segment for trading, keep the others unchanged

Essentially giving yourself 4 lives, if wrong, there is a chance to be saved

Benefits: Resist consecutive stop losses, won't lose all ammunition at once

Step 2: Control each risk at 1%-2% of total funds

Recommended practice: control the single stop loss amount within 140U (about 10%)

For example, doing BTC:

Difference between entry point and stop loss point = 500USDT

Using 10 times leverage means a fluctuation of 50USDT

To not exceed the risk of 140U, the maximum can only open 2.8 BTC contracts ≈ 3 contracts

→ This is the process of reverse calculating positions.

Remember a phrase: it's not about how many contracts you want to open, but how many the market allows you to open.

Step 3: Pyramid increase, only enlarge the position when making a profit

If you go long from a low position and have a floating profit of 100U, you can consider:

Increase part of the position and continue to ride the trend upwards

Raise the stop loss to the break-even or even profit zone

The remaining part can attack freely, risk control has already protected yourself

This way, even if the market pulls back, you can retreat without harm.

Increase positions only when there are floating profits, do not increase when losing!

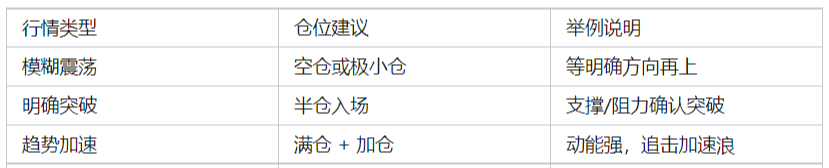

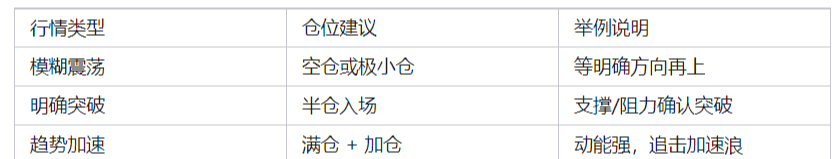

Step 4: Market grading, determine the strength of the position

3. Additional precautions for crypto contract trading

1. Leverage recommendation: no more than 20 times (here I mean the total leverage rate of the account)

Leverage does not amplify profits, but amplifies mistakes

High leverage is suitable for ultra-short line experts, not suitable for swing positions

2. Transaction fees have a huge impact

It is recommended to choose large platforms and rebate links, and not to trade frequently on high transaction fee platforms

Transaction fees will eat away most of your small capital's compound profits

3. During high volatility, use light positions or even observe

When there is major news or extreme volatility, reduce your position by half

Small accounts have poor pressure resistance, most afraid of large candles sweeping back and forth

4. A practical example: Use 350U to penetrate a wave of the market

Select coins: DOT breaks through the independent structure of the box and stands on the key platform/UNI breaks through the trend line/WOO's bottom continues to rise, forming a rising structure in the box/BTC has not broken below 107200 for a long time and forms a new independent structure, meeting the entry criteria in the trading system

Entry: Confirm right-side entry after breaking the platform and pulling back, left-side entry after breaking the box, left-side entry after breaking important trend lines

Stop loss: set the stop loss at the lower edge of the platform, with risk control within 100U

Increase position: add half when the price breaks the structural position or a trend candlestick appears, move the stop loss to the cost when there is a pullback

Reduce position: when the price rapidly rises or approaches previous highs/resistance, take partial profits

After one wave, the account grows nearly 500%. This is the path small capital in contracts should take—no greed, no fear, no reckless rushing.

5. Small position is your martial arts secret, not a shackle

Small funds are not the problem; misusing positions is the problem. You don't lose on technique, but die in liquidation. Stable positions, stable emotions, and stable operations.

Remember this phrase: "Being able to win a trade is ability; being able to lose a trade is system."

Small funds are most afraid not of slowness, but of dying. First learn to survive, then slowly become stronger.

Mu Qing only does real trading, the battle team still has spots, come quickly to $BTC $ETH, the sky is wide, spread your wings!

If you don't want a day trip, read this article carefully. 3000 bucks to earn a million, let me talk about something practical! See how I did it in a month.

