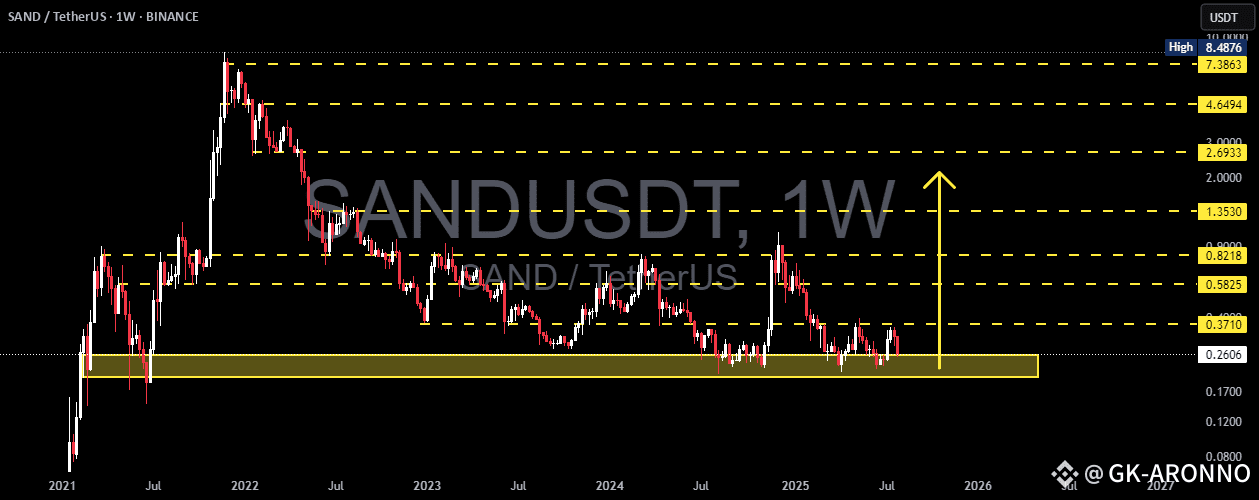

🔍 Overview:

SAND is currently trading at a crucial historical support zone, which has held firm multiple times since mid-2022. The chart shows a prolonged accumulation phase, offering significant potential for a major breakout or a decisive breakdown depending on market reaction.

---

🧠 Price Structure & Price Action:

After reaching an all-time high at $8.4876 in late 2021, SAND has been in a long-term downtrend.

However, over the past year, it has formed a wide base around the $0.26–$0.37 range — a clear sign of potential accumulation.

Price is currently moving sideways in a compression structure, signaling the build-up of energy for the next explosive move.

---

🧱 Key Levels:

Level Function Status

$0.2613 Primary Historical Support Currently being tested

$0.3710 Local Resistance Needs to be reclaimed

$0.5825 Major Resistance Bullish confirmation level

$0.8218 Weekly S/R Flip Mid-range target

$1.3530 Psychological Resistance Potential medium-term target

$2.6933 / $4.6494 Expansion Phase Targets Long-term upside potential

$7.3863 Pre-ATH Resistance Late-cycle target

---

🟢 Bullish Scenario:

1. If price holds and bounces off the $0.26–$0.37 demand zone, a bullish reversal may unfold.

2. A weekly close above $0.3710 would be the first sign of strength.

3. Breaking $0.5825 with solid volume would confirm trend reversal and open the path toward $0.82 – $1.35.

📌 Additional Bullish Confirmation:

Bullish divergence on RSI (if present)

Increasing volume during upward moves

---

🔴 Bearish Scenario:

1. A clear breakdown below $0.2613 on the weekly timeframe would signal a loss of major support.

2. This opens downside risk toward:

$0.17

$0.12

Possibly even $0.08 if the market seeks a deeper revaluation.

3. Such a move would likely represent a full structure reset.

📌 Additional Bearish Confirmation:

Strong bearish candles with high volume

Weak or no bullish reaction within the demand zone

---

🔁 Formations in Play:

Accumulation Rectangle: A sideways range often found at market bottoms before new bull cycles.

Multi-year Base Formation: Can serve as a launchpad for major parabolic moves if resistance is broken.

---

📚 Conclusion:

SAND is at a make-or-break zone. The market is coiled like a spring — preparing either for a new bullish expansion or for further downside pain. Smart traders and investors will:

Wait for breakout confirmation

Or exit positions on breakdown signals

This is a golden zone for preparation, not reaction.

---

📌 Suggested Trading Plan:

✅ Bullish Bias: Scale in within support zone; tight stop below $0.26

❌ Bearish Bias: Short only after weekly close below $0.26

🧠 Neutral/Waiting: Let the market prove itself