Date: Sat, Aug 02, 2025 | 09:10 AM GMT

The cryptocurrency market continues to bleed as Ethereum (ETH) faces strong resistance near $3,940 and has since pulled back to $3,500—a sharp 5% daily drop. This broader weakness is weighing heavily on memecoins, with Pepe (PEPE) sliding 17% in a week and giving back all its monthly gains.

While many assets are experiencing short-term corrections, PEPE's chart reveals a familiar and potentially bearish fractal pattern that could be signaling more downside ahead.

Source: Coinmarketcap

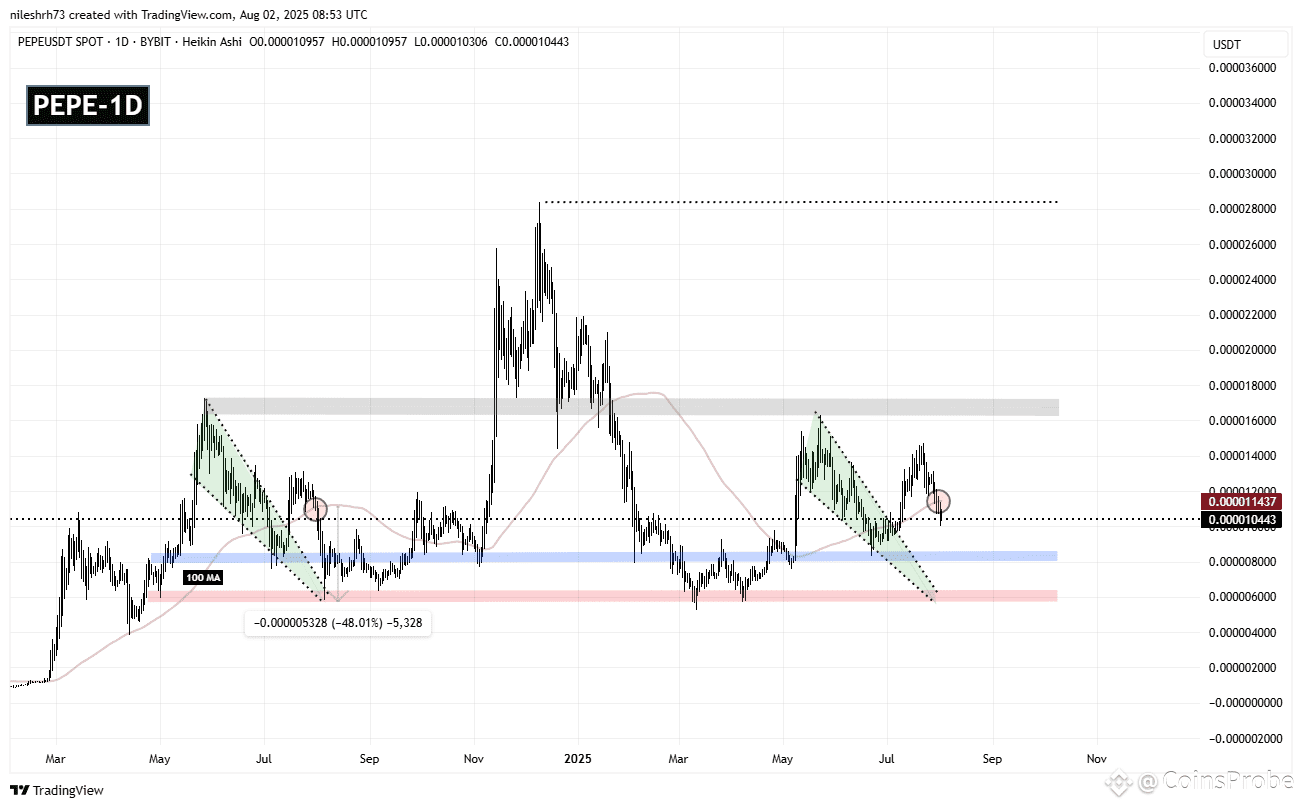

Fractal Setup Hinting at Bearish Continuation

On the daily chart, $PEPE appears to be mirroring a pattern last seen in August 2024.

Back then, the price bounced off the blue demand zone and broke out of a falling wedge formation, pushing it above the 100-day moving average (MA). But after a brief rally, it failed to hold support at the 100-day MA (marked with a circle), leading to a steep 48% drop down to the red support zone.

PEPE Daily Chart/Coinsprobe (Source: Tradingview)

Now, a nearly identical setup seems to be forming again.

PEPE has once again bounced from the same blue support zone, broken out of a falling wedge, and rallied above the 100-day MA—only to now lose that level again in the latest breakdown. The current price action is eerily similar to what preceded the last major drop.

What’s Next for PEPE?

If the fractal plays out again, bears could be targeting a drop back to the familiar blue and red support zones, located around $0.0000083 and $0.0000058, respectively—a potential 44% decline from current levels.

That said, the bearish outlook could be invalidated if bulls manage to reclaim the 100-day MA at $0.00001143, flipping it back into support. That move could shift momentum back in their favor and stall the pattern.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before making investment decisions.