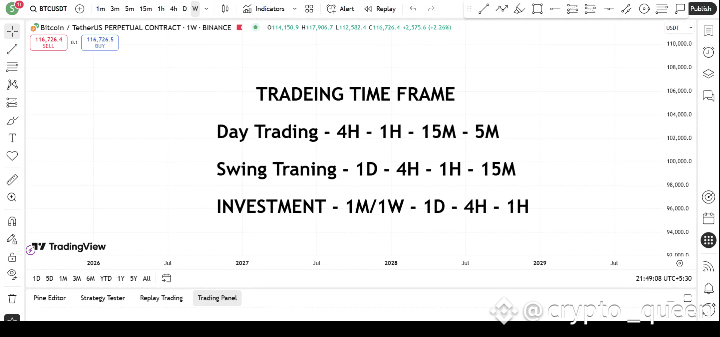

"Master your timeframes, master your trades. 📈⏰ Your chosen timeframe shapes your style—from big-picture trends to pinpoint entry and exit moves. 🎯"

Here's a breakdown by trading type:

1. Day Trading ☀️

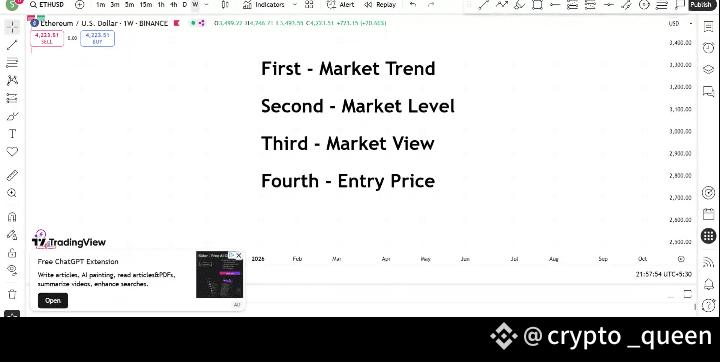

For day traders, the process typically unfolds as follows:

* 4-Hour (4H) Timeframe: Begin by analyzing the overall market trend – is it bullish 🐂, bearish 🐻, or consolidating sideways ⚖️?

* 1-Hour (1H) Timeframe: Identify key support 🛡️ and resistance levels Market levels🧱 to understand potential price boundaries.

* 15-Minute (15M) Timeframe: Gain further clarity by analyzing candlestick patterns (market view )🕯️ to spot potential reversal or continuation signals.

* 5-Minute (5M) Timeframe: Finally, execute your buy 🟢 or sell 🔴 orders based on the precise entry and exit zones identified.

2. Swing Trading 🎢

Swing traders adopt a similar approach but with longer time horizons:

* 1-Day (1D) Timeframe: Start by assessing the overarching market trend.

* 4-Hour (4H) Timeframe: Determine significant market levels like support and resistance.

* 1-Hour (1H) Timeframe: Analyze candlestick patterns for confirmation and clearer market views.

* 15-Minute (15M) Timeframe: This timeframe is generally used for final buy or sell decisions. 🛒

3. Investment (Spot Trading) 💰💎

For long-term investments in the spot market, the focus shifts to broader perspectives:

* 1-Month (1M) or 1-Week (1W) Timeframe: (1M for older coins 🪙, 1W for newer coins ✨) Begin by identifying the overall market trend.

* 1-Day (1D) Timeframe: Pinpoint crucial market levels, including strong support and resistance zones.

* 4-Hour (4H) Timeframe: Review candlestick patterns to refine your market view.

* 1-Hour (1H) Timeframe: This timeframe helps in determining the optimal entry price for your long-term position. 🚀

"Pick the right timeframe, trade smarter. ⏰📈 It guides you from trend spotting to perfect entry and exit points. 🎯"