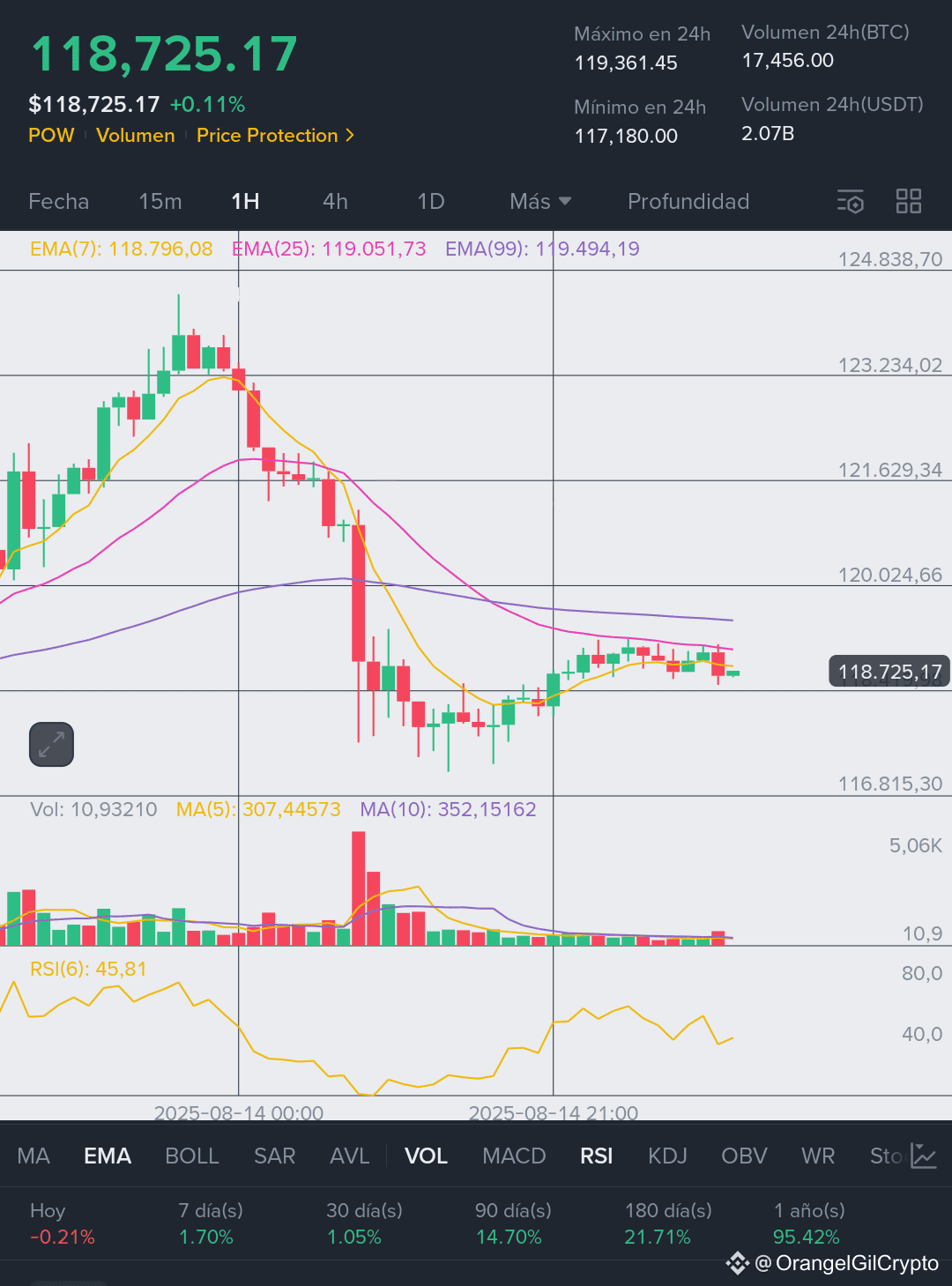

Price: $118,727.74 | 24h: -0.08%

Market Cap: $2.36T | 24h Volume: $83.59B

Technical read. BTC holds above prior breakout areas and its rising long-term MAs—macro uptrend intact. Funding and basis have normalized after the last push, consistent with range-building near highs. Dips toward round numbers attract liquidity hunts; dominance remains elevated, anchoring overall risk.

Key levels. Support: $116k–$117k; stretch $112k–$113k (trend guard). Resistance: $120k–$122k, then $128k–$130k.

Scenarios (next weeks).

Base (60%): Sideways $116k–$122k while leverage resets.

Bull (25%): Hold >$122k → path to $128k–$130k.

Risk (15%): Macro wobble/ETF outflows test $112k–$113k.

Strategic reflection. Track ETF net flows, perp funding, and basis. As Lyn Alden stresses, liquidity cycles drive BTC’s big legs; position sizing > prediction.