The Bitcoin bull cycle is approaching its final stage after 997 days since the cycle bottom on November 21, 2022. This indicates that the peak could occur within 70 days, possibly from October 15 to November 15, 2025.

Bitcoin Cycle Peaks in October–November 2025

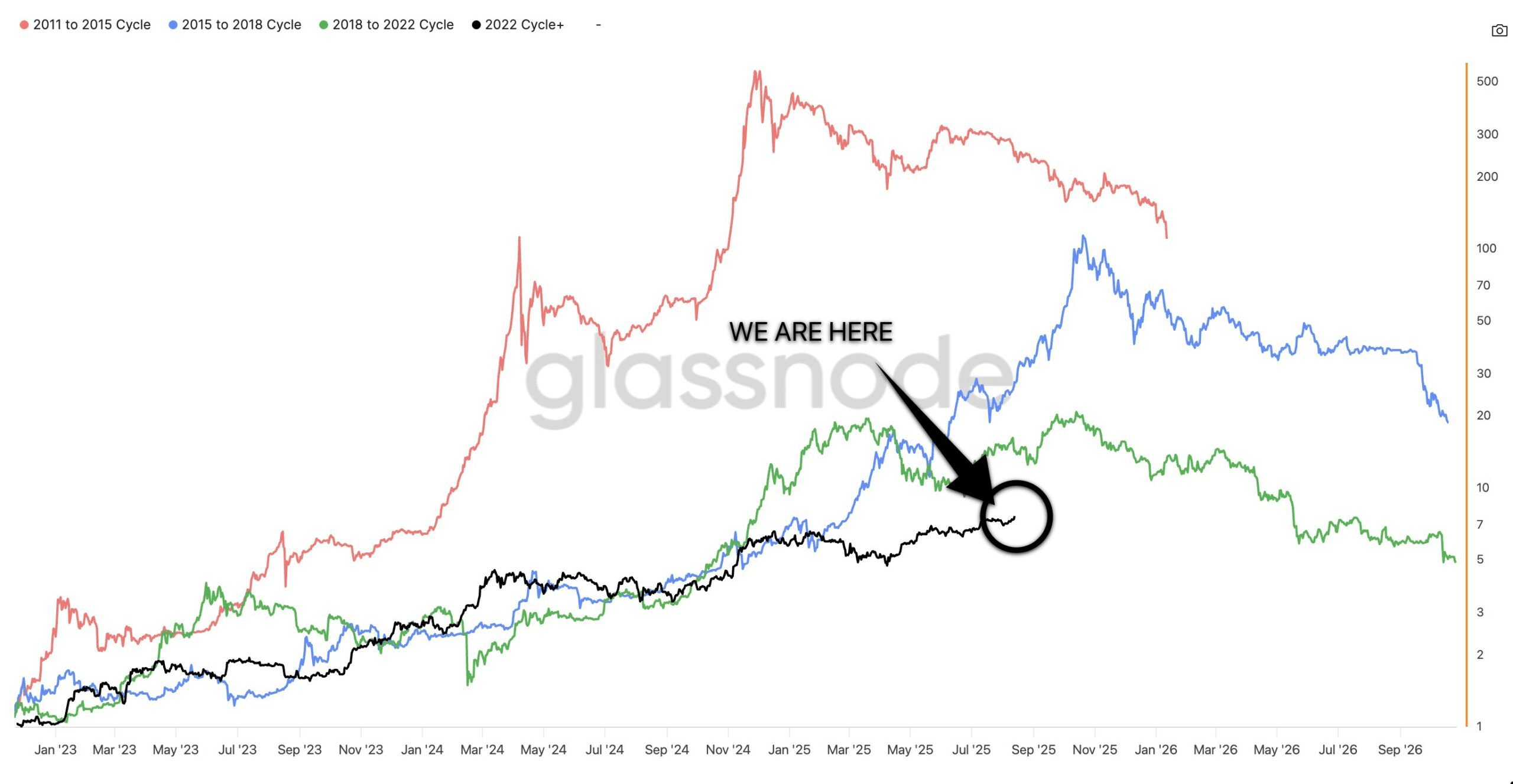

In a recent observation of Bitcoin's historical cycles, analyst CryptoBirb shared some notable insights.

