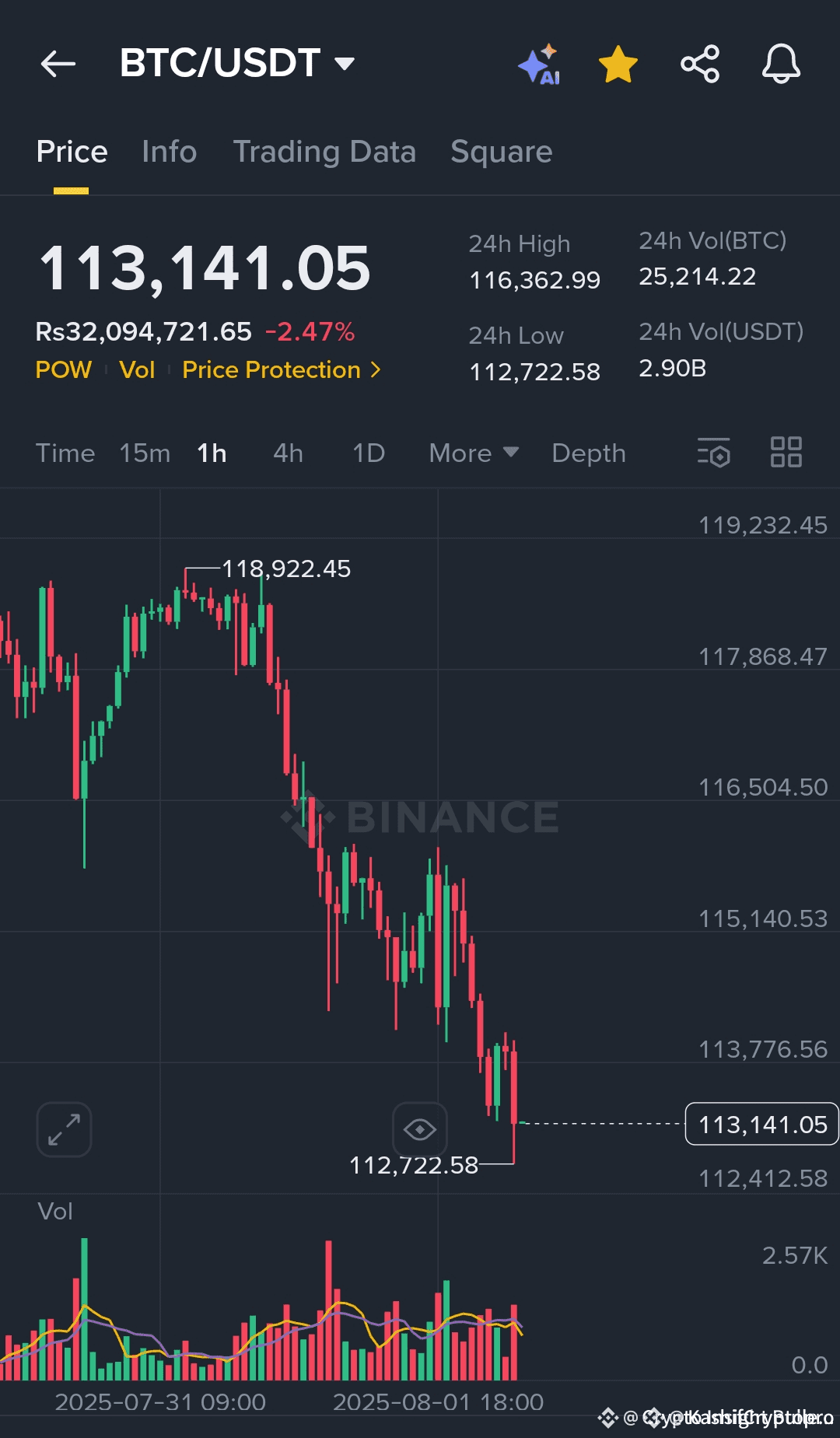

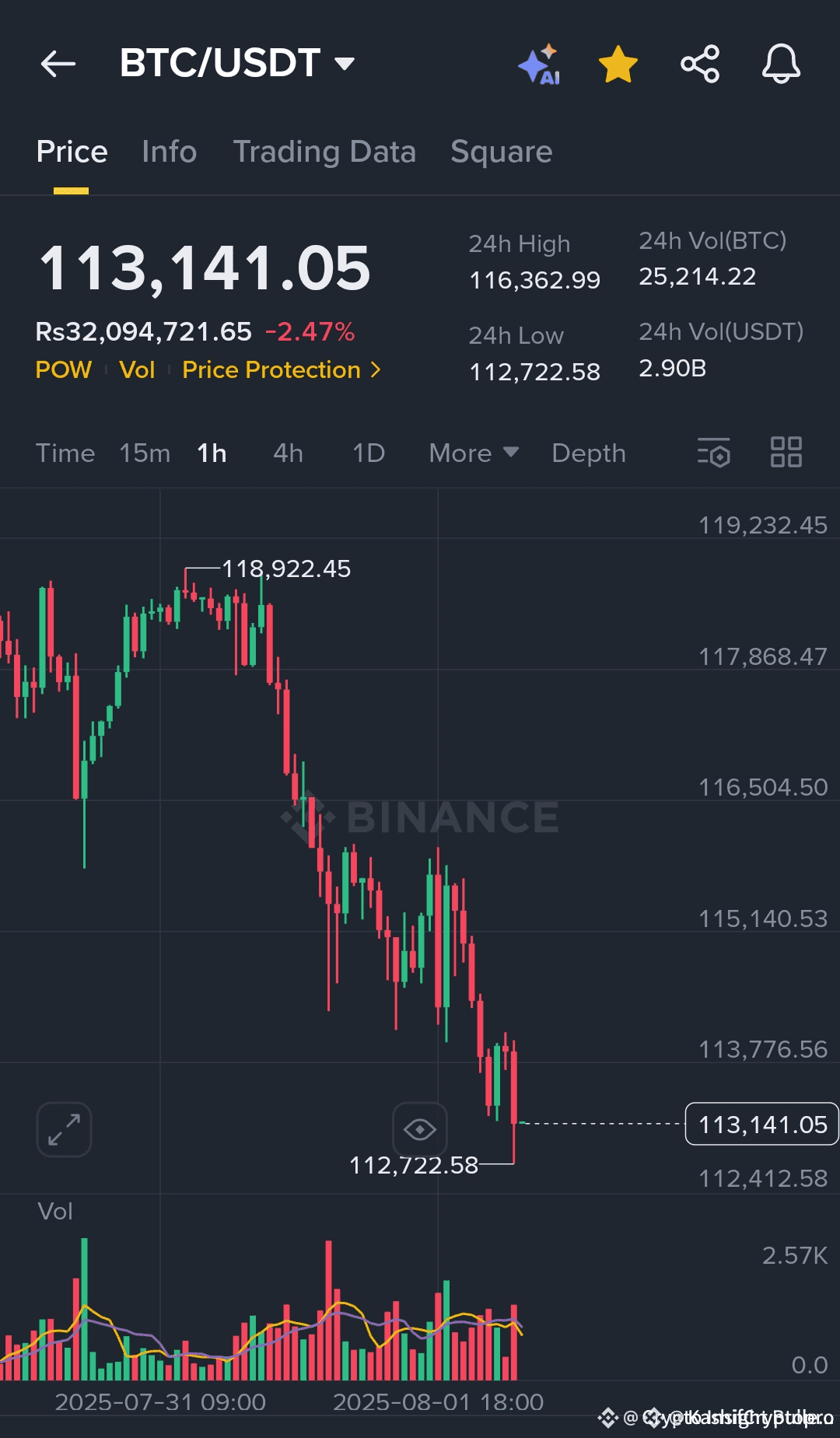

Bitcoin (BTC) has sparked market-wide panic, plunging from its recent high of $123,218 to a daily low of $112,722 — erasing nearly $10,500 in value in just a few days. At the time of writing, BTC trades around $113,141, marking a sharp -2.47% drop over the last 24 hours.

Real-Time Price Snapshot (Aug 1, 2025)

Current Price: $113,141

24h High: $116,362

24h Low: $112,722

Volume (USDT): $2.9 Billion

Volume (BTC): 25,214 BTC

❗ What’s Triggering the Sharp Sell-Off?

🔸 1. Technical Breakdown

BTC has slipped below critical support levels:

$118,900 → $115,500 → $113,776

These demand zones have now flipped into resistance, signaling a confirmed bearish structure.

🔸 2. Whale Selling Pressure

Large holders (whales) appear to have sold heavily near the $123K peak, setting off a chain reaction of liquidations and stop-loss triggers.

🔸 3. Weak Buyer Response

Even after touching $112,722, BTC saw little bounce volume — showing a lack of confidence from buyers.

🔸 4. Global Sentiment Shift

Geopolitical jitters — including Trump’s controversial remarks on India-Russia economic ties — have added uncertainty to global markets, rattling crypto investors.

