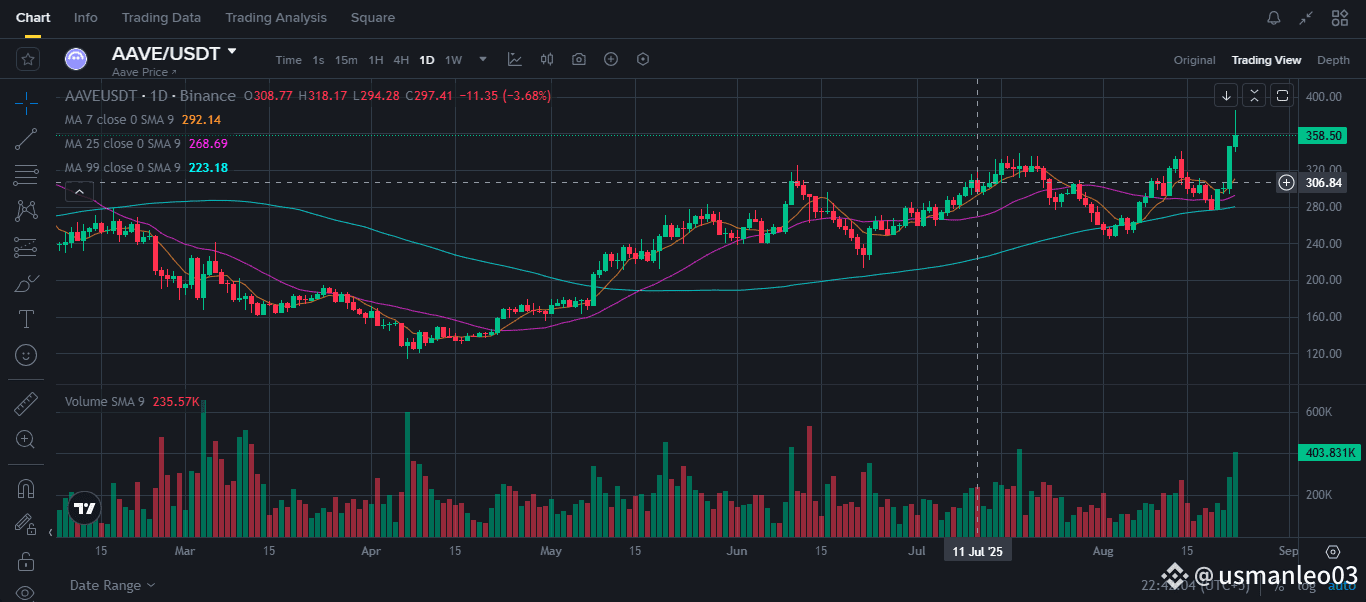

📈 Trade Setup Analysis (AAVE/USDT – 1D, Binance)

Pattern / Price Action:

The chart shows AAVE in a corrective phase after a rejection from higher levels. The price closed at 297.41, down -3.68% for the day, with a high of 318.17 and a low of 294.26. The price is currently trading below the MA7 (292.14) but above the MA25 (268.69) and MA99 (223.18), indicating mixed signals with a slight bearish bias in the short term. The volume SMA9 is at 235.57K, suggesting moderate activity. The price action indicates a pullback within a broader uptrend, potentially finding support near the MA25.

🎯 Suggested Trade Plan

Entry Zone:

Around 295.00 – 298.00 USDT (near current price and MA25 support).

Stop-Loss (SL):

Set at 288.00 USDT (below the MA25 and recent low, allowing for noise).

Target Levels (TP):

TP1: 310.00 USDT (near recent resistance)

TP2: 318.00 USDT (previous high)

TP3: 330.00 USDT (psychological resistance)

⚖️ Risk-to-Reward Ratio (RRR)

Entry: 296.50

Stop-Loss: 288.00 → Risk = 8.50

TP1 (310.00): Reward = 13.50 → RRR ≈ 1.59 : 1

TP2 (318.00): Reward = 21.50 → RRR ≈ 2.53 : 1

TP3 (330.00): Reward = 33.50 → RRR ≈ 3.94 : 1

📊 Probability of Success

Bullish Factors:

Price holds above key MA25 (268.69) and MA99 (223.18), indicating overall trend strength.

Pullback may present a buying opportunity within the uptrend.

Volume is moderate, not indicating panic selling.

Risks:

Short-term bearish pressure as price is below MA7.

Break below MA25 could lead to deeper correction towards MA99.

👉 Estimated Probability:

60% chance of hitting TP1

45% chance of reaching TP2

30% chance of achieving TP3

✅ Summary

This is a pullback trade within an uptrend, aiming to buy near MA25 support. Suggested stop-loss at 288.00, with targets at 310.00 → 318.00 → 330.00. The risk-to-reward ratio is favorable for TP2 and TP3. Trade with caution and monitor for any break below MA25 which would invalidate the setup.