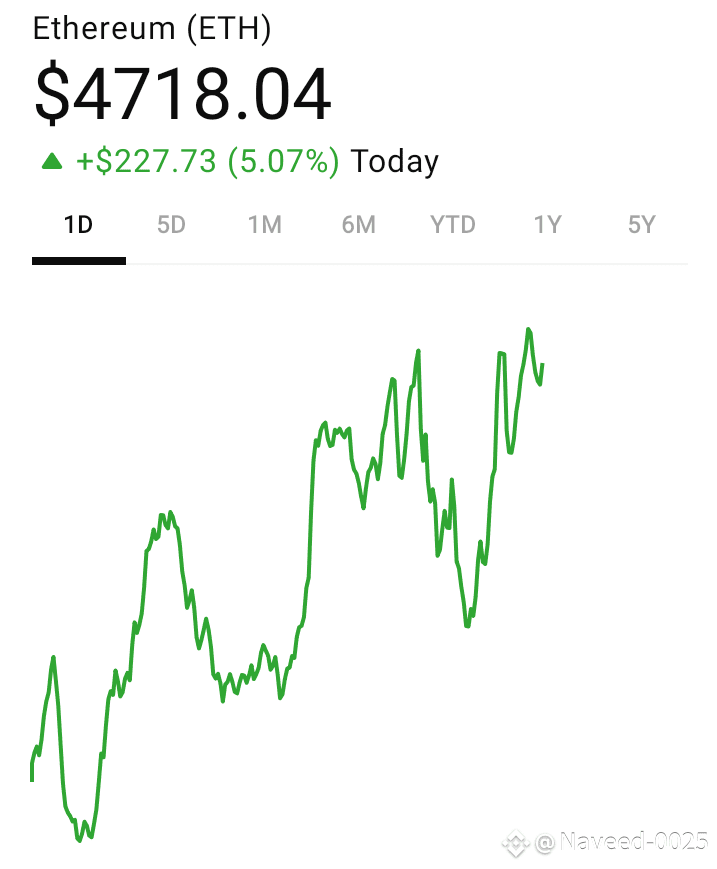

Ethereum is currently enjoying a powerful rally, trading near $4,718, a level not seen since late 2021. Here's who is behind this surge—and who might be setting the stage for what comes next.

1. Institutional Investors & Spot ETH ETFs

ETF inflows have been relentless: Ethereum-based funds pulled in $268 million last week, with a staggering $1 billion+ in spot ETF inflows in a single day .

Management giants like BlackRock are leading, with BlackRock’s ETHA ETF alone capturing $639.8 million last week .

Standard Chartered now forecasts ETH hitting $7,500 by end-2025, citing sustained ETF demand and deepening enterprise engagement .

Corporate treasuries are actively stocking up—companies such as SharpLink Gaming and Bitmine Immersion have increased their ETH reserves .

👉 Bottom line: Institutional entry through ETFs and treasury acquisitions is tightening supply and reinforcing price strength.

2. Whales & Over-the-Counter Flows

Large OTC trades totaling $160 million in a single hour, including a $19 million transfer of 4,500 ETH to an OTC desk, confirm whale activity .

On-chain peaks include one whale accumulating $1.34 billion worth of ETH, signaling confidence from major holders .

Exchange reserves are near all-time lows, as whales move ETH off exchanges into cold storage or staking .

🧠 Interpretation: When whales buy in bulk and hide ETH off exchange, supply tightens—fueling pricing pressure.

3. On-Chain Fundamentals & Ecosystem Strength

Staking levels remain robust with ~28% of supply locked—reducing available liquidity .

Network activity: Block capacity is nearly maxed, underscoring sustained DeFi and NFT usage .

Ethereum dominates key blockchain sectors: ~59.5% of DeFi TVL, 50% of stablecoin issuance, and 54% of tokenization flows .

🔧 Effect: Strong real‐world use cases translate to persistent demand and justify premiums.

4. Macro & Regulatory Tailwinds

The GENIUS Act (stablecoin regulation) incentivizes more activity on Ethereum, which hosts most stablecoins .

The U.S. executive order enabling 401(k) crypto investment has brought in $1.57 billion in digital asset inflows, with ETH receiving more than $268 million .

Project Crypto policy from the SEC is legally clarifying DeFi, staking, and tokenized securities—favorable catalysts for Ethereum .

✅ In brief: Easing regulation and institutional acceptance are painting ETH as a legit alternative investment.

5. Derivatives Markets vs. Spot Demand

While futures and leveraged positions have propelled much of the move, spot demand hasn’t been as aggressive .

Futures open interest has surged to record highs, underlining speculative momentum .

⚠️ Caveat: If futures cool off without spot buying support, consolidation or a minor retrace could follow.

What Lies Ahead?

Timeline Likely Drivers Price Targets

Short-Term ETF flow, whale accumulation $4,800–$5,500 (breakout zone)

By End-2025 Institutional adoption, policy $6,000–$7,500, per Standard Chartered & Tom Lee

2026–2028 Persistent structural demand $7,500 → $10,000+ if supply tightens

Long-Term DeFi and Web3 integration Major upside if DeFi/NFT expansion continues

Final Take

Driving force: Large-scale institutional inflows, corporate treasury acquisition, whale accumulation, and favorable macro/regulatory context.

Sustainability check: On-chain fundamentals support the rally, but derivatives dominance carries risk if spot follow-through falters.

Key watch zones: Breaking $4,800–4,900 could unlock a path to $6,000+; heavy profit-taking near this zone could set up a short-term retracement.

Should You Care?

If you're an investor considering ETH:

For entry: Accumulating on dips around $4,400–4,500 might position you well for the next leg.

For existing holders: Keep an eye on ETF flows, derivatives signals, and policy developments. A confirmed thrust past ATH could spark a bullish rerating.

For risk control: Us

e partial take-profits approaching $5,500+, and set stop-losses if ETH drops below key support near $4,200.