$XRP Ray has drawn attention to a critical moment for the XRP community: between October 18 and October 25, 2025, the U.S. Securities and Exchange Commission (SEC) is scheduled to issue rulings on seven pending spot-XRP exchange-traded fund (ETF) applications.

This intense one-week window has the potential to transform how XRP is accessed, traded, and adopted by institutional and retail investors worldwide.

✨The Lineup of Decisions

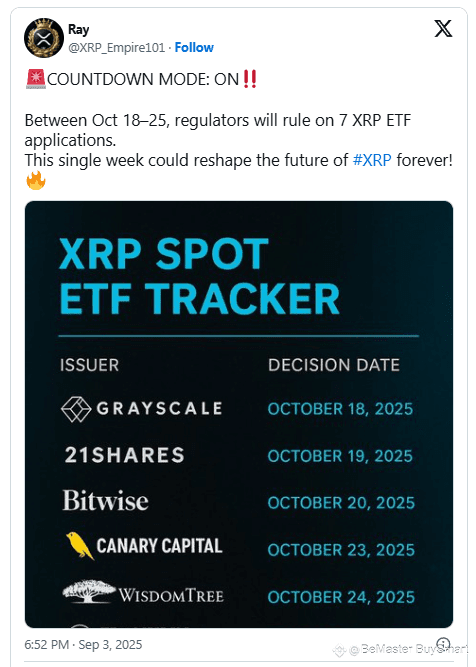

Regulatory filings confirm the exact timing of these decisions. Grayscale’s application is due for a ruling on October 18, while 21Shares follows on October 19. Bitwise’s application will come up on October 20, with Canary Capital’s deadline set for October 23. WisdomTree’s submission is scheduled for October 24, while both Franklin Templeton and CoinShares face decisions on October 25.

The clustering of these deadlines is no coincidence. Over the past year, the SEC has repeatedly extended review periods on XRP ETF filings, setting the stage for all final decisions to converge within this narrow October timeframe.

✨Why This Week Is Historic

The stakes could not be higher. If the SEC approves even one of these ETFs, XRP would gain a new level of legitimacy in U.S. financial markets. Institutional investors would be able to access XRP through regulated, exchange-listed products, bringing liquidity, volume, and mainstream recognition.

Multiple approvals could ignite a surge in capital inflows, similar to what Bitcoin experienced when spot ETFs were approved earlier in 2024.

On the other hand, blanket rejections or piecemeal approvals could fragment the market and dampen momentum. That uncertainty is part of what makes this one-week window so pivotal: the SEC’s stance will either open the floodgates or reinforce existing barriers to adoption.

✨The Legal and Market Backdrop

This moment comes on the heels of a long and contentious history between XRP and U.S. regulators. Ripple’s legal battle with the SEC, which concluded earlier in August with both parties withdrawing their appeals, cleared a major hurdle for the asset. With the legal overhang removed, the focus has shifted squarely to how regulators will handle broader market access through ETFs.

Meanwhile, global demand for tokenized assets and institutional-grade crypto products has surged. Analysts note that ETFs provide the safest entry point for traditional investors, offering secure custody, efficient price discovery, and regulatory oversight. For XRP, an asset already positioned in cross-border payments and liquidity solutions, ETF approval could expand its role into mainstream portfolios.

✨A Week That Could Define XRP’s Future

As Ray highlighted, October 18–25 is not just a week of regulatory deadlines. It is a defining test for XRP’s future in global finance. Every decision in that span will ripple across the industry, shaping market confidence, liquidity flows, and adoption trajectories.

Whether the SEC delivers approvals, rejections, or a mix of both, this concentrated timeline ensures one thing: the future of XRP will look very different after this pivotal week.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.