#HumaFinance ($HUMA ) Price Analysis – Comprehensive Report @Huma Finance 🟣 #HUMA

1) Project Summary: PayFi + RWA Lending Infrastructure

Huma Finance combines core payments financing and RWA (real-world asset)-based short-term loan products in an approach it calls "PayFi." The protocol aims to create credit by collateralizing cash flows such as salary/income, bill receivables, or business revenue, focusing on scenarios such as receivables-backed credit lines, revenue-based financing, and payment-focused financing for businesses.

This model offers an alternative to DeFi lending, which relies solely on overcollateralization.

2) Token and key market metrics (August 10, 2025, Turkish Time)

Price: ≈ $0.036

Market capitalization: ≈ $63–65M

Circulating supply: ≈ 1.73B HUMA (max. supply 10B)

24h volume: ≈ $22–33M

ATH (May 2025): around $0.118 according to sources (some data providers report lower peaks)

These metrics are compiled from multiple sources such as CMC/Coingecko/CryptoRank/TradingView; minor fluctuations may occur due to different exchanges and methodologies.

3) Tokenomics and unlocks

HUMA's maximum supply is 10B. Major allocations: These are distributed across LP & Ecosystem, Investors, Team & Advisors, Protocol Treasury, CEX & Marketing, Initial Airdrop, MM & On-chain Liquidity, and Pre-Sale; full unlocks extend to 2029. The next major unlock is on August 26, 2025 (Protocol Treasury). This timeframe is a key factor that could create supply pressure in the medium term.

4) Roadmap, ecosystem, and integrations

Roadmap/2025 focuses: Multi-chain scaling and deployment to high-throughput chains (Solana at the core, as well as interoperability with Ethereum and Polygon), deep integration with DeFi components, and real-world use cases (cross-border remittances, merchant payments, credit card financing).

Official blog: $HUMA token is designed for governance and long-term incentive alignment.

Partnership example: On the Circle partner page, Huma is listed as a protocol providing "deposit/withdrawal for LPs" and payment financing solutions in the RWA & PayFi space.

5) Short-term news flow (price triggers)

Exchange listing expansion: Announcement of listing on Thailand-based Bitkub (via the Solana network) in July 2025. New fiat gateways and local exchanges could increase liquidity and influence price volatility.

Media/opinion pieces: Content highlighting Huma's PayFi positioning and tokenomics throughout 2025 increased visibility. (Exchange/media blogs; methodological differences may apply.)

