Current Sentiment: ETH is testing major resistance and analysts are split on whether the next move will be explosive or corrective.

📅 Short-Term Outlook (Aug–Sept 2025)

CoinDCX: Break above $4,800 → rally toward $5,500–$6,000. Drop below $4,000 → fall to $3,800.

CoinCodex: ~10.85% rise → $5,240 by Sept 11–12, with possible spike to $5,417.

Changelly:

Aug: $4,652–$5,585 (avg $5,118)

Sept: $3,199–$5,154 (avg $4,177)

📅 By End of 2025

Standard Chartered: $7,500 target (boosted by ETF inflows & GENIUS Act).

Tom Lee (Fundstrat): Up to $15,000 possible with Fed rate cuts + institutional buying.

Yahoo Finance: Low $2,061 | Avg $4,054 | High $6,000.

Changelly (Q4): $2,793–$5,367 (avg $4,080).

📅 Long-Term (2028 & Beyond)

Standard Chartered: $25,000 by 2028.

CoinCodex: $10,000 by 2028; potential $33,092 peak by 2050.

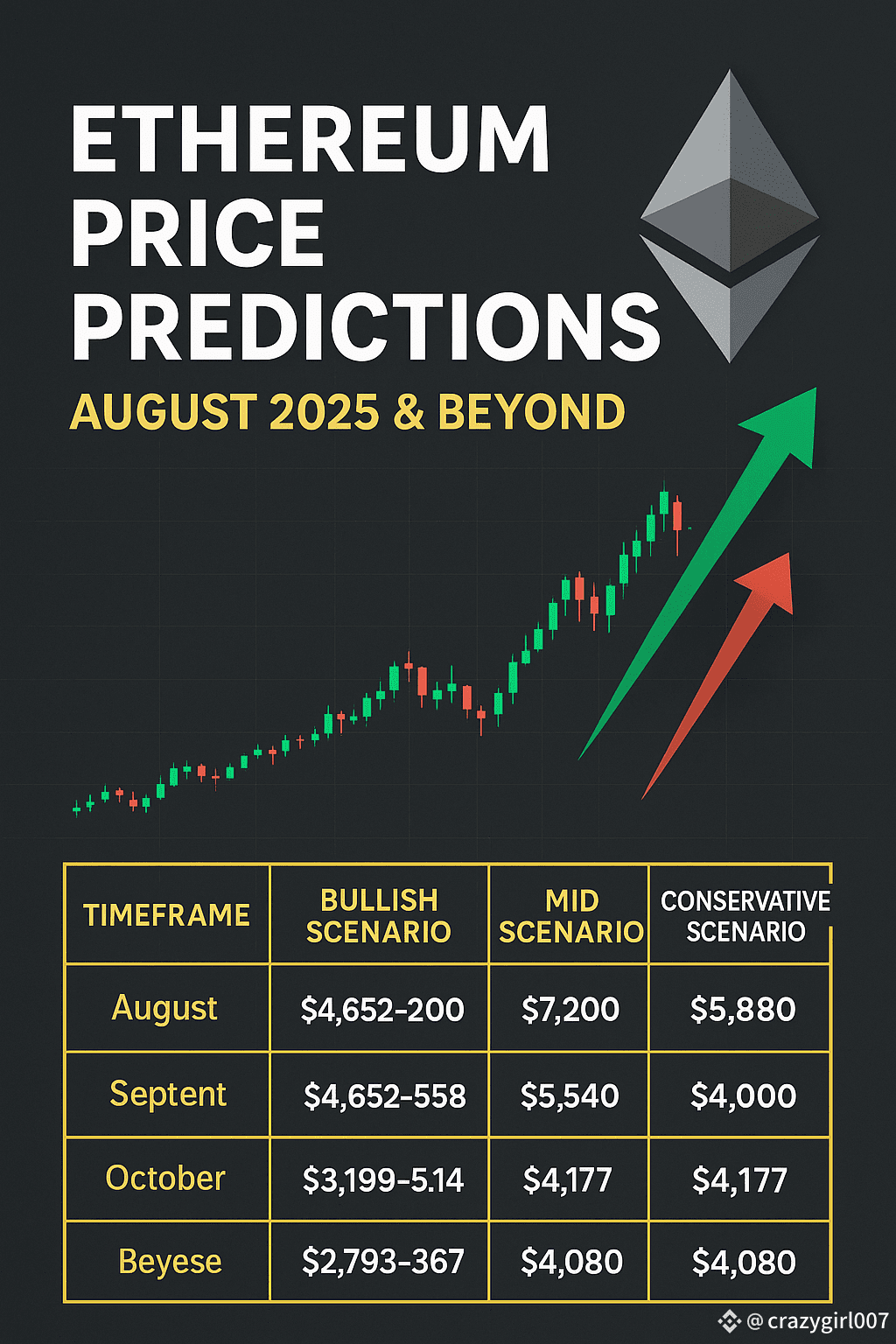

📊 Summary Table

Timeframe Bullish Scenario Mid Scenario Conservative Scenario

Aug–Sept 2025 $5,500–$6,000 $5,240 $3,800–$4,000

End of 2025 $7,500–$15,000 ~$6,000 ~$4,000

By 2028 $25,000–$33,000 $10,000 –

📈 Sentiment Signals

Retail traders skeptical near ATH → historically bullish.

Gamma exposure in ETH options may push prices toward $4,400+.

💡 Takeaway: ETH could be gearing up for a strong move. Watch $4,800 closely—breakouts from here may set the stage for multi-thousand-dollar gains by year-end.

⚠ Disclaimer: Not financial advice. Crypto is volatile—DYOR before investing.

#Ethereum #ETH #CryptoAnalysis #PricePrediction #Blockchain