June 17–18, 2025 FOMC Meeting Highlights

1. Policy Decision

The FOMC unanimously kept its federal funds rate in the 4.25%–4.50% range—the fifth consecutive hold—maintaining a cautious stance amid lingering uncertainties

The accompanying statement revised language: uncertainty was described as "diminished but remains elevated," removing prior language suggesting growing economic volatility

2. Economic Projections (Summary of Economic Projections)

Core PCE inflation projections rose to 3.1% for 2025, with slight increases expected in 2026 and 2027

GDP growth forecasts were downgraded to 1.4% for 2025, signaling softening momentum

Unemployment projections edged up modestly, while the long-run neutral rate remained at 3.0%

The median projection implied two 25-basis-point rate cuts in 2025, though internal divisions suggest some members expect no cuts

3. Internal Dynamics & Minutes Insights

The minutes, released July 9, noted a growing split within the FOMC:

Two Trump-appointed members—Christopher Waller and Michelle Bowman—favored an immediate rate cut in July,

While 17 other members expected one or two cuts in total, and 7 foresaw no cuts this year

Markets priced in a 25% chance of a July cut, increasing the odds for cuts in September or December

🎯 Market Reactions & Outlook

4. Current Market Sentiment

Market analysts and economists widely anticipated no rate change in July, despite mounting political pressure from former President Trump

Morgan Stanley forecasted disappointment—predicting that inflation and labor strength would keep the Fed sidelined

Goldman Sachs updated its forecast, expecting three rate cuts starting in September, contrary to the Fed’s more cautious median path

5. Policy Outlook

Most views center on a September rate cut, assuming inflation data eases and employment remains stable; markets still expect ~2 cuts by year-end

Alternative projections (EY, Nuveen) align with this, expecting additional easing in 2026 if conditions worsen

📌 Cross-Asset Implications

U.S. Dollar: Held steady above 98.7 in the index ahead of the meeting, reflecting caution before Chair Powell’s remarks

Gold and Commodities: Markets remained sensitive to FOMC outcomes—gold spiked above Rs 99,000 per 10 g ahead of the announcement, showing traders’ positioning for rate-related volatility

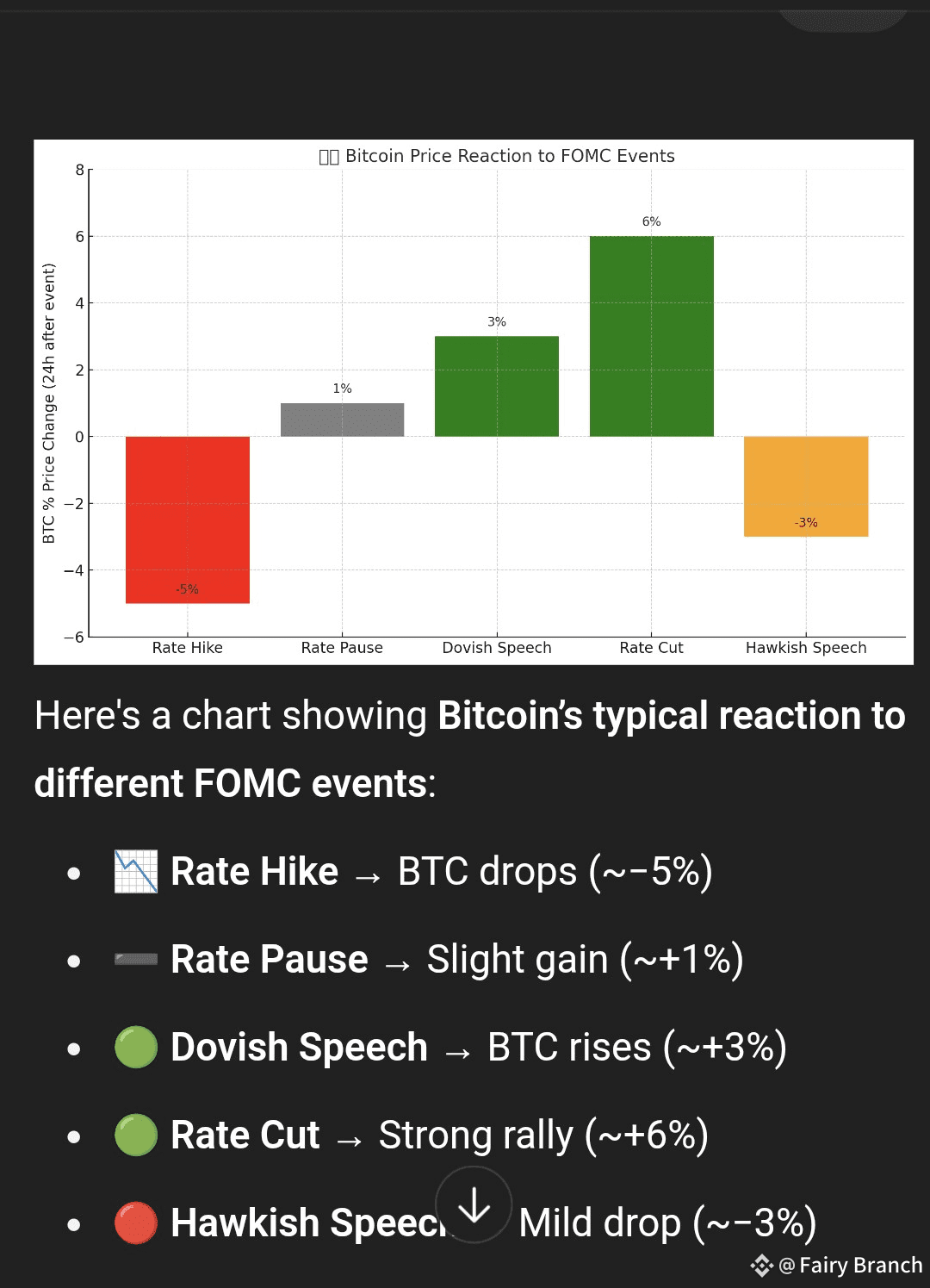

Equities & Crypto: Risk assets showed mixed reactions. Hopes of future easing sustained broader rally sentiment, though uncertainty weighed on traders until a firmer dovish shift emerged

🧠 What to Expect Next

Chair Powell’s tone during upcoming press events will shape perceptions. Markets are watching for explicit cues on the timing of rate cuts.

Upcoming U.S. data—especially jobs, CPI, and trade numbers—will be pivotal ahead of the September FOMC meeting

The dot plot is expected at the next meeting, potentially signaling a shift in consensus tone.

Political pressure remains a risk; however, analysts see the Fed’s independence holding strong despite vocal criticism

📋 Summary Table

Category Highlights

Policy Rate Held steady at 4.25%–4.50%, unanimous vote

Inflation Core PCE measure projected at 3.1% for 2025

Growth Outlook Revised down to ~1.4% GDP growth in 2025

Internal Divides Some dissent for cuts (Waller, Bowman); policy split reflected in minutes

Market Expectation Cuts likely in September, modest easing through 2025

Risks to Monitor Inflation pressures, political interference, global economic data

$Doge