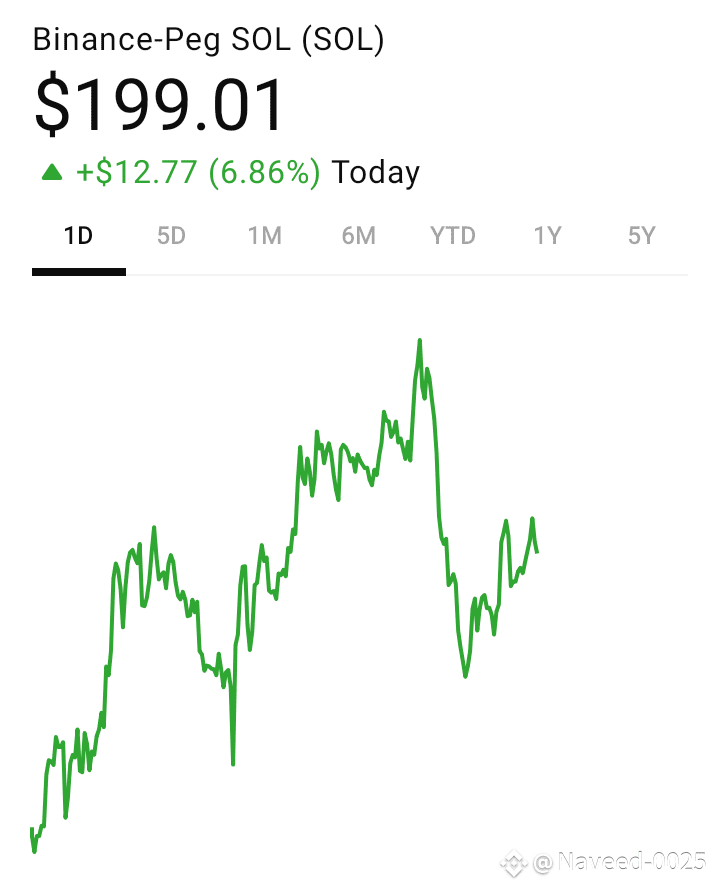

You're seeing impressive momentum: SOL is trading just under ~$200 after jumping ~14.7% in the past 24 hours. Here's a breakdown of how analysts and models view Solana's future, from short-term technical levels to long-term projections.

Near-Term Outlook (Days to Weeks)

Technical analysis (CoinDCX/YouHodler) anticipates support holding around $160–162 (100-day EMA). A break above $175–180 may push toward $195–205, while failure under $160 could drop it to $150–153

As of today, SOL broke a bearish trendline near $178, testing resistance at $200–205 .

Short-term targets include $175–180 in the next few days, with extension toward $195–199 if bullish momentum persists .

✅ Summary: Watch the $175–180 resistance zone. Holding above it could trigger a rally toward $200+; a dip under $160 may form a deeper pullback.

Mid-Term (End of 2025 to 2026)

Changelly project a slight pullback to ~$160 in late August 2025, then a recovery to $183 average, with $171–183 range over 2025 .

By 2026, Changelly forecasts SOL between $299–344, averaging ~$307 .

Similarly, Benzinga & CoinCodex expect SOL reaching $250–300 by 2026 .

A Bitget analyst sees SOL potentially hitting $300 by end-2025, driven by institutional inflows .

🔍 Summary: Mid-term gains to $250–300 are widely expected, especially if bullish market forces and institutional interest continue.

Long-Term Forecasts (2027–2030 and Beyond)

CryptoNews aggregating forecasts for 2030 range dramatically: bearish as low as $9.81, bullish as high as $3,211 . Key voice predictions include:

Jake Gagain: ~$750 next bull run

Tyler Hill: ~$669, possibly $2,230

Wolf of Crypto Street: ~$500 by 2025 .

YouHodler lays out two scenarios:

High-end: SOL could reach $500–1,500 by 2030

Moderate: $200–500 by 2030 .

Binance estimates a growth to $201.64 in 2025 and $257 by 2030 .

Kraken’s model with a steady 5% annual growth projects $254 by 2026 and $413 by 2040 .

Benzinga reports some analysts forecasting a 10× increase by 2030, potentially exceeding $1,000 .

🔭 Summary: Long term, forecasts range from a few hundred dollars to over a thousand. Bull-case scenarios envision SOL reaching $500–1,000+ by 2030, while conservative models predict $300–500.

Risks & Catalysts Influencing Price

1. Technical vulnerabilities & decentralization concerns

Security incidents with smart contracts and DDoS-style outages remain notable issues .

2. Regulatory environment

Ongoing SEC scrutiny—Solana is still contested as a potential security—adds complexity .

3. Institutional adoption

Momentum from partnerships (e.g. Blue Origin, staking protocols), NFT/DeFi usage, and growing institutional interest could boost demand and price .

4. Market cycles & altcoin season

If a broad bull cycle unfolds, SOL usually correlates strongly with Bitcoin and Ethereum, sometimes outperforming thanks to its tech capabilities .

Summary Table

Horizon Conservative Estimate Bull Case

Short-Term (weeks) $175–205 (technical rebound) $220+ breakout toward $250

2025–2026 $180–250 $250–300+

2027–2030 $300–500 $500–1,000+

Post-2030 $400–600 $1,000–3,000+

What This Means for Investors

Short-term traders: Use technical levels—buy dips near $160 and sell around $200–205 or higher.

Mid/long-term holders: Bull case relies on growing ecosystem use, institutional uptake, and regulatory clarity. Conservative views still offer ~2–3× returns if mid-century scenarios play out.

Risk factors: Network reliability, hack/security risk, regulatory moves, and macro downturns could derail performance.

Community & Analyst Sentiment

On Reddit’s r/solana, users echo bullish sentiment—with some Binance analysts eyeing $650 in the next six months .

Final Take

Near-term: Solid technical footing with potential bounce into low $200s.

Medium-term (2026): Most forecasts cluster around $250–300.

Long-term (2030+): Range is wide—from $300–500 to $1,000+, depending on fundamentals and adoption.

If you’re targeting $250–300, feel free to position gradually during dips. For long-term gains, keep a balanced view and monitor network performance, ecosystems developments, and regulatory landscape.