This suggests that the peak could occur within 70 days, possibly from October 1 to November 15, 2025. Historical data presented by this analyst outlines the length of previous bull cycles: 2010–2011 (~350 days); 2011–2013 (~746 days); 2015–2017 (~1,068 days); 2018–2021 (~1,061 days). If history repeats itself, the current cycle is predicted to last about 1,060–1,100 days.

As of now, from the bottom of the previous cycle on November 21, 2022, the price increase of Bitcoin has lasted 997 days and is approaching its final stage. The peak may occur within the next 70 days if history continues to unfold similarly.

CryptoBirb notes: 'The highest odds will also be highest in the next 3 months, ideally from October 15 to November 15, 2025.'

Calculating the timing of the cycle peak based on Bitcoin halving events also yields a similar forecast. From the 2012 halving to the 2013 peak took about 366 days; from 2016 to 2017 was about 526 days; and from 2020 to 2021 was about 548 days. Based on this, the period from the 2024 halving to the next peak could be around 518–580 days.

CryptoBirb adds: 'The next peak will occur around the timeframe from October 19 to November 20, 2025 (518–580 days).'

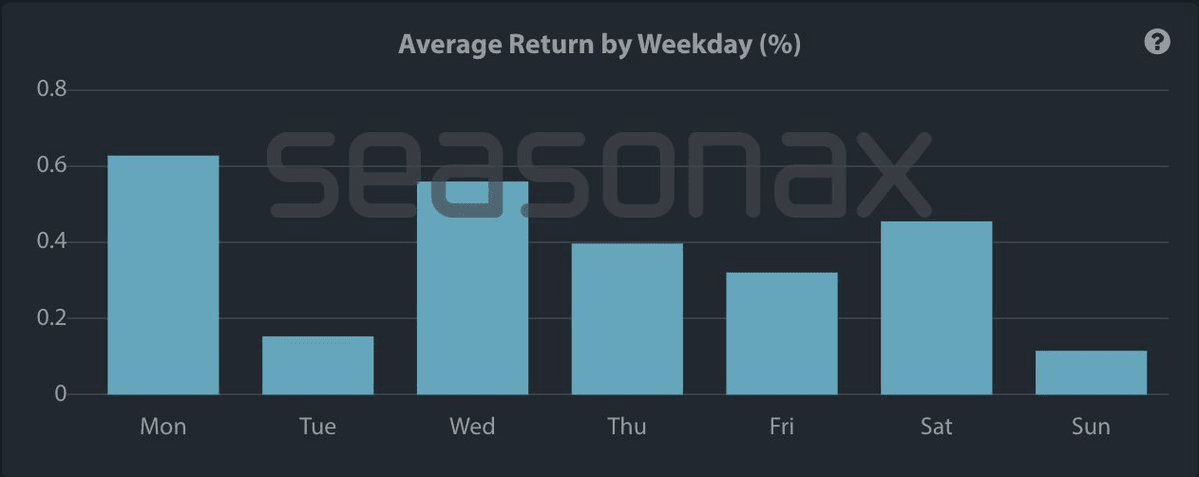

To further reinforce this view, CryptoBirb points out that in previous cycles, October and November are often the strongest growth months for Bitcoin, especially on key days such as Monday (October 20, October 27) and Wednesday (October 22, October 29). Among them, October 22 is the time when prices are most likely to break out.

The overlap between the four-year cycle of the U.S. presidential election and the Bitcoin halving event further reinforces the hypothesis that the cycle peak will fall around mid-October to mid-November 2025. This pattern has been observed multiple times when political factors combine with supply scarcity to drive strong price increases.

CryptoBirb states: 'The next ATH ratio is heavily concentrated around the timeframe from October 15 to November 15, 2025 — where history, mathematics, and market dynamics converge. I guess we are not far from the fourth week of October.'

This aligns with the view of CEO Alphractal, who believes that the Bitcoin cycle remains intact and is likely to peak in October, but warns investors to prepare for increased volatility before reaching the peak.

Bear Market 2026

From a market psychology perspective, the period before the peak often witnesses extreme euphoria, a surge in trading volume, and a peak in interest in searching for Bitcoin-related keywords. This phase may also feature strong short-term corrections to 'shake out' weak holders before prices rise. Bitcoin has experienced strong upward momentum along with recent downward corrections.

