@Solv Protocol | #BTCUnbound | $SOLV

Bitcoin has long been called digital gold a safe store of value that sits in your wallet, waiting for the price to rise. But what if it could do more? Solv Protocol changes the game, turning idle BTC into a productive, yield-generating asset you can use across multiple blockchain networks all while keeping full control of your funds.

What Is Solv Protocol?

Solv lets you stake, lend, and earn yield on Bitcoin without locking it away. Its Staking Abstraction Layer (SAL) simplifies BTC staking. Deposit BTC, and you receive SolvBTC always backed 1:1 with Bitcoin which can be traded, lent, used in DeFi, or redeemed anytime.

Already live on Ethereum, BNB Chain, Solana, and more, SolvBTC unlocks earning opportunities where BTC wasn’t usable before. With Liquid Staking Tokens (LSTs), you can earn staking rewards while keeping liquidity intact.

The SolvBTC Token

Max supply: 100M tokens

Deployed on 5+ major chains (Ethereum, BNB mainnet, etc.)

Backed by 19,000+ BTC reserves

Supported by top DeFi players like Babylon Protocol & Ethena

Audited by Quantstamp, Certik, Slowmist for transparency & security

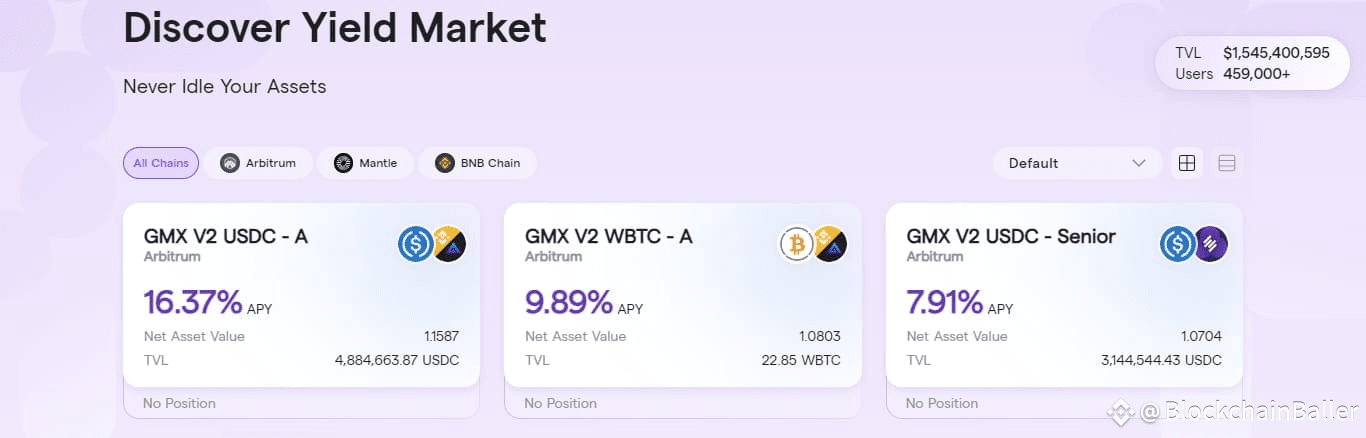

The Solv Yield Market

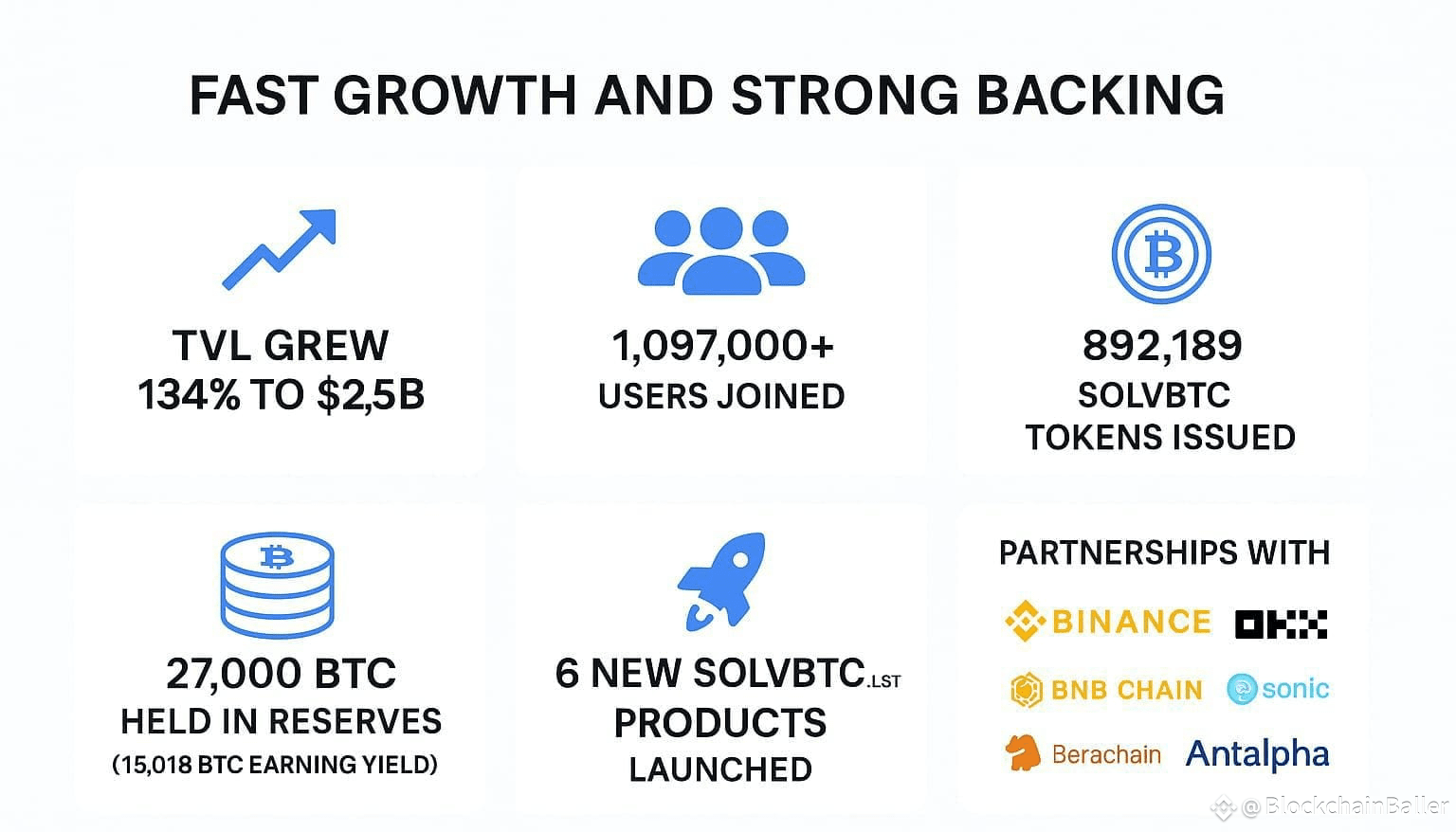

453,000+ users | $1.3B TVL

Supports multiple chains: Mantle, Arbitrum, BNB

Avg APY: ~10% (range: 1% – 23%)

Multiple earning options with built-in liquidity and low risk

What’s Coming Next

1. BTC+ Vault – 4.5–5.5% APY (promo up to 99.99%)

2. SolvBTC Lending – Cross-chain + institutional yield

3. Vault Expansion – AI-linked (SolvBTC.AI) & RWA (SolvBTC.RWA) products