Doing contract rolling compound+: from over 1100U, equivalent to 8000 yuan, earning millions!

The core is one sentence: rely on contract trading to amplify profits!

Many people start doing contracts with only 10,000 funds (about 1400U), thinking, 'Small principal, just do it.' But the truth is: the smaller the funds, the more position management is needed.

Large funds can rely on time to endure, while small funds rely entirely on discipline. Otherwise, a single liquidation will require recharging 'faith.'

The following set of methods is suitable for contract players with capital between 5000 and 20000 yuan. The goal is not to double in one day, but to have low drawdowns and steady growth.

1. Core goal: not to get rich overnight, but to steadily compound

Small funds doing contracts are not to earn a BMW per trade, but to earn a phone case each month, and after 12 times it becomes an iPhone.

Compound rhythm:

Monthly target return: 10%~20%

Control the maximum single loss to not exceed 2% of the total account funds

Swing positions, allowed to hold for 1 to 5 days, with intermediate stop loss adjustments

2. Four-step method for small fund position management

Step 1: Account segmentation, define the 'battle fund pool'

Account: 10000 yuan ≈ 1400U

Divide into 4 trading segments, each segment 350U

Only use one segment for trading, keep the others unchanged

Essentially giving yourself 4 lives, if wrong, there is a chance to be saved

Benefits: Resist consecutive stop losses, won't lose all ammunition at once

Step 2: Control each risk at 1%-2% of total funds

Recommended practice: control the single stop loss amount within 140U (about 10%)

For example, doing BTC:

Difference between entry point and stop loss point = 500USDT

Using 10 times leverage means a fluctuation of 50USDT

To not exceed the risk of 140U, the maximum can only open 2.8 BTC contracts ≈ 3 contracts

→ This is the process of reverse calculating positions.

Remember a phrase: it's not about how many contracts you want to open, but how many the market allows you to open.

Step 3: Pyramid increase, only enlarge the position when making a profit

If you go long from a low position and have a floating profit of 100U, you can consider:

Increase part of the position and continue to ride the trend upwards

Raise the stop loss to the break-even or even profit zone

The remaining part can attack freely, risk control has already protected yourself

This way, even if the market pulls back, you can retreat without harm.

Increase positions only when there are floating profits, do not increase when losing!

Step 4: Market grading, determine the strength of the position

3. Additional precautions for crypto contract trading

1. Leverage recommendation: no more than 20 times (here I mean the total leverage rate of the account)

Leverage does not amplify profits, but amplifies mistakes

High leverage is suitable for ultra-short line experts, not suitable for swing positions

2. Transaction fees have a huge impact

It is recommended to choose large platforms and rebate links, and not to trade frequently on high transaction fee platforms

Transaction fees will eat away most of your small capital's compound profits

3. During high volatility, use light positions or even observe

When there is major news or extreme volatility, reduce your position by half

Small accounts have poor pressure resistance, most afraid of large candles sweeping back and forth

4. A practical example: Use 350U to penetrate a wave of the market

Select coins: DOT breaks through the independent structure of the box and stands on the key platform/UNI breaks through the trend line/WOO's bottom continues to rise, forming a rising structure in the box/BTC has not broken below 107200 for a long time and forms a new independent structure, meeting the entry criteria in the trading system

Entry: Confirm right-side entry after breaking the platform and pulling back, left-side entry after breaking the box, left-side entry after breaking important trend lines

Stop loss: set the stop loss at the lower edge of the platform, with risk control within 100U

Increase position: add half when the price breaks the structural position or a trend candlestick appears, move the stop loss to the cost when there is a pullback

Reduce position: when the price rapidly rises or approaches previous highs/resistance, take partial profits

After one wave, the account grows nearly 500%. This is the path small capital in contracts should take—no greed, no fear, no reckless rushing.

5. Small position is your martial arts secret, not a shackle

Small funds are not the problem; misusing positions is the problem. You don't lose on technique, but die in liquidation. Stable positions, stable emotions, and stable operations.

Remember this phrase: "Being able to win a trade is ability; being able to lose a trade is system."

Small funds are most afraid not of slowness, but of dying. First learn to survive, then slowly become stronger.

Aze only does real trading, the battle team still has spots, come quickly to $BTC $ETH