The upcoming governance decision on $WCT staking mechanics represents a pivotal moment for WalletConnect's future. With voting concluding shortly, the outcome may significantly influence how traders, investors, and institutions engage with the network moving forward.

Proposed Changes Overview

The upgrade focuses on three core improvements:

1. Revised rewards distribution to maintain sustainable yields

2. More flexible staking terms to reduce lock-up risks

3. Enhanced liquidity options while earning staking rewards

These modifications aim to position WalletConnect as a competitive choice in the evolving DeFi space, appealing to both short-term yield seekers and long-term infrastructure investors.

Potential Market Impact

Historical patterns suggest governance-approved upgrades often lead to:

- 10-20% price movements within 24 hours of approval

- Increased trading volume across major pairs

- Potential breakout attempts from key resistance levels

Key Factors to Monitor

- Network activity spikes during final voting hours

- Support level resilience during volatility

- Broader market correlation with BTC/ETH trends

Institutional Considerations

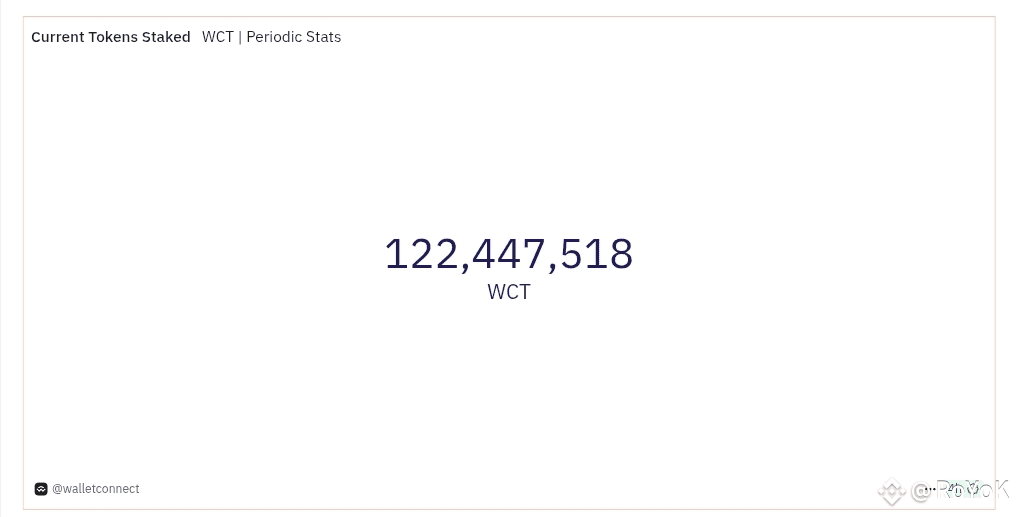

Successful implementation could:

- Increase Total Value Locked (TVL) over time

- Generate 30-50% volume growth post-upgrade

- Create more stable yield environments

Participants might consider:

- Short-term volatility plays around the decision

- Momentum trades following confirmation

- Long-term staking position accumulation

Sector Context

External influences include:

- Bitcoin's overall market direction

- Ethereum price movements

- General Web3 infrastructure sentiment

Protocol Background

Since 2018, WalletConnect has become essential Web3 infrastructure with:

- 600+ supported wallets

- 65,000+ integrated dApps

- 47.5 million unique users

Strategic Implications

This vote represents more than a technical adjustment - it's a potential inflection point for WCT's market position and future adoption curve. Market participants should prepare for possible volatility while assessing the upgrade's long-term implications for network growth and token economics.

Recommended Actions

- Monitor real-time on-chain metrics

- Establish clear trading plans beforehand

- Consider both short and long-term scenarios

The decision's outcome may serve as a case study in how strategic protocol upgrades can simultaneously impact token valuation and ecosystem development in the DeFi space.

DYOR 4ever ☝️🔑