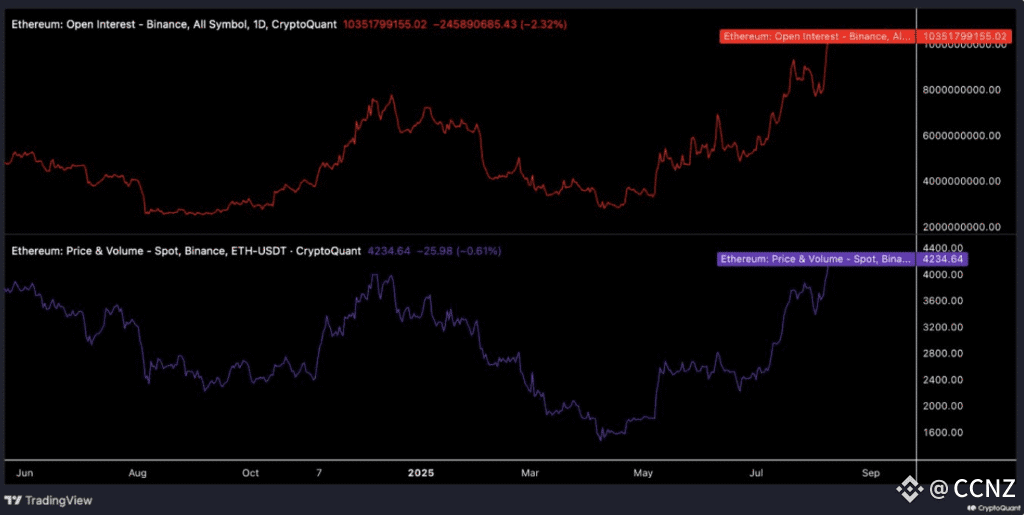

Ethereum open interest on Binance hits $10.35B despite daily drop.

ETFs post record $1.0188B inflows led by BlackRock and Fidelity.

ETH price holds above $4,200 with bullish technical momentum intact.

Ethereum markets are experiencing a sharp rise in activity across both derivatives and spot trading. According to CryptoQuant, Ethereum’s open interest in Binance reached $10,351,799,155 USDT, holding near historically high levels despite a 2.32% daily drop.

Ethereum’s spot price on Binance was $4,234.64, reflecting a 0.61% decline. Since November 2024, market-wide short positions have surged by 500%, with an additional 40% increase in the past week.

Ethereum Open Interest 1D Chart Source: TradingView

Ethereum Open Interest 1D Chart Source: TradingView

Analysts noted that this heavy short exposure could set the stage for a short squeeze if rising prices force traders to cover positions quickly. The elevated leverage across the market has heightened sensitivity to even modest price moves.

Record $1.0188 Billion ETF Inflows.

On August 11, 2025, Ethereum ETFs saw a record $1.0188 billion in daily inflows, the highest ever for the asset. BlackRock’s ETHA led with $639.8 million, followed by Fidelity’s FETH at $276.9 million.

$ETH ETF inflow + $1,018,800,000 yesterday.

That's a new record for Ethereum inflow. pic.twitter.com/P9Uam7gxvU

— Ted (@TedPillows) August 12, 2025

Other issuers, including Bitwise, VanEck, and Franklin Templeton, also reported notable gains. Grayscale’s ETHE posted a $66.6 million increase.

Market analysts attributed the surge in inflows to growing institutional confidence and rising demand for Ethereum exposure. The milestone further strengthened Ethereum’s position within the expanding crypto ETF sector.

Price Holds Above Key Technical Levels

Ethereum was trading at $4,207, down 1.02% after reaching an intraday high of $4,347. The price remains above the 20-day moving average of $4,243 and the upper Bollinger Band at $4,260, indicating strong bullish momentum.

The MACD showed positive divergence, with the histogram in green territory, pointing to ongoing buying pressure. The RSI stood at 70.57, suggesting overbought conditions that may prompt a period of consolidation or a short-term pullback.

Ethereum has rallied sharply from July lows near $3,200, and holding above $4,200 could pave the way for a retest of the $4,350–$4,400 resistance zone. A break below $4,100, however, could trigger a deeper retracement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.

<p>The post Ethereum Open Interest Tops $10B as ETFs See Record Inflows first appeared on Coin Crypto Newz.</p>