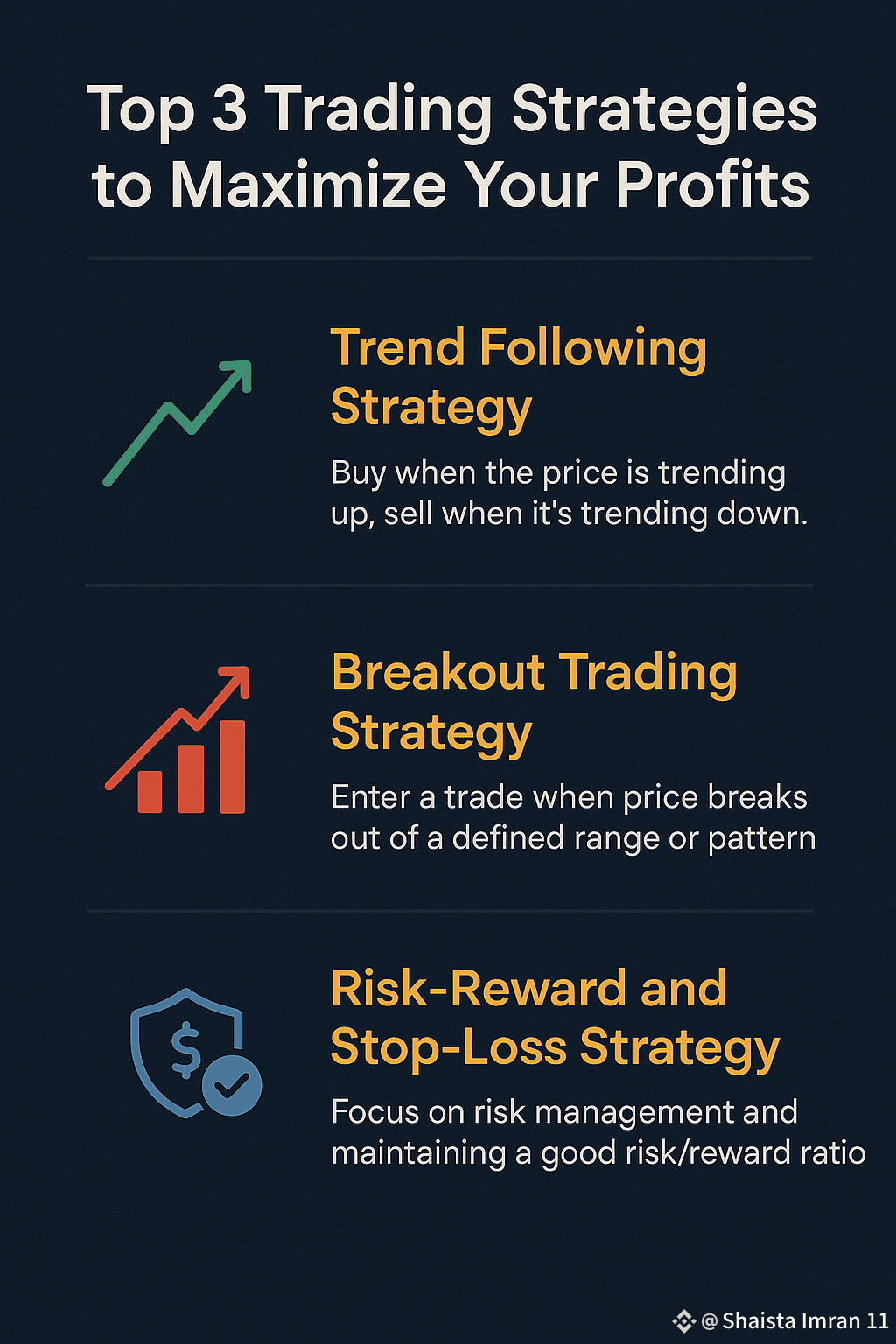

1. Trend Following Strategy

How it works: Buy when the price is trending up, sell when it's trending down.

Tools: Moving Averages (50-day, 200-day), RSI, MACD.

Example: If Bitcoin is above its 200-day moving average and showing strong volume, consider buying and riding the trend.

✅ Why it works: You go with the market flow, not against it.

---

2. Breakout Trading Strategy

How it works: Enter a trade when price breaks out of a defined range or pattern.

Tools: Support/resistance zones, volume spikes, candlestick patterns.

Example: If ETH breaks above a resistance level with high volume, buy the breakout and set a stop-loss just below the breakout zone.

✅ Why it works: Captures big moves early when momentum kicks in.

---

3. Risk-Reward and Stop-Loss Strategy

How it works: Focus on risk management — only enter trades with a good risk/reward ratio (at least 1:2).

Tools: Stop-loss and take-profit levels, position sizing.

Example: Risk $100 to potentially make $200. Set stop-loss levels that protect capital.

✅ Why it works: Even if you win only 50% of trades, you'll still be profitable long-term.

---

#TrendingTopic #TradingCommunity #TradingSignals #TradingStrategies💼💰 #TradingTopics