If AAVE is a 'decentralized bank', then Morpho is an 'intelligent matching layer' or 'efficiency optimizer' built on top of that bank. Its core goal is to provide lenders and borrowers with better rates than the underlying protocols (like AAVE or Compound).

🧠 In one sentence:

Morpho = Aave/Compound + peer-to-peer matching + higher efficiency lending rates.

🧬 Positioning of Morpho

Morpho is an optimized lending protocol built on Aave/Compound, aiming to improve capital efficiency and achieve more precise interest rate matching between lenders and borrowers.

It doesn’t aim to replace Aave, but rather to 'upgrade' the lending experience of Aave.

💡 What problem does it solve?

🏦 In traditional lending protocols (Aave/Compound):

In funding pool models like AAVE, there is an inherent 'spread'.

⏺️ Lenders deposit assets into the pool, and borrowers borrow money from the pool.

⏺️ The problem is: interest rates are not very 'precisely matched', leading to lending spreads.

⏺️ This results in: low returns for lenders, high interest rates for borrowers, and decreased capital efficiency.

🧩 Morpho's proposed innovation:

Morpho uses a 'peer-to-peer + pool backup' mechanism:

First, it matches lenders and borrowers for direct peer-to-peer lending, achieving better rates.

If a match cannot be found at the moment, it automatically falls back to the Aave/Compound pool, allowing for continuous lending.

In other words:

First match peer-to-peer to save the intermediate spread; then fallback to the pool, without affecting the experience.

An excellent analogy:

AAVE/Compound is like taking a taxi. The driver (protocol) is always there, the service is reliable, but the price (interest rate spread) is relatively high.

Morpho is like a carpool app (like Uber Pool). It will first try to find you a fellow passenger (P2P matching), so you can share the fare, which is cheaper for both (better rates).

If you can't find a carpool partner, the app will automatically help you call a regular taxi (fallback to AAVE funding pool). You won't be left stranded; the worst-case scenario is the same as hailing a taxi directly.

🔧 Overview of core mechanisms

Lending model: peer-to-peer first, pool as a backup

Interest rate mechanism: dynamically matched, usually better than Aave

Safety: using native Aave/Compound pools as underlying liquidity

Compatibility: supports mainstream assets like ETH, DAI, USDC, stETH, etc.

🧪 Morpho blueprint | Product iteration

1️⃣ Morpho-Aave: the first version, optimizing Aave lending.

2️⃣ Morpho-Compound: supports Compound lending optimization.

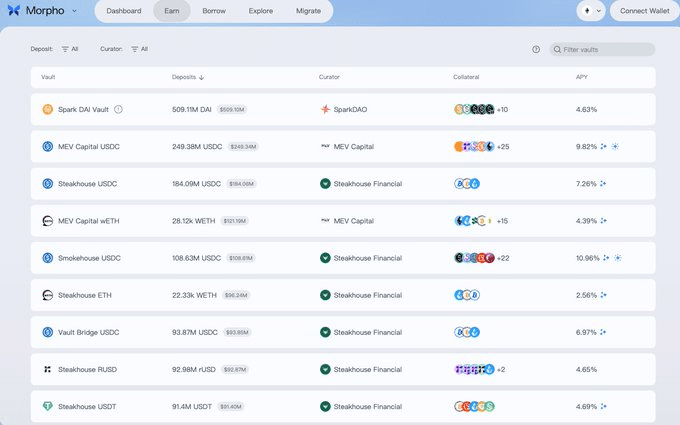

3️⃣ Morpho Blue (released in 2023): a 'modular version' of decentralized lending markets, allowing for customizable risk parameters (similar to Aave V3's 'isolated markets').

📦 What makes Morpho Blue special

Morpho Blue is the 'composable version' of Morpho:

Users can deploy their own lending markets, setting interest rate models, liquidation parameters, etc.

Similar to Uniswap V4's Hooks, making the protocol more flexible and modular.

Bringing stronger 'customizability' to on-chain lending.

One-sentence summary: Morpho Blue = 'Lego blocks of the lending world'.

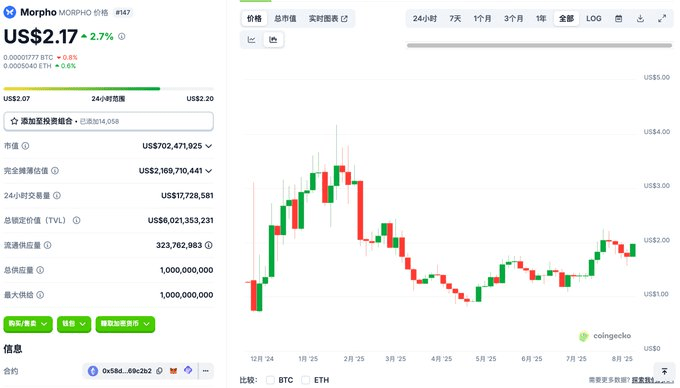

💰 Token information ($MORPHO)

Market cap: 702 million

Total supply: 1 billion tokens

The main functions of the token can be summarized as two points: governance and incentives. Main allocation:

Community: 51%.

Investors: 24.5%.

Core contributors (Team & Advisors): 24.5%.

For users:

🔘 If you are a liquidity provider (LP): you can 'mine' by providing liquidity to incentivized markets, earning tokens.

🔘 If you are $MORPHO to influence the flow of rewards through staking and voting, thus indirectly increasing the value of the market you invest in, or simply support the healthy development of the protocol.

🧠 Summarizing Morpho's highlights:

✅ Solving the problem of inaccurate matching of lending rates

✅ Balancing efficiency & safety (native Aave/Compound as a backup)

✅ Innovative peer-to-peer mechanism

✅ Compatible with mainstream assets, good user experience

✅ Morpho Blue takes it a step further, making the lending market 'modular and open'.

🔍 Who is Morpho suitable for?

Lenders wanting higher interest rates than Aave/Compound

Borrowers wanting lower interest rates

Users wanting to experience peer-to-peer lending or looking for potential airdrop opportunities

Developers wanting to deploy custom lending markets

📣 If you like this series, don't forget: share + like + follow 🙌

Feel free to share this with your friends who are using Aave but haven't heard of Morpho 😏