In the current DeFi landscape, real-world asset (RWA) integration has often been hindered by regulatory bottlenecks and lack of institutional-grade infrastructure. Enter @BounceBit with BounceBit Prime—a game-changer in the on-chain yield economy.

🔍 What Is BounceBit Prime?

BounceBit Prime is an on-chain yield infrastructure layer purpose-built to bring institutional yield strategies to the crypto-native audience. Unlike traditional DeFi platforms that rely on volatile staking and lending models, BounceBit Prime taps directly into tokenized RWA products backed by real institutions like:

BlackRock.

Franklin Templeton.

Other regulated custodians and fund managers.

These RWAs are tokenized representations of traditional financial instruments (such as bonds, T-bills, and yield-bearing ETFs), offering stable yield while retaining the benefits of blockchain interoperability.

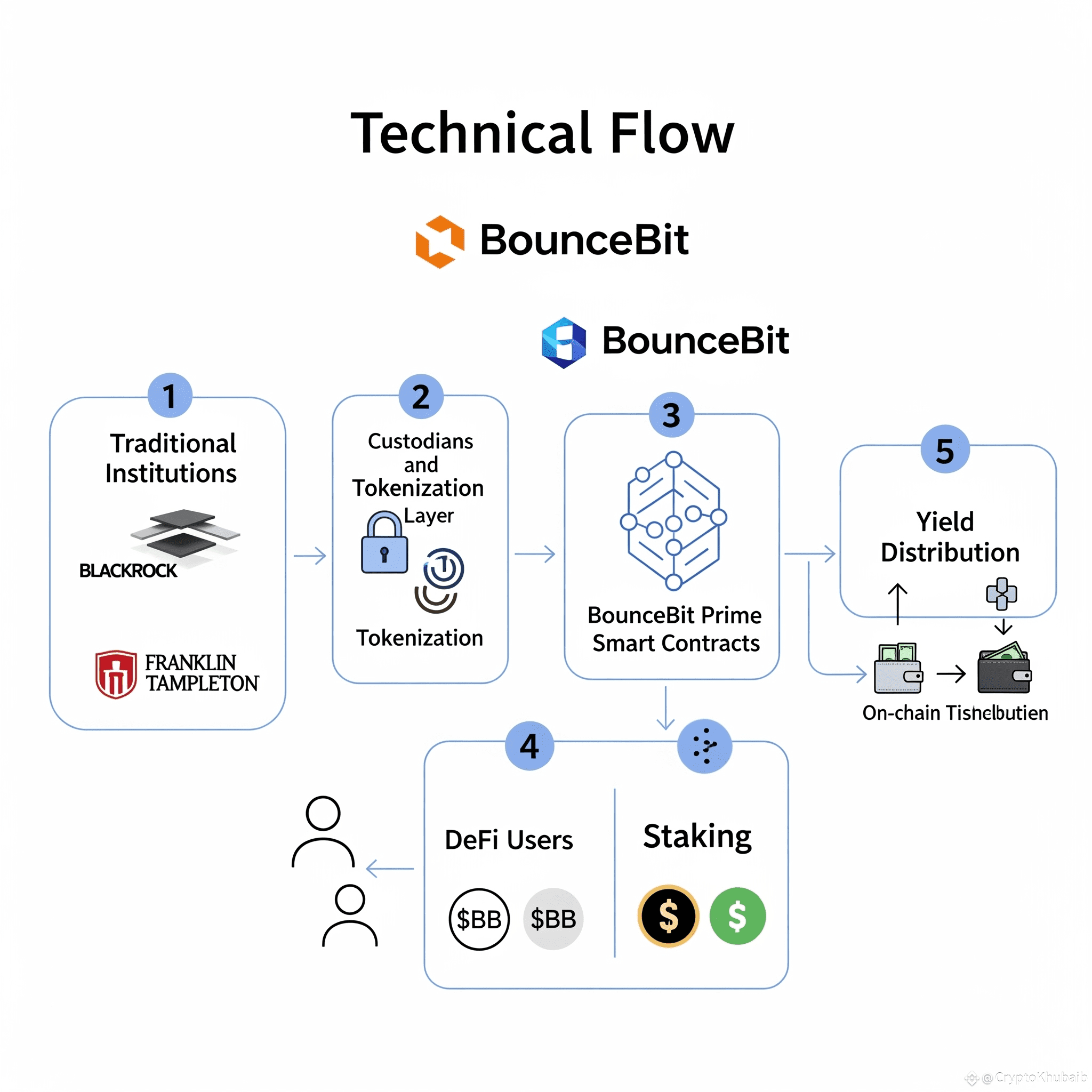

🧩 How It Works — Institutional Yield, On-Chain Flow

Here’s a simplified technical flow of how BounceBit Prime operates:

RWA Origination

BounceBit partners with asset managers (e.g. BlackRock) to access regulated financial products.

Tokenization Layer

These RWAs are wrapped into on-chain tokens that represent their yield-bearing value.

Custodial Safeguards

Partner custodians (licensed entities) hold and manage the real-world collateral behind the scenes.

User Access

Users stake $BB or stablecoins into Prime and receive yield-bearing synthetic tokens.

Yield Distribution

Yield generated from RWA exposure is programmatically distributed to users’ wallets on-chain.

This flow combines CeFi-grade asset safety with DeFi-grade transparency and access.

🧠 Why It Matters

Decentralized but Regulated: Built on a trust-minimized architecture while working with regulated custodians.

RWA Accessibility: Brings previously unreachable TradFi yield to global DeFi users.

Yield Stability: More sustainable compared to high-risk DeFi farming loops.

Cross-Chain Ready: BounceBit’s modular structure makes it easily extendable to multiple ecosystems.

This positions BounceBit Prime as a decentralized investment rail for the next 1 billion users who want stable returns from real assets.

🚀 The Role of $BB in Prime

The $BB token is the native utility and governance token that powers the BounceBit ecosystem:

Staking in Prime unlocks exclusive access to premium yield products.

Rewards distributed to $BB holders for protocol participation.

Governance enables token holders to vote on onboarding new RWA strategies or partners.

🎯 Final Thought

BounceBit Prime isn’t just a passive yield protocol—it’s a blueprint for DeFi-RWA convergence. By embedding the yield logic of traditional finance within the trustless rails of DeFi, it opens the door to sustainable, scalable income generation for everyone—not just institutional whales.

If you believe in a future where real assets live on-chain, BounceBit Prime is your gateway.

Tag: @BounceBit

Hashtags: #BounceBitPrime $BB