This week, the crypto market has had to face a clear reality: BlackRock – the global financial giant – confirms that there are no plans to launch an ETF fund for XRP or Solana, according to a statement from Nate Geraci, president of The ETF Store.

"BlackRock quickly responded, bluntly denying. They assert that there are currently no plans for launching a spot ETF for XRP (or Solana). Personally, I believe this will be a decision they will regret in the future. We will soon see the results."

This immediately extinguishes hopes for a new wave of institutional capital, which had excited the crypto community recently. However, it is noteworthy that despite the ETF catalyst not materializing, both XRP and Solana are still showing strong breakout potential on both technical charts and order book data.

XRP: ETF disappointment, but technical trend remains strong

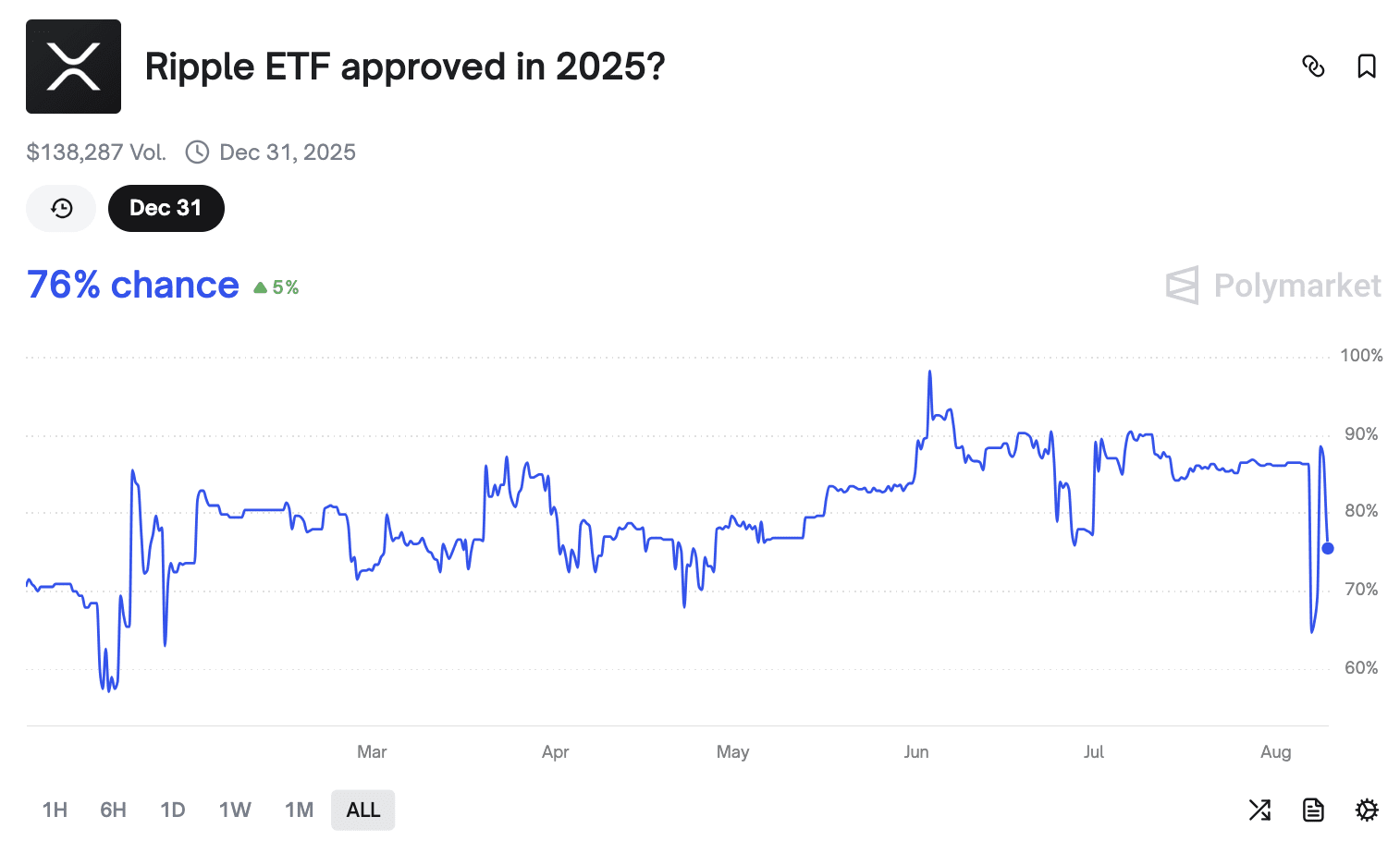

The information that BlackRock has no intention of launching an XRP spot ETF has caused the odds for this fund to drop to 76% on Polymarket at the time of writing, much lower than the over 98% recorded in early June. However, Bloomberg's senior ETF analyst, Eric Balchunas, still maintains that the odds of this fund being approved this year is 95%.