📊 Multi-Timeframe Technical Breakdown

🕐 1H Chart

Sharp drop from $118.9K

Weak bounce — likely a bearish retest of $113.7K

Volume still favors sellers

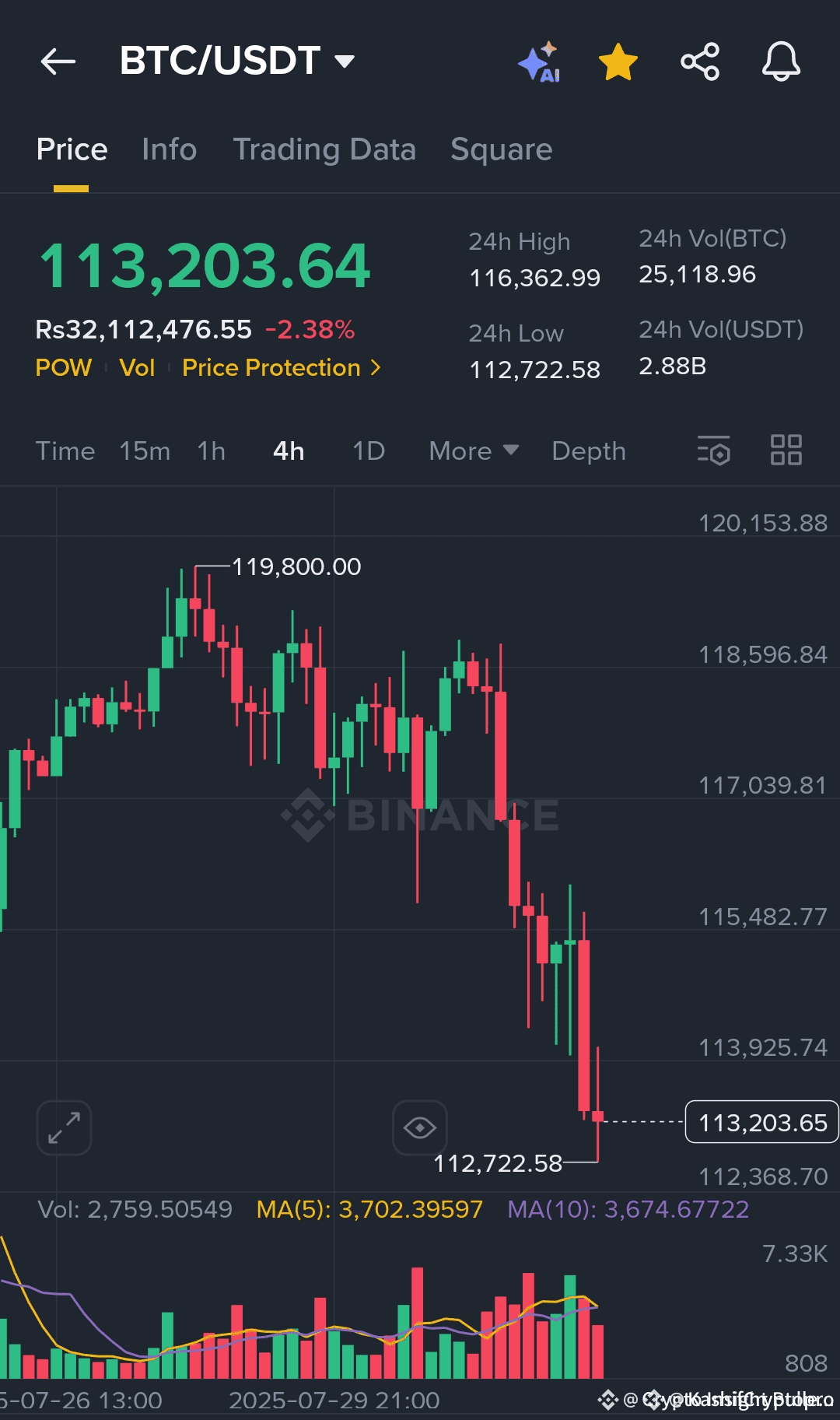

⏱️ 4H Chart

Clear downtrend with major rejection at $119.8K

MA(5) and MA(10) show bearish crossover

Struggling to hold $113.2K — risk of a break below $112.7K

📆 1D Chart

Massive bearish engulfing candle

Momentum stalled after the $123K peak

If $112.7K fails, next supports lie at $107,957 and $102,453

🔮 What’s Next for Bitcoin?

📌 Short-Term Scenarios

✅ Scenario A – Relief Rally (Low Probability)

If BTC reclaims $115.5K with strong volume, a retest of $117.8K–$118.9K is possible.

Trigger: RSI divergence or positive macro news.

❌ Scenario B – Continued Breakdown (More Likely)

Failure to defend $112.7K could lead to drops toward $110K → $107K → $102K.

Trigger: Further whale exits, weak bounce volume, or broader market fear.

🧠 Pro Trader’s Strategy

Scalpers: Wait for a clear rejection or reclaim at $113.7K before entering.

Swing Traders: Avoid longs unless $115.5K flips into support.

Spot Buyers: Consider DCA entries near $107K–$102K, long-term support.

Leverage Users: Keep tight stop-losses — high volatility will wipe out overexposed positions.

🔥 Final Take

Bitcoin has entered a short-term bearish zone. This could be a healthy pullback in the larger bull trend, but the next 48 hours are crucial.

If $112.7K breaks, expect a

slide toward $107K and potentially $102K.

Smart traders are waiting — in this environment, panic or FOMO = REKT.