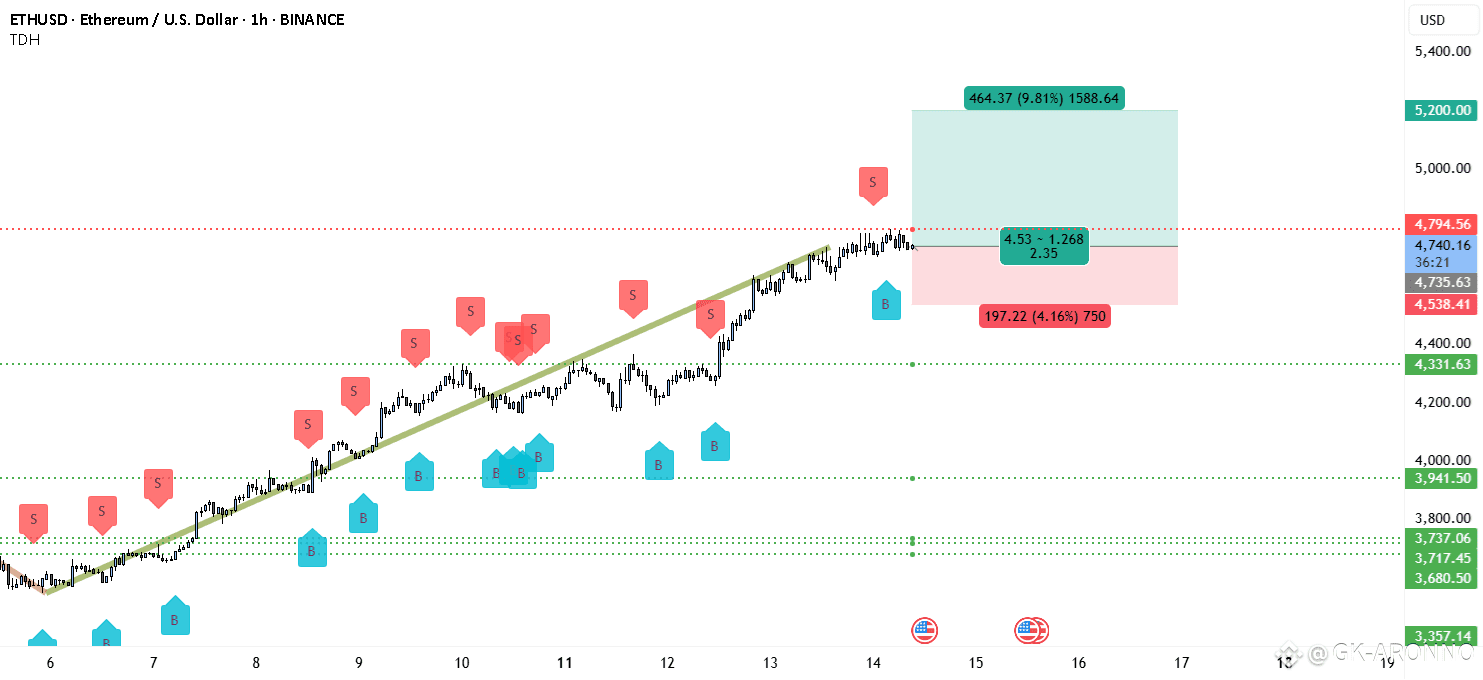

ETH has been in a strong upward channel since August 6, with the price consistently respecting the rising trendline. The structure remains firmly bullish, showing a series of higher highs and higher lows. Every dip over the past week has been met with strong buying pressure, suggesting that bulls remain in control.

Currently, ETH is hovering just under the $4,794 resistance zone, which is the last major hurdle before the psychological $5,000 level. Above this, the chart shows a target zone at $5,200, which aligns with the upper projection from the recent bullish swing. On the downside, the immediate support is at $4,331, with a deeper cushion around $3,941 in case of a pullback.

The buy and sell markers on the chart show that most recent buy signals occurred during shallow retracements, while the clustered sell signals in earlier phases have been invalidated by continued upward momentum. The risk/reward setup is clearly favorable for bulls, with the stop placed well below the current price action and the profit target extending into fresh highs.

Trade Setup 📊

• Entry: $4,735.99

• Stop Loss: $4,538.41

• Take Profit: $5,200

• R:R Ratio: 2.35

• Bias: Bullish

As long as ETH holds above $4,538 and the ascending trendline remains intact, the probability favors a push through $4,794 toward $5,000 and eventually $5,200. A clean breakout with volume would confirm continuation, while a failure to hold the support could invite a short-term retracement. Booking partial gains near $5,000 and trailing stops is recommended to protect profits.