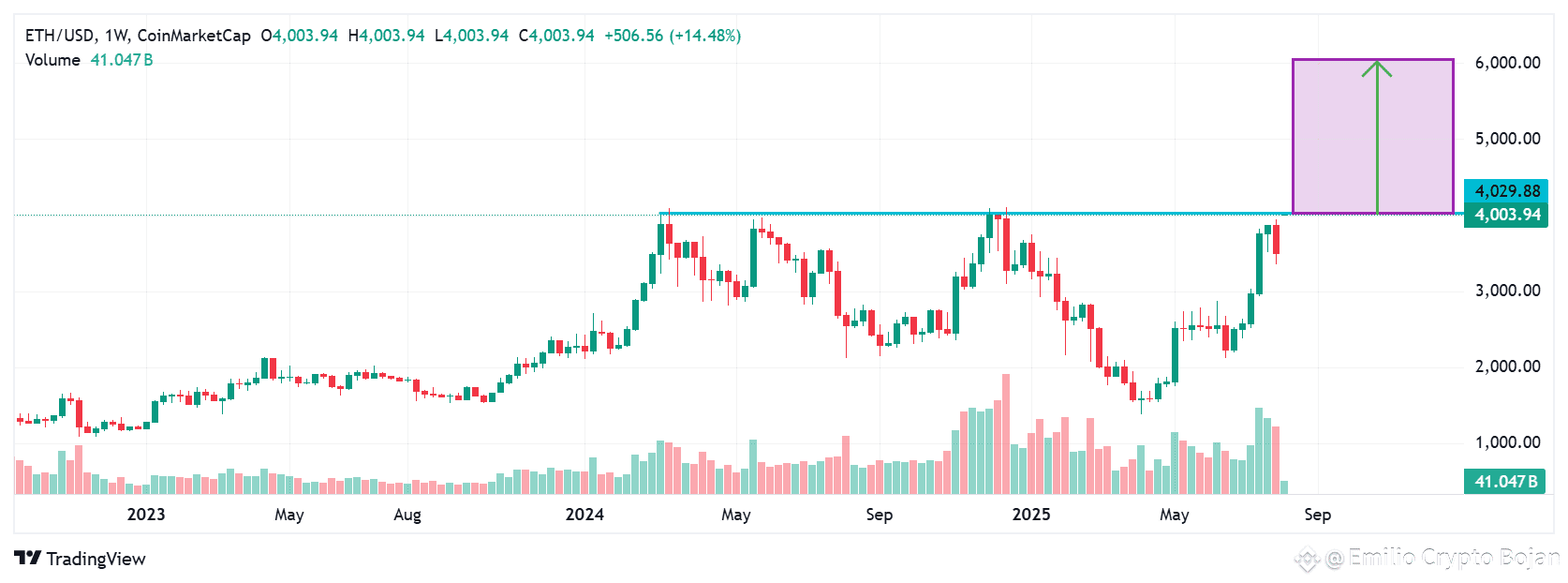

#Ethereum has reclaimed the $4,000 level, a move that could open the door for a run past $5,000 and even toward $6,000. The surge is being fueled by whale accumulation, strong ETF inflows, and aggressive corporate treasury allocations.

On-chain data shows SharpLink Gaming added another 10,975 ETH worth $42.79M in the last 24 hours, bringing its total holdings to a massive 532,194 ETH valued at $2.07B. This comes after a series of large buys in recent weeks, signaling relentless institutional conviction. Galaxy Global Markets also moved 10.98K ETH worth $41.88M just five hours ago, adding to the aggressive accumulation trend.

ETF flows are accelerating. On August 7, U.S. spot Ethereum ETFs bought 28,120 $ETH , representing roughly $222.3M in net inflows, with BlackRock’s spot product leading the charge.

Corporate adoption is joining the push. Nasdaq-listed Fundamental Global has filed to raise up to $5B, with most of the proceeds set to buy Ethereum as part of its treasury strategy. Ethereum’s market cap has now flipped Exxon Mobil’s, hitting $470.7B versus XOM’s $454.07B — a symbolic milestone underscoring ETH’s rise as a macro asset.

Vitalik Buterin welcomed the rise of Ethereum treasury companies for broadening investor access, but cautioned that the trend must be managed carefully to avoid becoming an “overleveraged game.”

Polymarket traders had already priced in an 87% chance $ETH would hit $4,000 this month — a target now achieved. With whales buying aggressively and $4K reclaimed, I see ETH pumping past $5K and setting its sights on $6K if momentum continues.