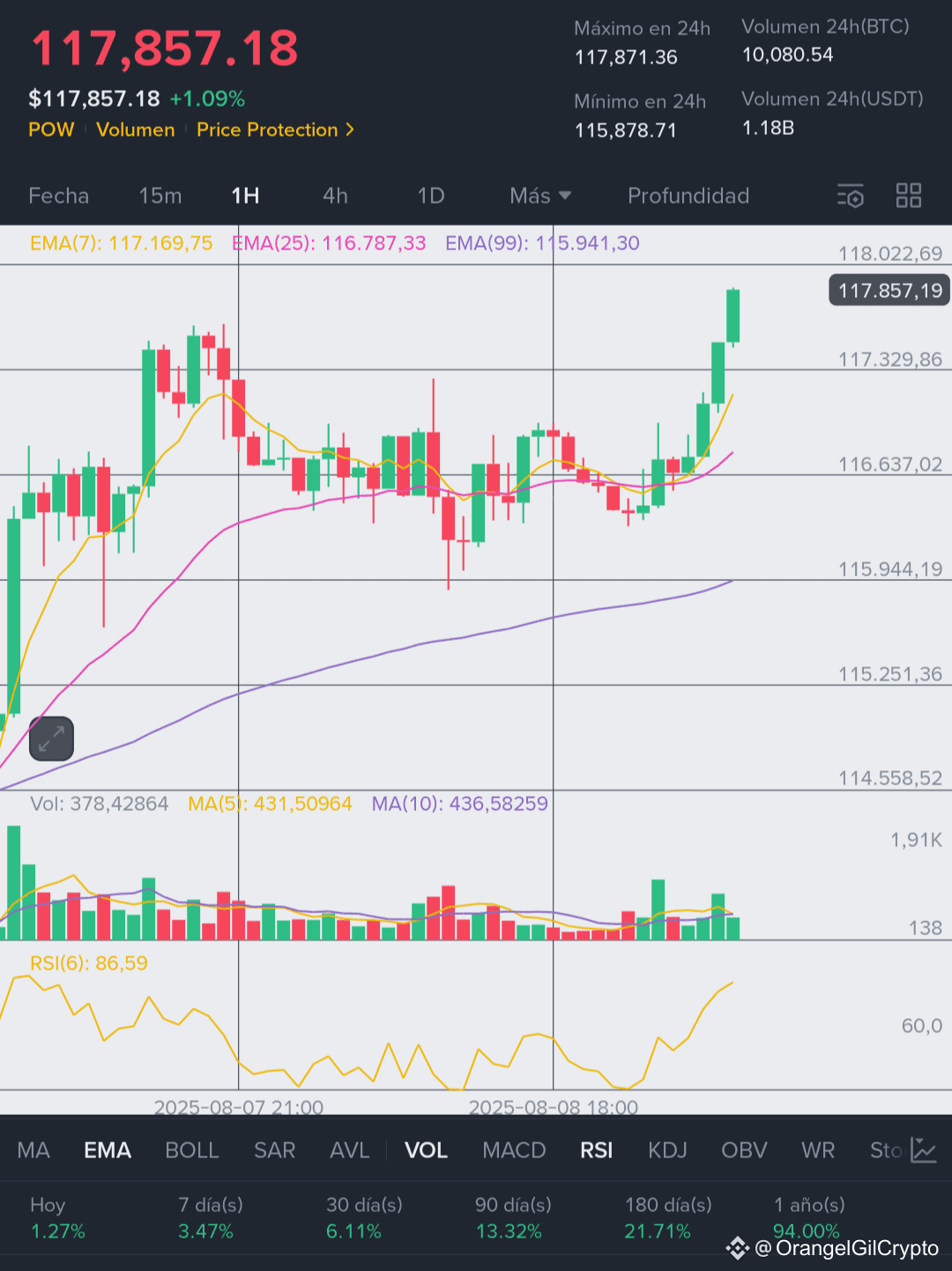

Bitcoin continues its steady ascent, adding 1.01% in the last 24 hours and consolidating above $117K, a level many analysts see as a critical psychological barrier. According to Michael Saylor, Executive Chairman of MicroStrategy, “Bitcoin’s resilience above key technical thresholds is a testament to its role as digital gold in uncertain macro conditions.”

From a technical perspective, BTC is riding the 200-day moving average and showing low volatility bands, often a precursor to a breakout phase. The current on-chain data from Glassnode indicates rising active addresses and long-term holder accumulation, signaling strong hands are in control.

Future Outlook:

If BTC closes the week above $118K, it could aim for the $120K–$122K range in the short term, provided macroeconomic stability and ETF inflows persist.

Strategic Reflection:

Accumulation during periods of low volatility historically yields strong upside potential — but only if macro headwinds remain muted.