—— Breakdown from a practical system with annualized returns of 30%+

1. Underlying Cognition: Three Major Truths of Profit in the Cryptocurrency Space

Market inefficiency = Opportunity

90% of participants in the crypto market have cognitive biases (e.g., FOMO chasing, panic selling),Arbitrage opportunities are hidden in collective irrationality.

Case: March 2023 Silicon Valley Bank collapse, BTC plummeted 20% in one day, on-chain data shows whales buying against the trend, rebounding 40% three weeks later.β returns > α returns

Long-term holding of BTC/ETH returns (β) outperforms 90% of short-term traders (α).

Data: From 2020-2024, BTC annualized returns 148%, while contract traders have a liquidation rate of over 95% (Bybit report).Risk asymmetry

Use 5% position to bet on a hundred-fold coin, potential returns >> principal loss, butmust strictly control single-risk exposure ≤ 2%.

2. My Four-Dimensional Profit Engine (Practical Model)

1. Core Position: β Capturer (60% of funds)

Targets: BTC + ETH (4-year cycle dollar-cost averaging)

Strategy:

Bear Market (Fear and Greed Index <30) monthly dollar-cost averaging

Bull Market (Index > 70) partial profit-taking

Effect: 2022 bear market dollar-cost averaging cost $19k, 2025 $110k, profit 478%

2. Trend Enhancement: Macro-driven trading (20% of funds)

Logic: Federal Reserve policy > Reasons within the cryptocurrency space

Rising expectations of interest rate cuts → Increase holdings in risk assets (Meme, AI sectors)

Accelerating balance sheet reduction → Transition to stablecoin mining (annualized 8-12%)

Case: 2024 Q1 interest rate cut expectations fermenting, SOL ecosystem surges 300%

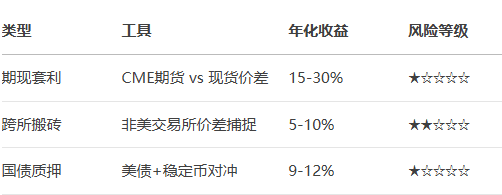

3. Arbitrage Matrix: Risk-free yield harvesting (15% of funds)

Screening Criteria:

On-chain real users > 10,000 (verified by Dune Analytics)

30% below VC cost price (e.g., Binance Labs investment portfolio)

Token economics without malicious inflation

Win rate: 6 hundred-fold projects hit in 3 years (e.g., 2021 MATIC, 2023 RNDR)

3. Risk Control Iron Law: Survival is the prerequisite for profit

Position Control

Single asset holding ≤ 10% of total position

Leverage never exceeds 3x (extreme market conditions strong liquidation probability <1%)

On-chain Security

Cold wallet storage of core assets (Ledger/Trezor)

Scan permissions with Revoke.cash before authorizing contracts

Black Swan Response

Retain 20% USDC to respond to a 312-style crash

Use Deribit options to hedge tail risk

4. Cognitive Upgrade: The Key to Crossing Cycles

Reject the 'get rich quick narrative': 99% of shitcoins going to zero is a mathematical inevitability

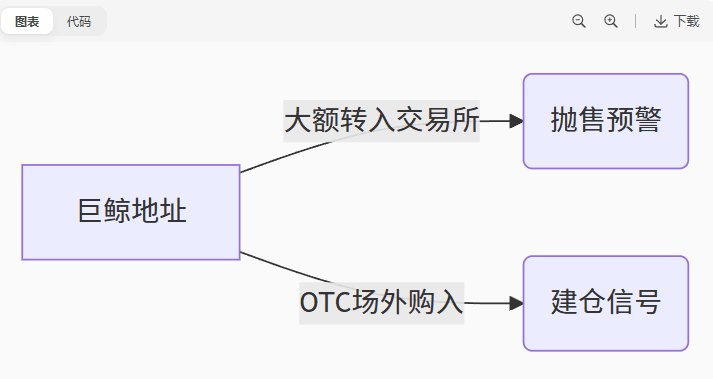

Focus on on-chain smart money:

Bear Market Mandatory Course:

Learning underlying technologies such as ZK/Rollup

Participate in Gitcoin donations to gain airdrop weight

Conclusion: The cryptocurrency space is a cash machine of cognition

The essence of profit is:

Capture market irrationality with systematic strategies,

Protect capital with risk control mechanisms,

Counter human nature with cyclical thinking.

#比特币流动性危机 #特朗普允许401(k)投资加密货币 #加密股IPO季

Continuously pay attention to: asr bb magic prove