In a market saturated with buzzwords, one trend is standing out in 2025: restaking.

While most narratives come and go, restaking has the potential to become a foundational piece of Ethereum’s modular future. Powered by protocols like EigenLayer, Symbiotic, and Karak, restaking is quickly evolving from an experimental concept into a multi-billion dollar security layer.

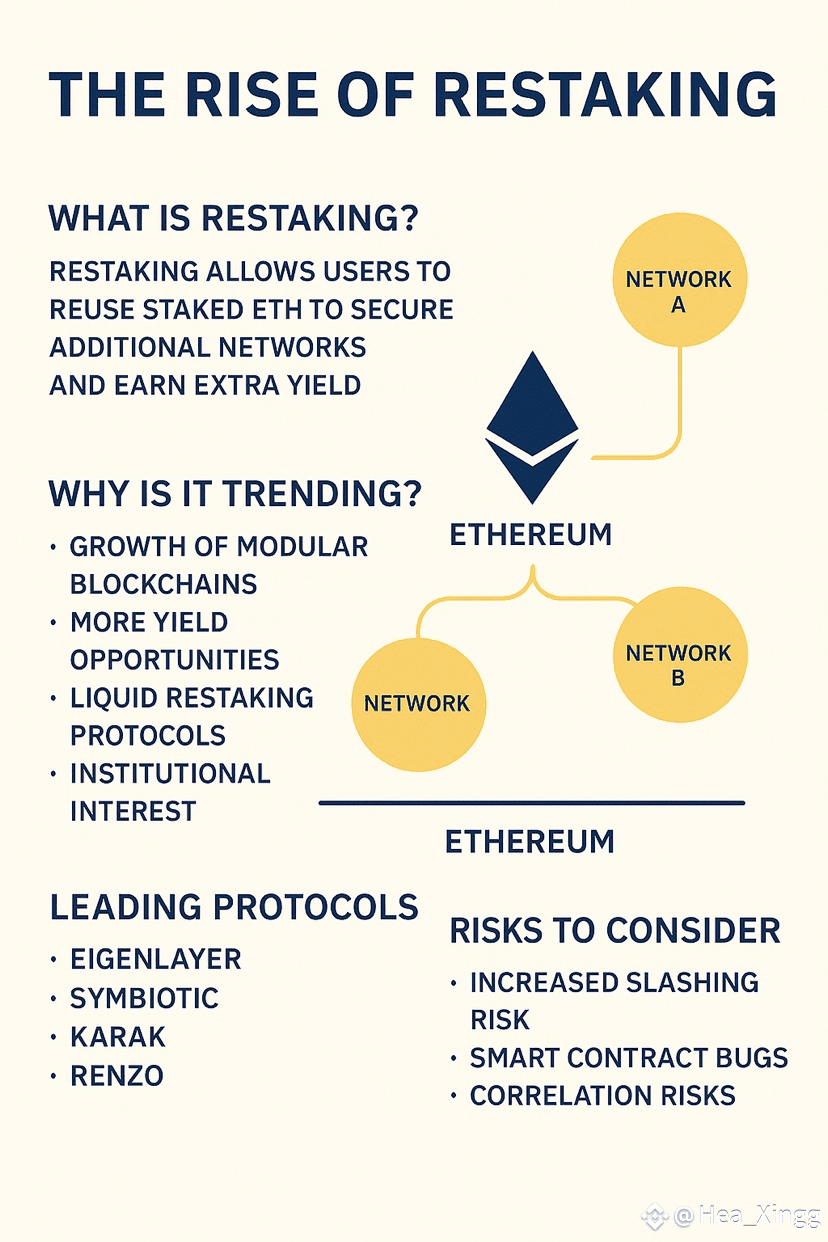

🧠 What Is Restaking?

At its core, restaking allows users to reuse already-staked ETH (or ETH-LSTs like stETH, eETH, etc.) to secure additional networks, such as rollups, oracles, and bridges — known as AVSs (Actively Validated Services).

Think of it as putting your ETH to work twice — securing Ethereum and other services at the same time, earning additional rewards without unbonding.

🚀 Why Is It Exploding Now?

Several catalysts are driving the restaking boom:

• EigenLayer mainnet expansion has brought attention to AVS models

• Modular blockchains are emerging fast, needing more flexible security layers

• Liquid restaking protocols (like ether.fi, KelpDAO, and Renzo) now let users earn yield without locking up their ETH

• Institutions are eyeing restaking as a scalable, passive yield strategy on top of Ethereum

Restaking is no longer a niche — it’s quickly becoming part of the DeFi core stack.

🔗 The Players Leading the Charge

• EigenLayer: Pioneer and dominant restaking platform

• Symbiotic: A new restaking model with broader design flexibility

• Karak: L2-native restaking protocol aiming to go multi-chain

• Renzo, KelpDAO, Ether.fi: Liquid restaking protocols that provide instant liquidity and auto-compound rewards

⚠️ Risks to Watch

Restaking isn’t without challenges.

• Slashing conditions may stack up as users opt into more AVSs

• Smart contract risk increases as protocols build atop multiple layers

• Correlation risk: A single failure can impact multiple AVSs sharing the same security pool

Still, protocols are actively working to mitigate these risks with customizable delegation and risk-tracking dashboards.

🔮 Why This Narrative Has Legs

Restaking is not just about yield — it’s about scaling Ethereum’s security outward in a trust-minimized way.

In a modular world, security is currency. And restaking is shaping up to be Ethereum’s security-as-a-service layer, enabling new types of decentralized infrastructure to flourish.

Whether you’re a builder, staker, or investor, it’s a trend you can’t ignore.

Always DYOR.