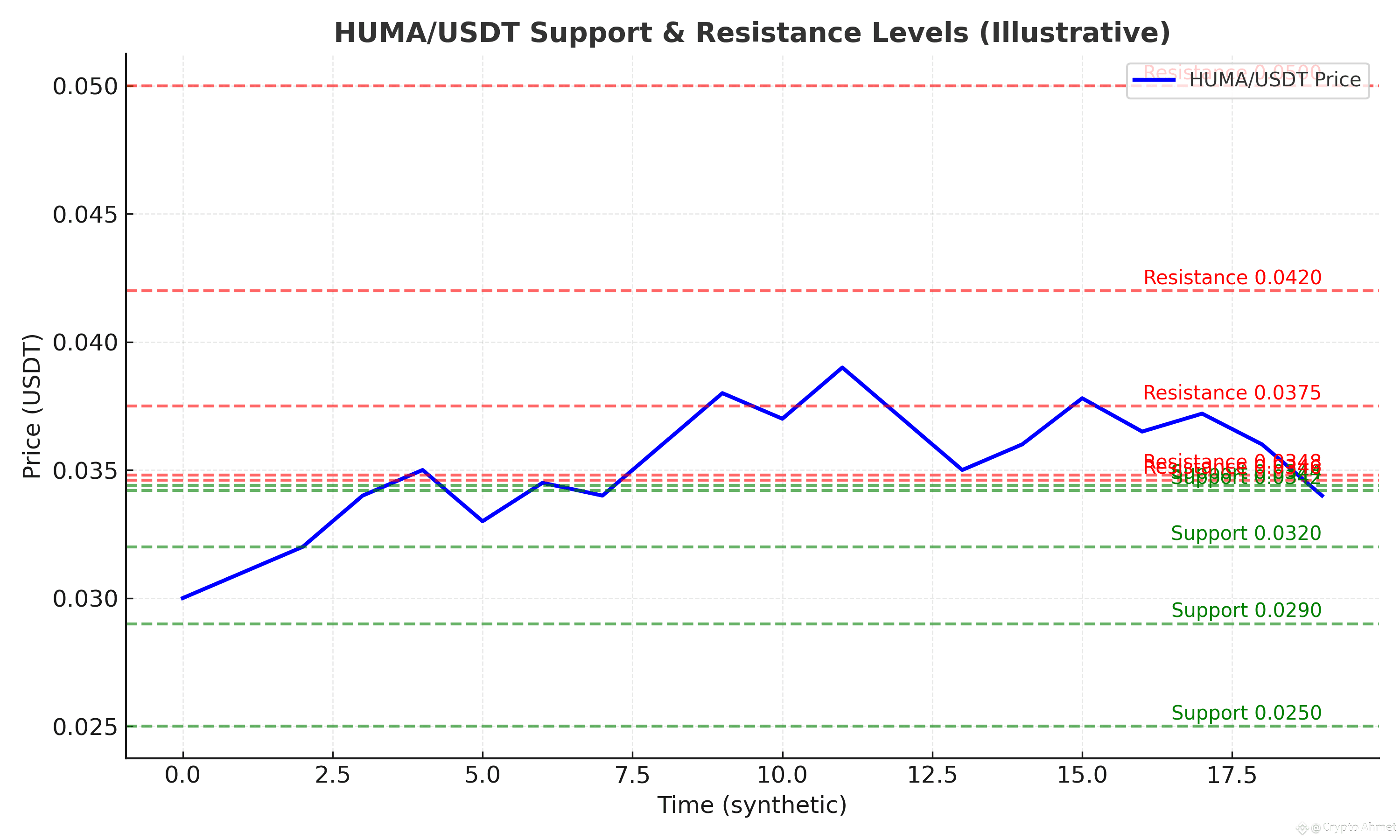

6) Technical landscape (price behavior, levels, scenarios)

Note: The levels below are indicative; deviations may occur in fast market conditions.

Trend and volatility: Consolidation within a narrowing band during the summer months after peaking in May-June 2025 due to the listing/airdrop effect. The current price being 65–70% below the ATH leaves the potential for a reaction on positive news flow; however, it could also create short-term selling pressure as the lock-up (August 26) approaches.

Short-term support: $0.033–0.032 (psychological & recent consolidation lower band), further below $0.030 round level.

Resistance: $0.040 (close horizontal), $0.050 if breached, and rapid attempts to reach the $0.060–0.065 region with news flow are possible.

Volume: 24h volume is in the $20–30M range, paving the way for "spike" movements sensitive to news flow.

7) Key drivers: Bullish/Bullish arguments

Bullish catalysts

Real-world adoption (PayFi): The promise of reducing the need for pre-financing in cross-border payments and RWA-based credit products fuel the demand side.

Ecosystem expansion & integrations (multi-chain, Circle partnership, new exchange listings).

Community and governance: Activation of governance and the user base created by airdrops.

Possible pressure risks

Token unlocks: August 26, 2025, and ongoing distributions may create supply-side pressure.

RWA/PayFi execution risk: Regulation, reliance on off-chain components for loan allocation/repayment discipline. (General RWA credit ecosystem dynamics.)

Liquidity fragmentation: Multi-chain structure and expansion into new exchanges may dilute liquidity initially.

8) Valuation and Position

Current market capitalization is $~63–65M, with a range of $310–380M for FDV, in the mid-range compared to similar early-stage RWA/payments protocols. Revaluation may occur as product/revenue streams become clearer (despite vesting/unlocking); otherwise, the market may continue to discount FDV.

Strategy Summary (not investment advice)

Short-term (weeks): Volatility is expected before/after August 26th; $0.033–0.030 is support to watch.

#BinanceAlphaAlert #CryptoIn401k #BinanceAlphaAlert #CFTCCryptoSprint