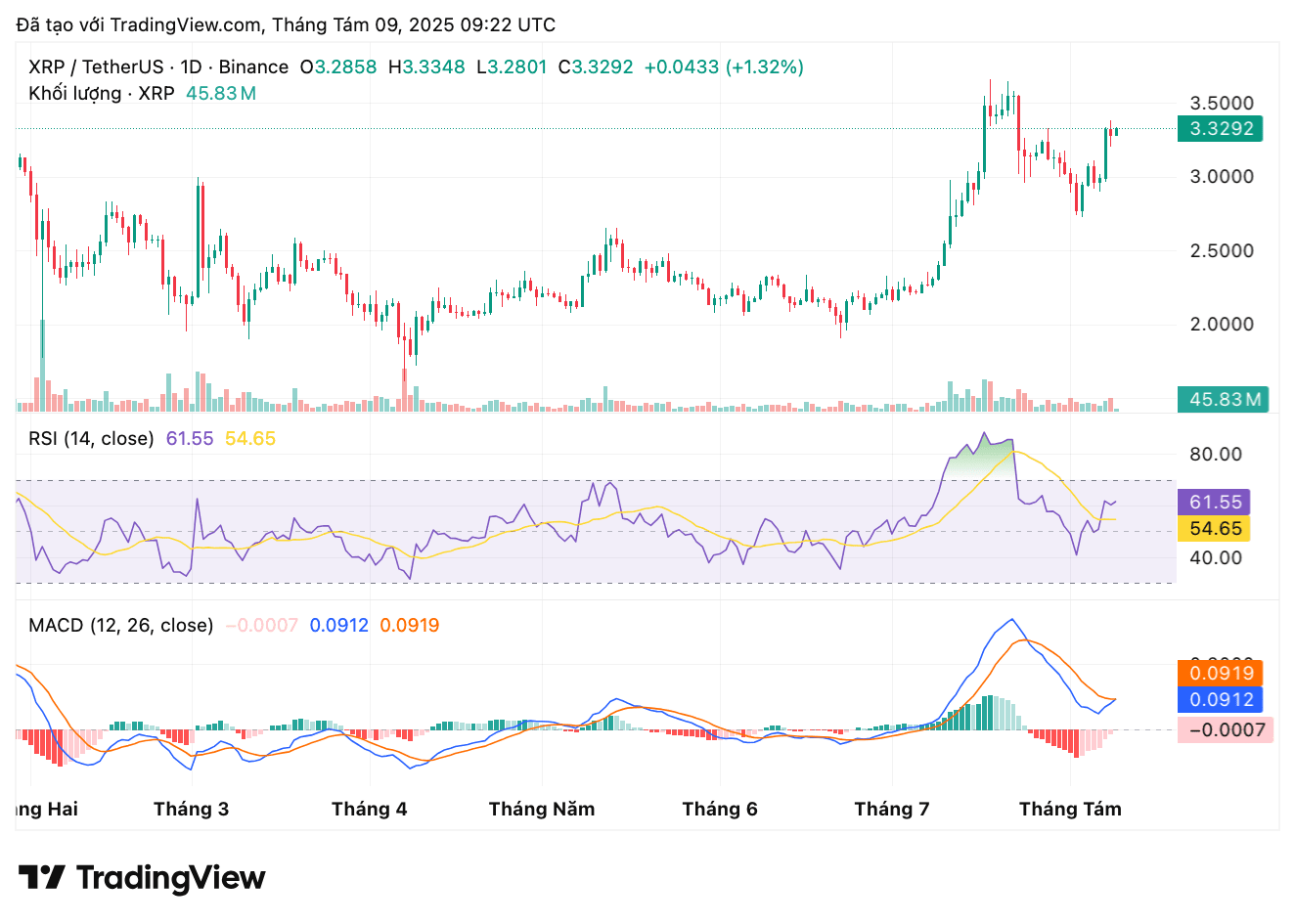

Positive technical structure

On the daily timeframe, XRP maintains a stable bullish structure. Short and medium-term EMA continues to trend upwards, indicating that the accumulation trend is occurring positively rather than being dominated by profit-taking actions.

MACD indicator: Surged above the 0 level and is preparing to form a bullish crossover, indicating that selling pressure is significantly weakening.

RSI: Still in the bullish zone, no signs of overbought – a factor indicating that the current growth momentum still has room.

The overall signal indicates that the current upward trend is healthy, supported by buying pressure when prices adjust.

Below are key technical levels that investors need to pay attention to:

Main resistance: $3.55

Strong support: $3.02 – $2.76 – $2.35

XRP order book analysis

Price level

Type

Volume

Potential impact

$3.31

Bid

124,308 units (≈411,907 USDT)

Decrease ~0.44% if breached

$3.05

Bid

123,186 units (≈407,168 USDT)

Decrease ~0.69% if breached

$3.28

Bid

103,904 units (≈341,781 USDT)

Decrease ~1.16% if breached

$3.35

Ask

247,807 units (≈830,154 USDT)

Increase ~0.66% if absorbed

$3.4

Ask

949,505 units (≈3,228,316 USDT)

Increase ~2.16% if absorbed

$3.42

Ask

137,548 units (≈470,415 USDT)

Increase ~2.76% if absorbed

Proposed trading strategy

Buy around the $3.02–$3.03 range

Take partial profit: $3.4–$3.47

Breakout target: $3.55

Cautious short: if rejected at $3.4–$3.47, but should tighten stop-loss due to the trend still being bullish.