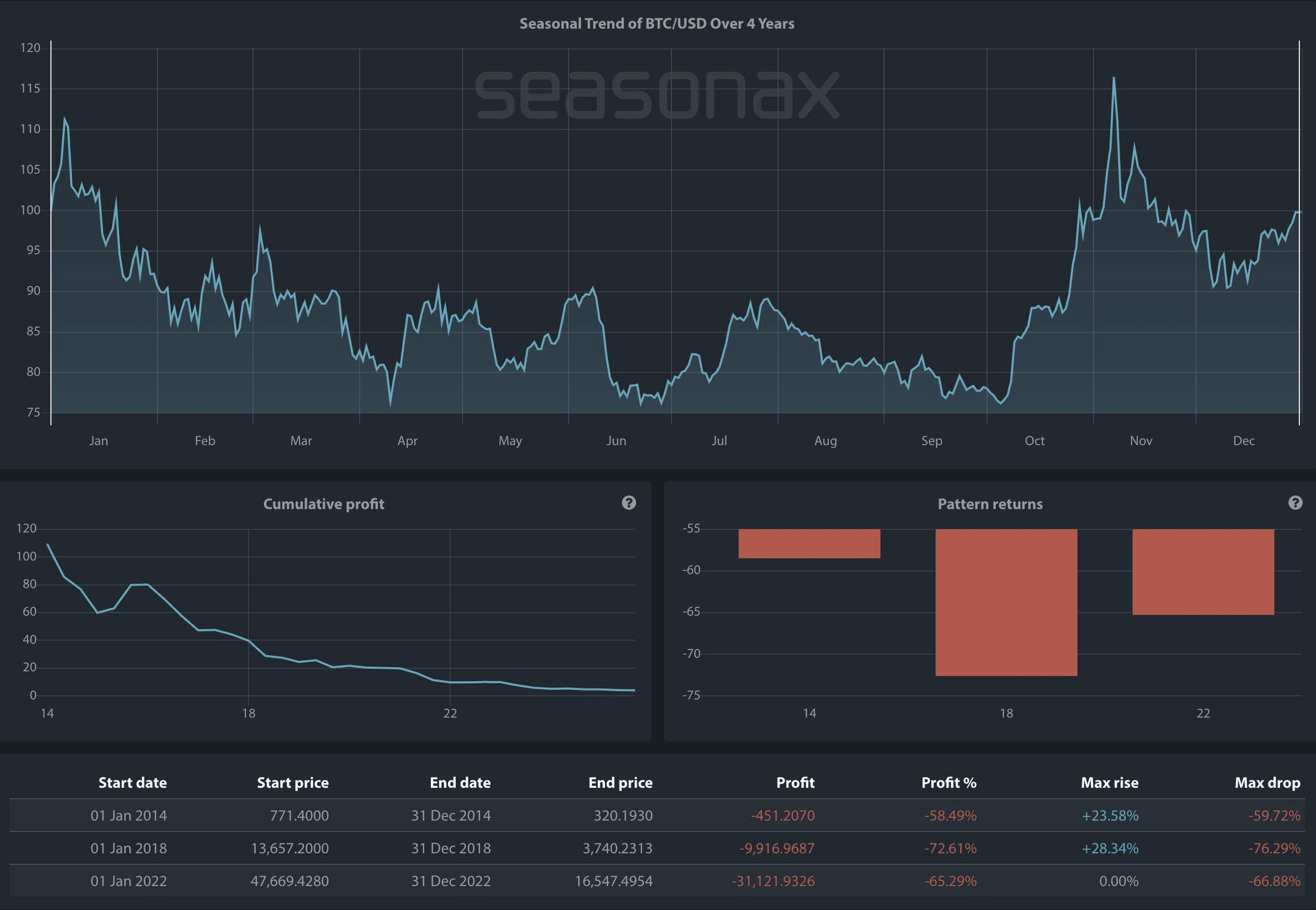

After the peak, historical trends show that the bear market usually lasts from 370 to 410 days, with an average decline of about -66%. If this scenario repeats, the downtrend could begin in 2026, opening up a deep correction phase before the next accumulation phase starts.

This is why many analysts recommend having an exit strategy before the market reverses. Some investors have planned to withdraw cryptocurrency before December to secure full profits.

However, as previously reported, some experts believe that the Bitcoin cycle has 'died.' Forecasting risk is currently more challenging, as the potential panic of institutions could reshape the future bear market.