Many new crypto traders believe they need huge starting capital to see significant gains. In reality, skill often matters more than size. With disciplined risk management and the ability to read chart patterns, even a small starting balance — like $680 — can potentially grow into tens of thousands over time.

One of the most valuable skills in trading is pattern recognition. Chart patterns reveal the market’s psychology, showing where price is likely to move next. Mastering them allows you to:

Identify high-probability entries and exits

Time your trades with precision

Manage risk effectively

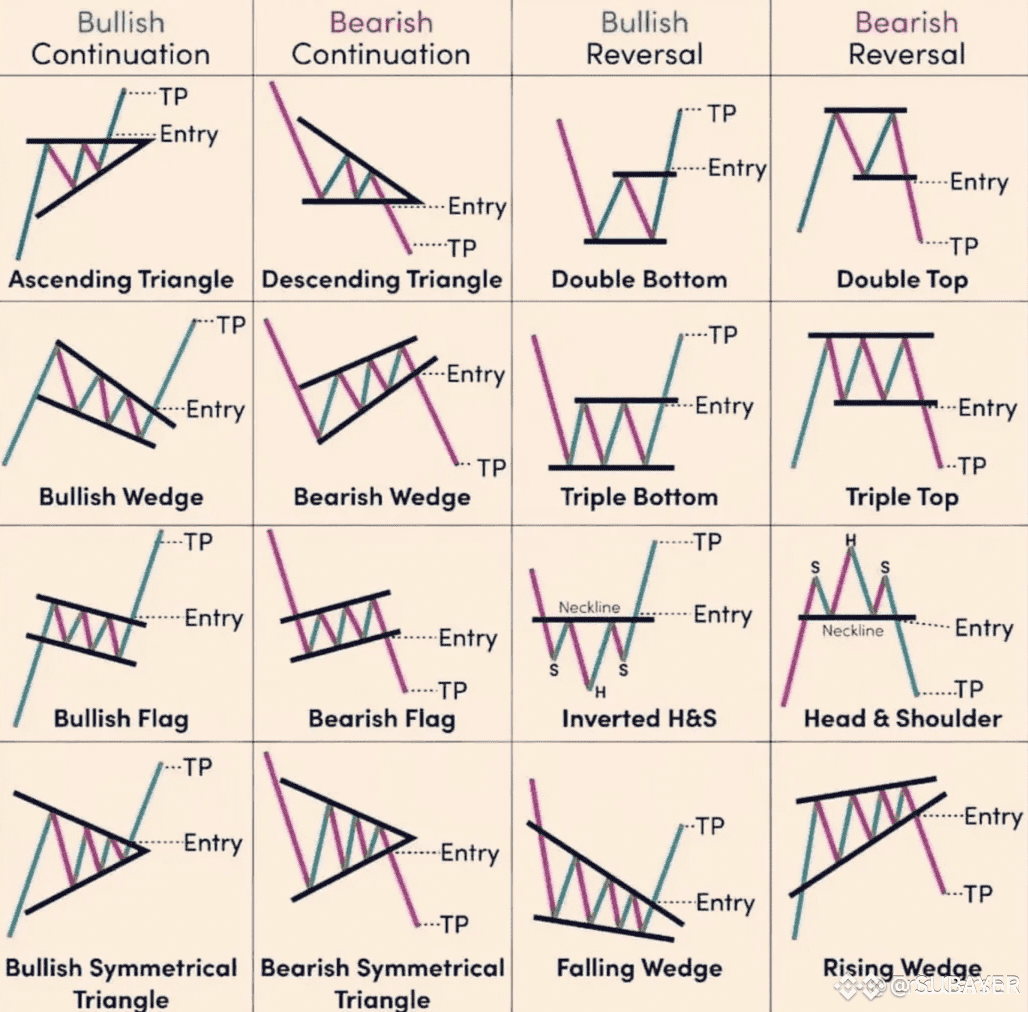

Step 1: The Four Main Categories of Chart Patterns

1. Bullish Continuation 🚀

Examples: Ascending Triangle, Bullish Wedge, Bullish Flag, Bullish Symmetrical Triangle

Meaning: The price pauses briefly before continuing higher. Ideal for joining an existing uptrend early.

2. Bearish Continuation 📉

Examples: Descending Triangle, Bearish Wedge, Bearish Flag, Bearish Symmetrical Triangle

Meaning: The price consolidates before continuing lower. Suitable for short positions or closing long trades.

3. Bullish Reversal 🔄

Examples: Double Bottom, Triple Bottom, Inverted Head & Shoulders, Falling Wedge

Meaning: The downtrend shows signs of ending, with a potential shift to an uptrend. Great for spotting bottoms.

4. Bearish Reversal ⚠️

Examples: Double Top, Triple Top, Head & Shoulders, Rising Wedge

Meaning: The uptrend is weakening, signaling a possible reversal to the downside. Helps secure profits before declines.

Step 2: Building a Trading Plan Around Patterns

Capital Allocation

Start with $680

Risk only 2–3% per trade (about $14–$20)

Leverage Use

For strong setups, use moderate leverage (3–5x)

Avoid overleveraging to reduce risk of liquidation

Entry & Exit Rules

Enter when price breaks out of the pattern with confirmation

Place a Stop Loss just beyond the opposite side of the pattern

Target profit based on the measured move (pattern’s height projected from breakout)

Step 3: Compounding Profits Over Time

The real growth comes from consistent small wins, not one big trade.

Example scenario:

Win 3–5% per trade

Repeat over 100+ trades with discipline

Results can snowball significantly

Hypothetical Growth

Trade 1: $680 → $714

Trade 10: $960 → $1,008

Trade 50: $5,200 → $5,460

Trade 100+: Potentially $40,000+

(Note: This is a hypothetical example, not a guarantee.)

Step 4: Risk Management is Key

Even the best patterns fail sometimes. Survival in trading depends on:

Always using a Stop Loss

Avoiding emotional trades and chasing breakouts

Trading in line with the broader market trend

Step 5: Practice Before Going Live

Backtest these patterns using historical charts

Learn to confirm breakouts using RSI, MACD, and volume analysis

Focus on filtering out false signals

✅ Final Takeaway

If you can spot these 16 patterns quickly and apply them with solid risk management, you’ll be ahead of most traders. The combination of skill, discipline, and

compounding can turn a small account into something much bigger over time — but only with patience and consistent execution.