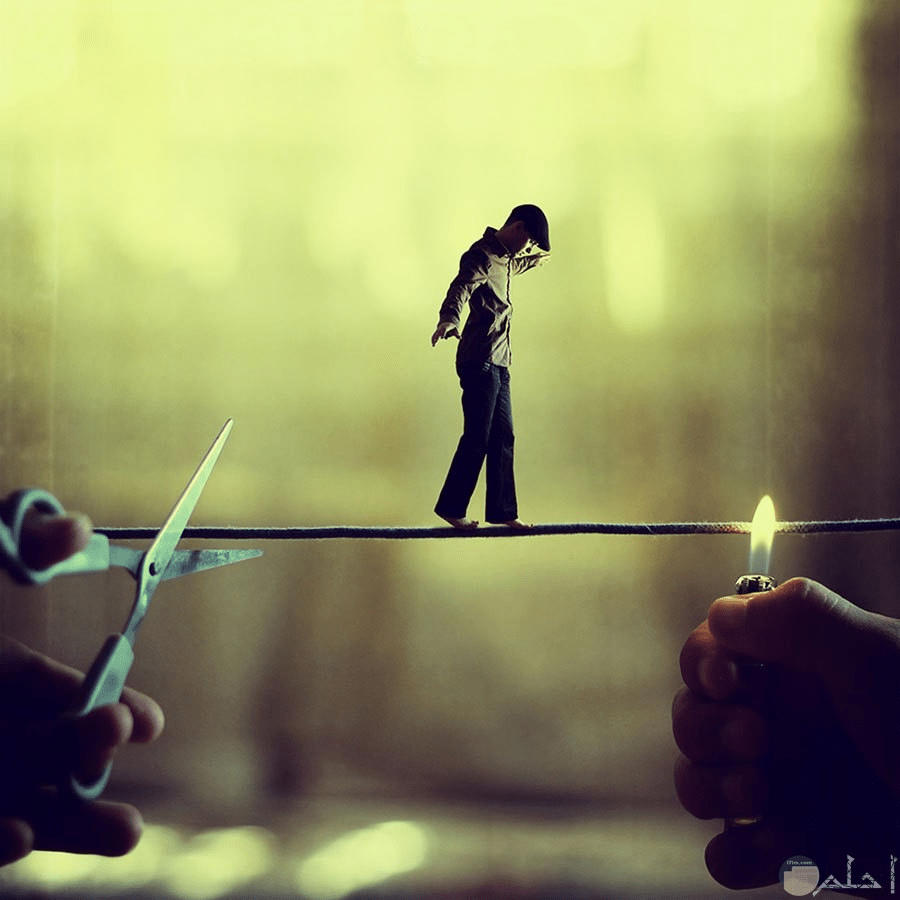

Ten years ago, he entered the cryptocurrency field with only $50,000 in capital and started his trading career. Now, his assets have exceeded $50 million. He told me there is a very simple way to trade, but this method could lead to nearly all profits eroding, so you learn it slowly. First, there are three things we must avoid when trading.

First: Never buy when the price is high; we should be greedy when others are fearful, and fearful when others are greedy. We should train ourselves to buy when the price is low and make it a habit.

Second: Never use leverage.

Third: Never invest all your capital; full investment makes you too passive, and the market is never short of opportunities. The opportunity cost of investing all your capital is extremely high.

Now, I will tell you what he also said about the six main rules for short-term trading.

First, after a rise stabilizes, there is usually a new rise. After a decline stabilizes, there is usually another new decline, so we must wait until the trend direction becomes clear before taking any action.

Second, do not trade during sideways movement; most people lose money when trading because they cannot follow this simple rule.

Third, when selecting candles, you should buy when there is a bearish candle and sell when there is a bullish candle.

Fourth, when the decline slows down, the recovery also slows down; a rapid decline leads to a rapid recovery.

Fifth, building positions using the pyramid method; it is the only consistent principle in value investing.

Sixth, when cryptocurrencies continue to rise after a long period of decline, they will inevitably enter a sideways state. At this stage, there is no need to sell at the highest price or buy at the lowest price. After a period of accumulation, a trend change will definitely occur. If the price direction changes from its highest levels, we must liquidate our positions in a timely manner; in short, we must act quickly.