Written by: mattdotfi

Compiled by: AididiaoJP, Foresight News

Currently, only a few people are aware of @LayerZero_Core's acquisition of @StargateFinance, but since such mergers are extremely rare, I believe it is worth exploring in depth.

Proposal Summary

LayerZero plans to acquire Stargate's tokens and treasury (currently, each $STG is supported by $0.1444 of funds), and terminate the Stargate DAO, merging it into the $ZRO-led economic system.

Acquisition price: $0.1675 per $STG, or 0.08634 $STG for each $ZRO exchanged.

The proposal will follow the standard procedures of Stargate DAO, requiring at least 1.2 million votes and a 70% approval rate to pass.

Future excess revenue generated by Stargate will be used to reduce the circulation of $ZRO through buybacks.

Pros and Cons Analysis

This raises a key question: "Who will benefit the most?"

In the current situation, LayerZero and $ZRO holders seem to be the biggest beneficiaries, as this is a liquidity acquisition conducted through its tokens, specifically manifested as:

Acquiring $STG supported by the Stargate treasury at a moderate 16% premium while increasing the number of $ZRO holders.

Earning fees generated by the protocol (according to @DefiLlama data, approximately $1.74 million annually), which will be used to buy back $ZRO on the open market.

By repurchasing, vertically integrate the $ZRO token economy with cross-chain operations (LayerZero is in a leading position), enhancing its utility.

So what can $STG and $veSTG (locked STG) holders gain? Not much:

Due to the recent price increase of $ZRO, its exchange discount is low; $STG only has a slight premium due to market volatility, but its price floor is clear.

After an initial 24-hour discussion, LayerZero decided to pay $veSTG holders six months of Stargate revenue, as they cannot unlock their tokens before the end of the lock-up period.

Drawbacks and Concerns

The issue here is complex, but ultimately boils down to one word: compromise.

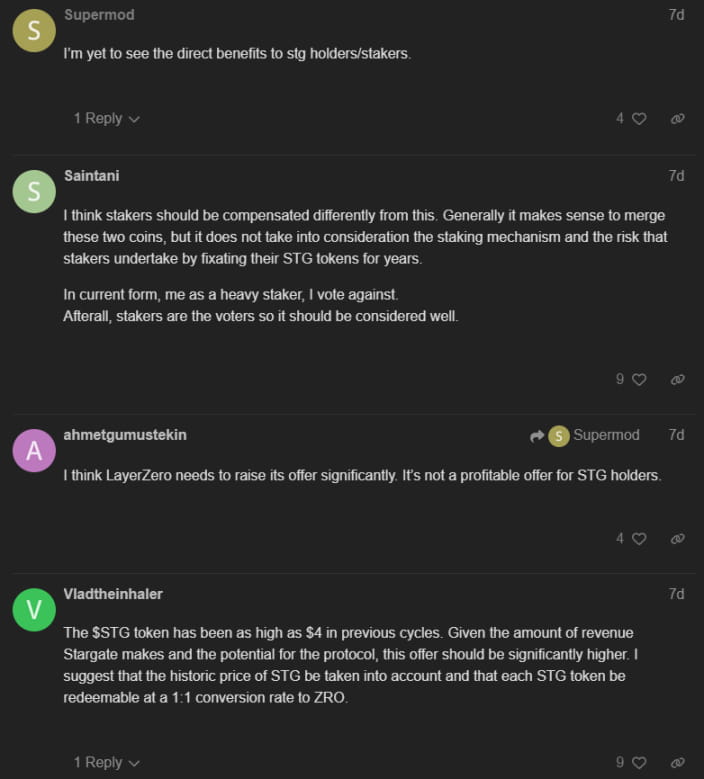

LayerZero stands to profit more in the current situation, while Stargate token holders are hard to satisfy. Here are three major issues and uncertainties:

How should a reasonable premium for LayerZero's acquisition of $STG be calculated?

For $STG holders, how should they choose between the "lesser of two evils"? Should they continue to endure ongoing selling pressure on the tokens, or opt for a safe but limited-growth solution?

$veSTG holders have an average lock-up period of about one year; if the proposal passes, what incentive do they have for just six months of compensation?

Currently, the fully diluted valuation (FDV) of $STG is less than 10% of $ZRO, with $STG worth $8.1 million locked in the form of $veSTG.

Many holders request a 1:1 exchange of $ZRO for $STG, but this is unreasonable, as it means they would instantly gain 12 times the profit, while LayerZero would need to use the entire FDV to acquire a stable but low-revenue business.

Personal Opinion

Although I believe the LayerZero team should reassess the premium paid to $STG holders and design a more reasonable income-sharing plan for stakers, this acquisition may not necessarily be a disaster for the project itself.

DAOs mainly rely on revenue and token issuance to maintain operations, and $STG has plummeted over 95% from its historical peak, with Stargate's annual revenue of only $2 million making it difficult to expand. Additionally, Stargate already relies on LayerZero's infrastructure, and integration will make it easier to achieve growth through its tech stack and funding.

Nevertheless, I believe this proposal makes sense for Stargate, but there is no need to rush to conclusions. The retention and loyalty of $STG holders to LayerZero largely depend on how the team handles this matter. Otherwise, they may lose a batch of potential new $ZRO loyal holders and participants who have supported Stargate since the project's inception.

Update:

The proposal has been launched on Stargate DAO, with the minimum threshold met. Currently, 2.3 million circulating $veSTG (out of a total of 17 million) have voted "in favor" (98% to 2% "against").

I don't think this is a hostile takeover, but at this stage, LayerZero's benefits are clearly far greater than those of $STG and $veSTG holders.