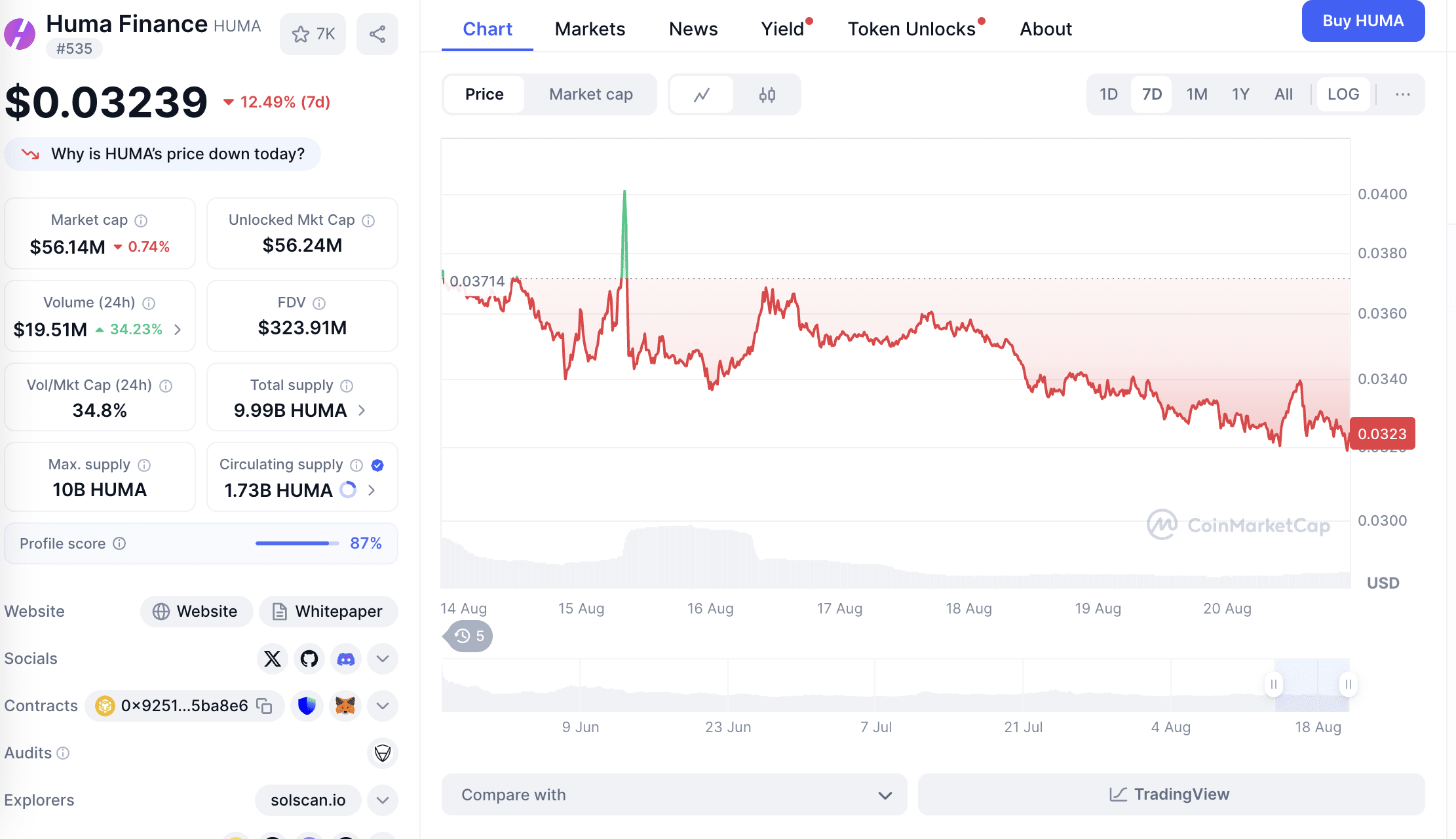

Once seen as a hopeful contender in the PayFi space, $HUMA has recently seen a continuous decline in price, dropping over 12% in the past 7 days, with the current quote at $0.03244. Despite a 24-hour trading volume increase to $19.57M (+35.74%), the market still seems to lack confidence.

🧩 Market cap and valuation contradictions, is the PayFi narrative hindered?

Huma's circulating market cap is $56.24M, but its FDV is as high as $324.46M, showing a serious gap between overvaluation and market realization capability. The circulation rate is only about 17.3%, meaning a large number of tokens are still not unlocked, and there may be future selling pressure risks in market expectations.

The core value of PayFi lies in the on-chain credit mechanism and DeFi products supported by stable cash flow. Huma did provide a new income verification-based credit model (such as payroll lending, invoice financing) early on, once considered a combination of RWA and credit DeFi. However, the recent lack of obvious product iterations, partnerships, or narrative push has led to a gradual weakening of its 'payment finance' narrative.

🩸 Trading volume rebounds, but the price continues to decline.

In the K-line chart from August 14 to now, a short-term spike in volume can be seen, but it still overall maintains a downward channel, currently falling to around $0.032. Despite a 35% increase in 24h trading volume, possibly due to institutional or project liquidity management, it has failed to significantly change the price trend, indicating weak market enthusiasm for its rise.

🪙 The issues of token economics cannot be ignored.

Total supply: 10B HUMA

Circulation: 1.73B HUMA (~17.3%)

FDV valuation: $324.46M

Unlocking situation: Over 80% of tokens are still not in circulation.

Such enormous potential unlocking pressure, combined with the market not seeing obvious revenue or protocol expansion, poses serious challenges to current valuation.

💡 Where is the turning point for the future?

For Huma to recreate the glory of PayFi, it must answer several key questions:

Hong Kong stablecoin, RWA, PayFi ecosystem, and other positive factors—can Humafinance deeply participate?

Are there real credit financial products in place? (Payroll lending / Real world borrower)

Is there off-chain cooperation or endorsement from financial institutions?

Will it leverage LayerZero, Chainlink, or other modules to achieve cross-chain credit?

Will the token economy undergo redesign to reduce FDV?

Otherwise, the PayFi story may be taken over by new projects combining other RWA or stablecoin + credit hybrid models.

$HUMA #humafinance

Follow the orange cat to find the next hundredfold project.