Price slippage is defined as the difference between the expected price of a trade and the actual price at which it was executed. This slippage occurs in markets that experience high volatility or when liquidity is low, leading to the trade not being completed at the price set by the trader.The link from here

Price slippage is defined as the difference between the expected price of a trade and the actual price at which it was executed. This slippage occurs in markets that experience high volatility or when liquidity is low, leading to the trade not being completed at the price set by the trader.The link from here

The importance of adjusting price slippage $XRP

Controlling slippage is crucial for traders as it ensures they do not incur unexpected losses. By adjusting the slippage percentage, you can set the maximum loss you can bear in the trade. The lower the slippage percentage, the higher the chance of executing the trade at the price you specified, but this may lead to delays in execution or failure. On the other hand, allowing a higher slippage percentage can increase the chances of completing the trade quickly, but it may expose you to larger losses.

How to adjust slippage on the Binance app

To modify slippage settings on the Binance app, you can follow one of the following paths:$BNB

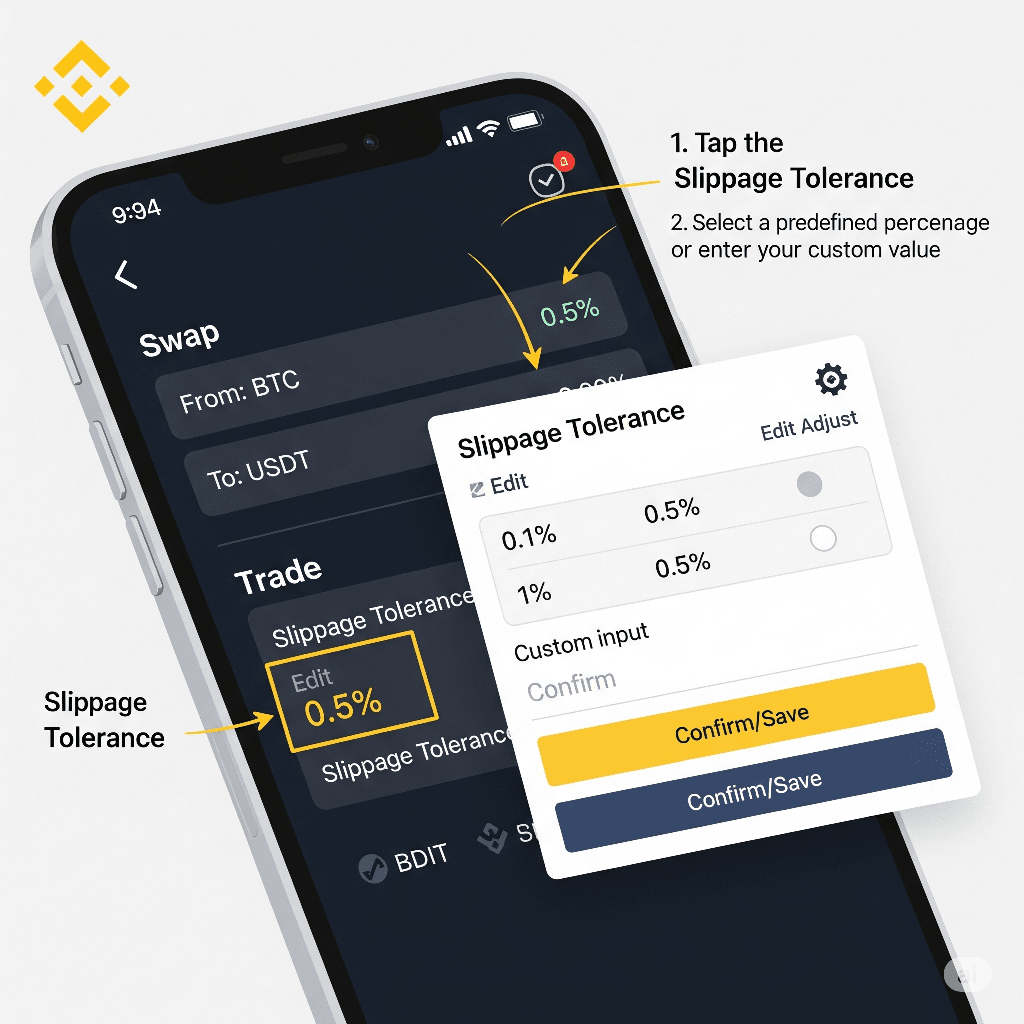

First method: via the 'Swap' or 'Bridge' feature

* Open the Binance app and go to 'Wallet'.

* Click on 'Trade' and then select 'Swap' or 'Bridge'.

* On the trading page, click on 'Slippage' to access the settings. $BTC

* Here you can choose between:

* Automatic slippage: The app automatically adjusts the best slippage percentage based on market conditions.

* Customization: Allows you to manually enter the slippage value or choose a preset percentage like 0.05%, 0.5%, or 1%.

Second method: via the 'Pro' feature

* Open the Binance app and go to 'Wallet'.

* Click on 'Trade' and then select 'Pro'.

* On the Pro trading page, click on settings (the icon shown in pictures).

* Choose 'Slippage Settings' and adjust the value that suits you either manually or automatically.

* Save the settings to apply them to all your future trades.

Important tips

* Start with a low percentage: It is always recommended to start with a low slippage percentage and only increase it if necessary, especially when trading in highly volatile assets.

* Balance speed and price: Remember that there is a trade-off between the speed of trade execution and the price you get.

* Be aware of the risks: Never allow a slippage percentage that exceeds the maximum loss you can bear.

Controlling slippage gives you greater control over your trades and helps you effectively manage risks. #BTCUnbound #CFTCCryptoSprint #BinanceHODLerPROVE #BinanceHODLerTOWNS #BTCReserveStrategy