Overview

Solayer redefines staking on Solana by enabling users to restake SOL—and various liquid staking tokens (LSTs)—to support dApps directly.

Instead of passively staking SOL, restakers receive sSOL, a liquid token that maintains liquidity, earns native MEV-boosted yield (~8.17%), and powers Actively Validated Services (AVSs)—dApps that benefit from blockspace prioritization through stake-weighted QoS.

It’s the foundation of a shared validator network (SVN) offering modular, secure infrastructure for app developers.

Core Offerings

• Native & LST Restaking – Stake SOL, mSOL, JitoSOL, bSOL, or INF; receive sSOL in a single, efficient transaction.

• Accelerated dApp Execution – Delegate sSOL to dApps (endoAVS); they then gain faster access to leader slots for quicker processing.

• Super Liquidity Model – sSOL remains liquid even while securing AVS, enabling seamless unwrapping back to SOL without delays.

Technical Edge

• Shared Validator Network (SVN) – A pooled security system for Solana apps, providing scalable, permissionless staking infrastructure.

• Unified Restaking Pool – Both native SOL and LSTs feed into a single pool, simplifying yield strategies and maximizing liquidity.

• Two-Day Cooldown – Unstaking involves a short (~2-day) cooldown period aligned with Solana epochs, with reward deductions for early withdrawals.

Innovations & Backing

• Binance Labs Investment – Backed in July 2024 as part of a $12M seed round led by Polychain Capital, valuing Solayer at $80M.

• Market Traction – The largest Solana restaking protocol, with over $180M TVL and hundreds of thousands of users securing both dApps and L1 throughput.

• sUSD Launch – Introducing a real-world asset (RWA)-backed stablecoin that earns U.S. Treasury yields and secures on-chain infrastructure beyond staking.

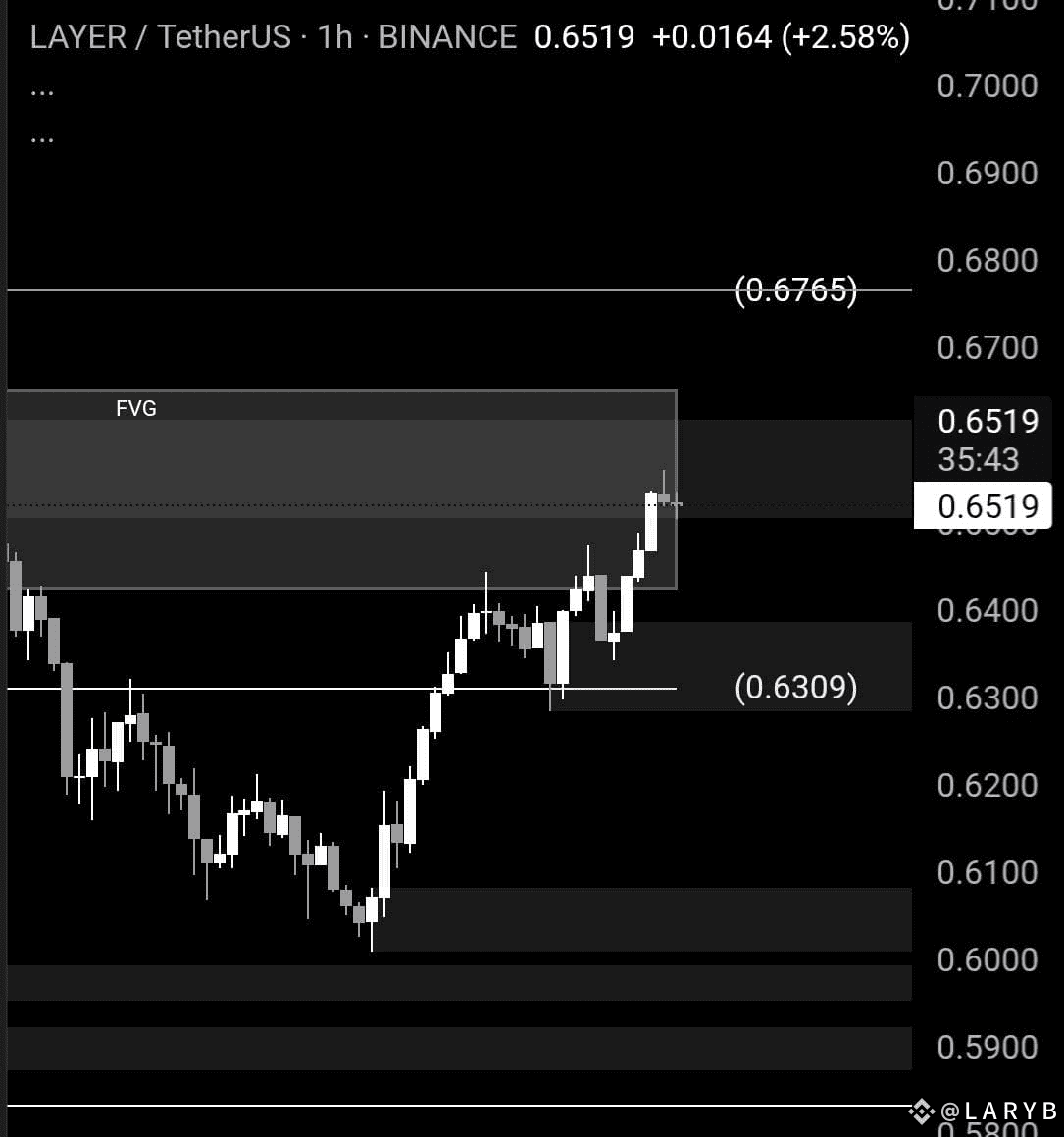

• Token Ecosystem (LAYER) – Solayer is gearing for a governance token launch with circulating supply visible in early airdrop and exchange listings

Why It Matters

Solayer transforms Solana-backed staking into a dynamic, app-enabled infrastructure layer.

Rather than locking SOL for passive rewards, users actively secure throughput for dApps, benefit from accelerated consensus, and retain full liquidity.

It bridges real-world utility and decentralized security—making appchains practical, scalable, and profit-generating—all at Solana speed.