Solana: No need for ETF to maintain bullish structure

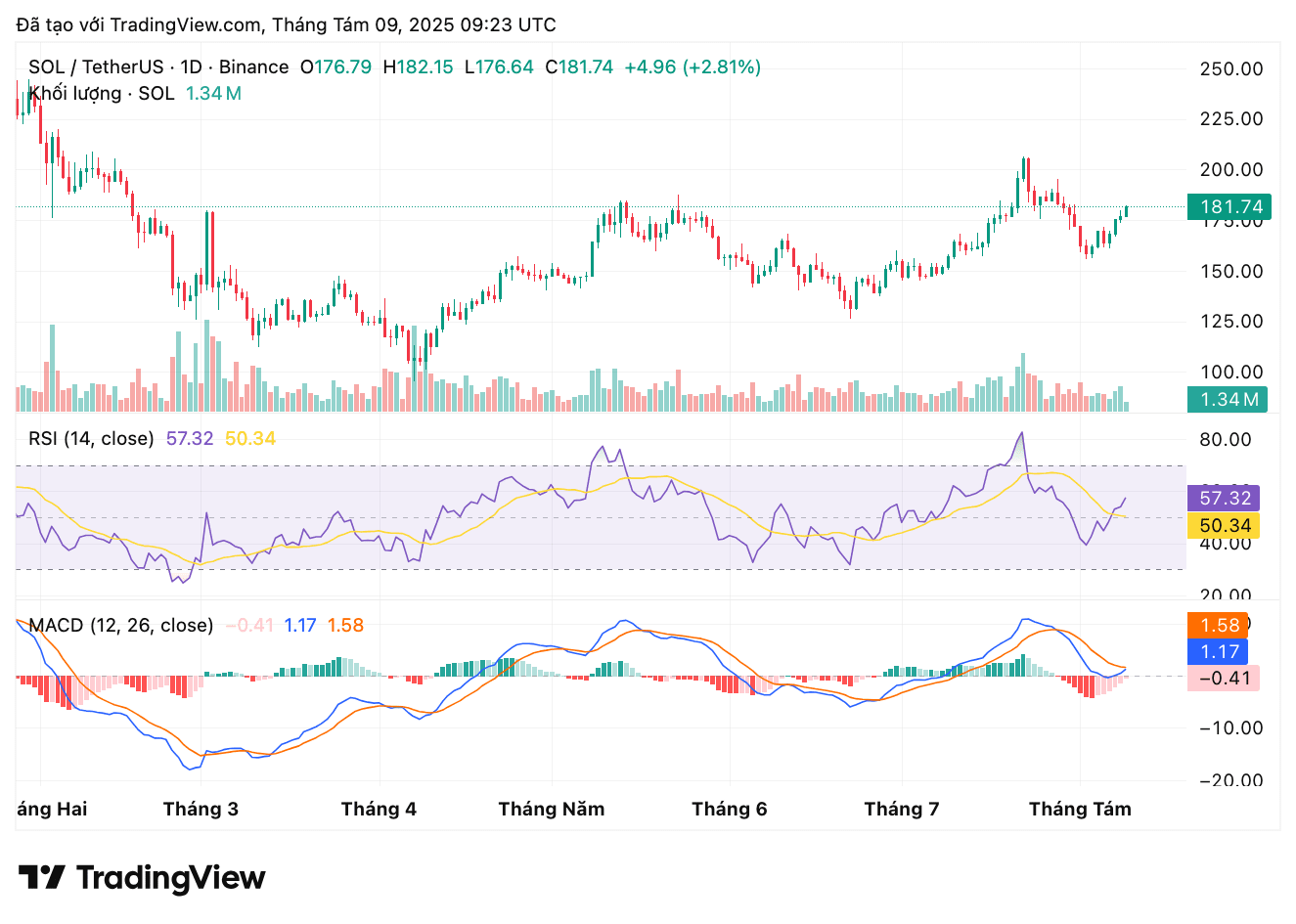

Stable technical signal

Despite the lack of positive news from BlackRock, the Solana (SOL) chart remains in a bullish state.

EMA: Continues to serve as support, indicating that the trend has not been broken.

MACD: Surged above the 0 level and is preparing to form a bullish crossover, indicating that selling pressure is significantly weakening.

RSI: In a positively neutral zone – allowing the upward trend to continue without generating overbought signals.

Below are key technical levels that investors need to pay attention to:

Key psychological thresholds: $180 – $190

Strong resistance: $190

Main support: $177.6 – $173

Solana order book analysis

Price level

Type

Volume

Potential impact

$177.6

Bid

2,607 units (≈463,065 USDT)

Decrease ~1.92% if breached

$173

Bid

3,696 units (≈639,328 USDT)

Decrease ~4.46% if breached

$172.8

Bid

2,599 units (≈449,229 USDT)

Decrease ~4.53% if breached

$182

Ask

7,279 units (≈1,324,781 USDT)

Increase ~0.51% if absorbed

$185

Ask

9,584 units (≈1,773,090 USDT)

Increase ~2.16% if absorbed

$190

Ask

9,707 units (≈1,844,283 USDT)

Increase ~4.93% if absorbed

Proposed trading strategy

Buy around $177.6 or lower at $173

Take partial profit: $182 – $185

Breakout target: $190

Cautious short: if price is rejected at the $185–$190 range, however, one must be particularly careful as EMA still supports the bullish trend.

BlackRock's refusal to expand the ETF to XRP and Solana has certainly been disappointing, but that does not mean the end of the bullish wave. Both coins are in a positive technical zone, reinforced by solid support levels and an order book skewed towards buyers.

In the context of altcoins seeking new catalysts amid a sluggish summer, XRP and SOL remain two names to watch closely, especially as key resistance levels are gradually being tested.