With XRP trading around $2.87 and awaiting a possible breakout above $2.91, the price chart has been displaying renewed strength. The asset may move closer to the $3.00-$3.08 range, where the 50-day moving average stands as resistance, if buying volume continues. With the $2.77 support remaining strong, and market sentiment beginning to change in a more positive direction, bulls are subtly regaining ground from a technical perspective.

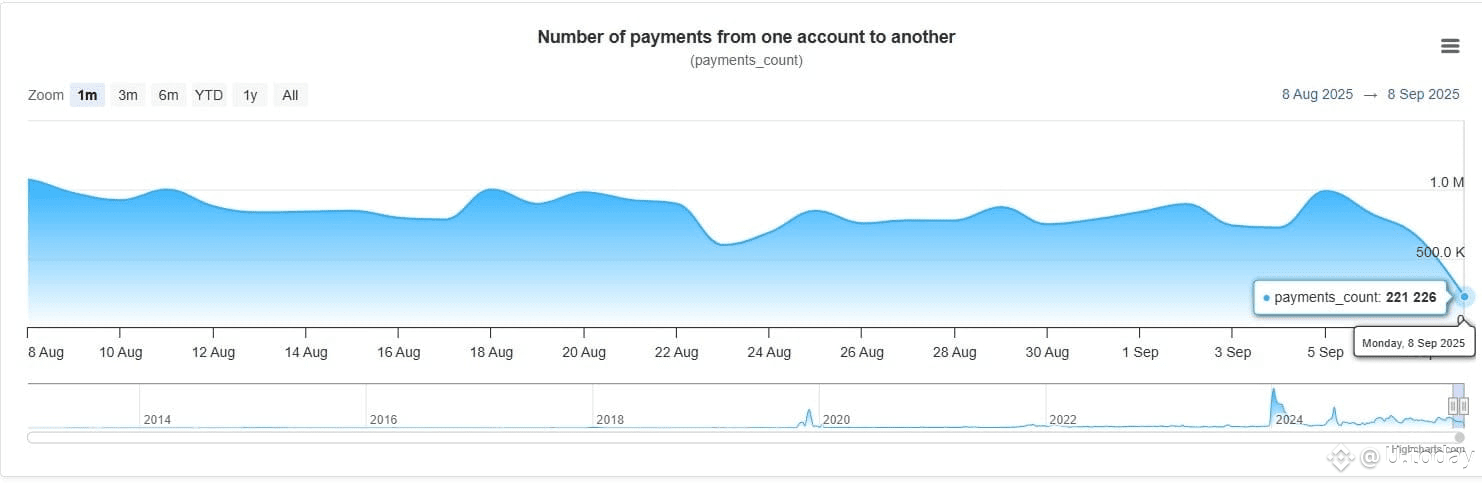

There is a far more concerning fundamental trend beneath this short-term optimism, though, as XRP’s payments activity has dropped by more than 70% in the past month. On Sept. 8, 2025, there were only 221,000 daily transactions made between accounts, down from over 750,000 in early August, according to XRP Ledger metrics. The fundamental usefulness of the token is seriously called into question by this decline.

Why payments matter

XRP is primarily focused on payments, in contrast to Ethereum or Solana, which have flourishing DeFi ecosystems, NFT markets and decentralized applications. Fast and inexpensive account-to-account transactions are its main selling point. There are fewer entities utilizing the network for its intended purpose, as indicated by the key metric cratering. Reduced remittance activity, waning institutional interest, or a shift toward alternative solutions could all be reasons for the steep decline.

card

The sustainability of XRP’s bullish momentum is compromised regardless of the cause. Short-term price spikes may result from speculation, but rallies are usually short-lived in the absence of steady on-chain utility.

XRP is at a turning point in its history. On the one hand, technical indicators indicate that additional upside could be triggered by a breakout above $3. However, it is questionable whether price increases can be maintained given the 70% decline in payments activity, which is the network’s lifeblood. With little real-world demand, XRP runs the risk of becoming a purely speculative asset unless utility metrics improve. The short-term setup appears favorable to traders, but the fundamentals are warning signs.