4. $100M BTC Reserve – More liquidity & institutional adoption

5. RWA Integration – Tokenized real estate, bonds & more

Why Users Win

No idle BTC – Earn yield with flexibility

Cross-chain utility – Use on multiple networks

Multiple yield streams – TradFi + CeFi + DeFi

Ownership perks – Governance, rewards, discounts

Why Hold $SOLV Long-Term

Early product access

Governance influence

Growth-linked benefits

Real infrastructure & utility

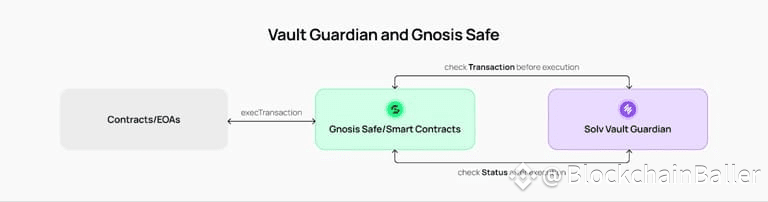

The Solv Protocol includes key features for security and liquidity:

Solv Guard: A security feature that protects assets by requiring multiple approvals (multi-signature) for transactions. It sets rules to ensure only valid transactions are approved.

Governance: Managed by the Vault Guardian and Governor, the system allows the Governor to control security, update settings, and manage token transfers to protect users’ assets.

Liquid Staking Tokens: The protocol offers two tokens, SolvBTC Babylon (SolvBTC.BBN) and SolvBTC Ethena (SolvBTC.ENA), enabling users to stake assets while maintaining liquidity.

How Does Solv Protocol Function?

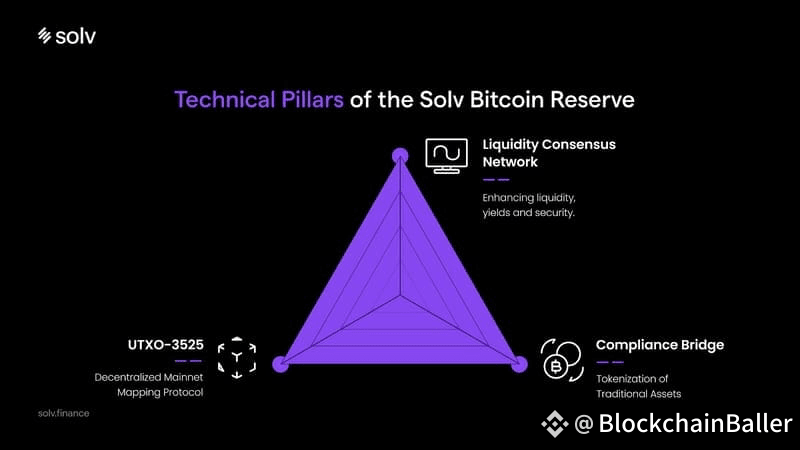

Liquidity Consensus Network (LCN), UTXO-3525, and the Compliant Bridge

Bottom Line:

Solv Protocol is building Bitcoin’s financial future productive, liquid, and secure. Whether you’re a trader, a DeFi power user, or a long-term holder, Solv makes your BTC work harder without giving up control.

FOR MORE DETAILS VISIT:

https://docs.google.com/document/d/11jWKmjsGj7FS58oeQrLMLQMu5bwaQPGavDE2zsQPd0/edit?usp=sharing