Strategy Incorporated, formerly operating as Microstrategy, has filed for a $4.2 billion offering of its Variable Rate Series A Perpetual Stretch Preferred Stock (STRC) while reporting record second-quarter net income of $10 billion, driven by unrealized gains on its massive bitcoin holdings.

Strategy Announces $4.2B STRC Offering and Record $10B Q2 Net Income

Strategy filed a prospectus supplement for an “at the market” offering of up to $4.2 billion of its Variable Rate Series A Perpetual Stretch Preferred Stock, trading under the symbol “STRC.” Sales agents include TD Securities, Barclays Capital, The Benchmark Company, Clear Street, and Morgan Stanley. Proceeds are intended for general corporate purposes, including acquiring bitcoin and funding working capital.

The STRC stock carries an initial liquidation preference of $100 per share and accumulates cumulative monthly dividends. The initial dividend rate is set at 9.00% annually. Strategy retains the right to adjust future dividend rates, within defined limits, aiming to maintain the stock’s trading price near its $100 stated amount. The first monthly dividend of $0.80 per share was declared on July 31, payable August 31. The company just raised a whopping $2.521 billion and purchased 21,021 BTC after the initial public offering (IPO) closed.

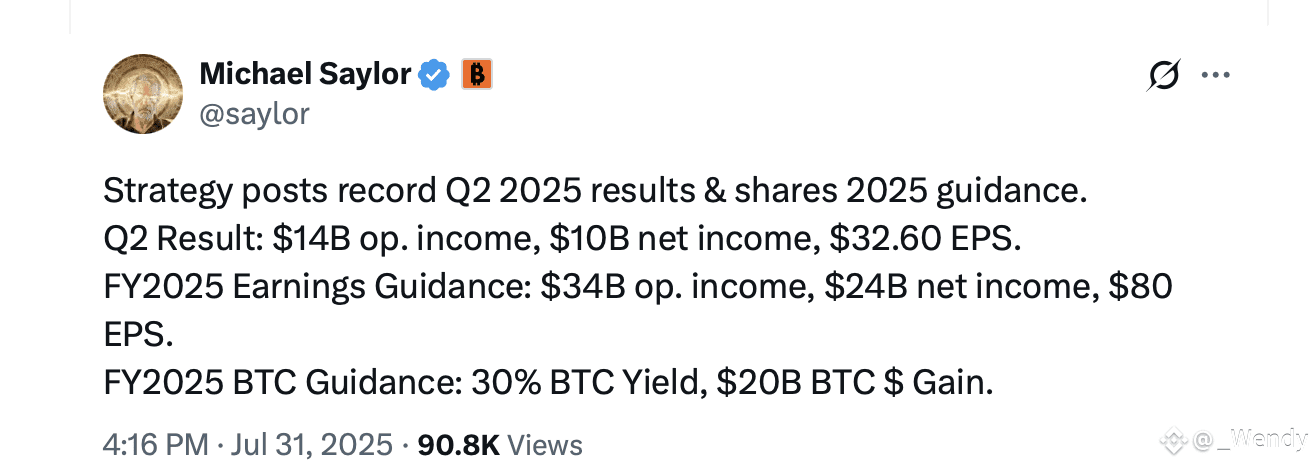

Simultaneously, Strategy announced record financial results for the second quarter ending June 30, 2025. The company reported operating income of $14.03 billion, a 7,106% increase year-over-year, primarily driven by a $14.0 billion unrealized gain on its bitcoin holdings following the adoption of fair value accounting. Net income reached $10.02 billion, or $32.60 per diluted share, compared to a net loss of $102.6 million in Q2 2024.

Strategy’s bitcoin holdings grew to 597,325 bitcoins as of June 30, 2025, with a total cost of $42.4 billion and a market value of $64.4 billion. The company added 69,140 bitcoins during the quarter using proceeds from capital markets activities. Year-to-date, Strategy achieved a BTC Yield of 25.0% and a BTC $ Gain of $13.2 billion.

Capital raising was significant in Q2. Strategy generated $6.8 billion in net proceeds through at-the-market offerings of its Class A common stock ($5.2B) and various preferred stocks (STRK, STRF, STRD), plus a $979.7 million STRD initial public offering. An additional $3.7 billion was raised in July, including a $2.5 billion STRC IPO.

Based on an assumed year-end bitcoin price of $150,000 per coin, Strategy issued FY2025 guidance projecting operating income of $34 billion, net income of $24 billion, and diluted EPS of $80. The company also raised its full-year BTC Yield target to 30.0% and BTC $ Gain target to $20 billion.

Strategy outlined a framework for managing its common stock ATM program based on its “mNAV” metric and introduced rules-based guidance for adjusting future STRC dividend rates monthly, linked to its recent trading price. The company held 628,791 bitcoins as of July 29, 2025.