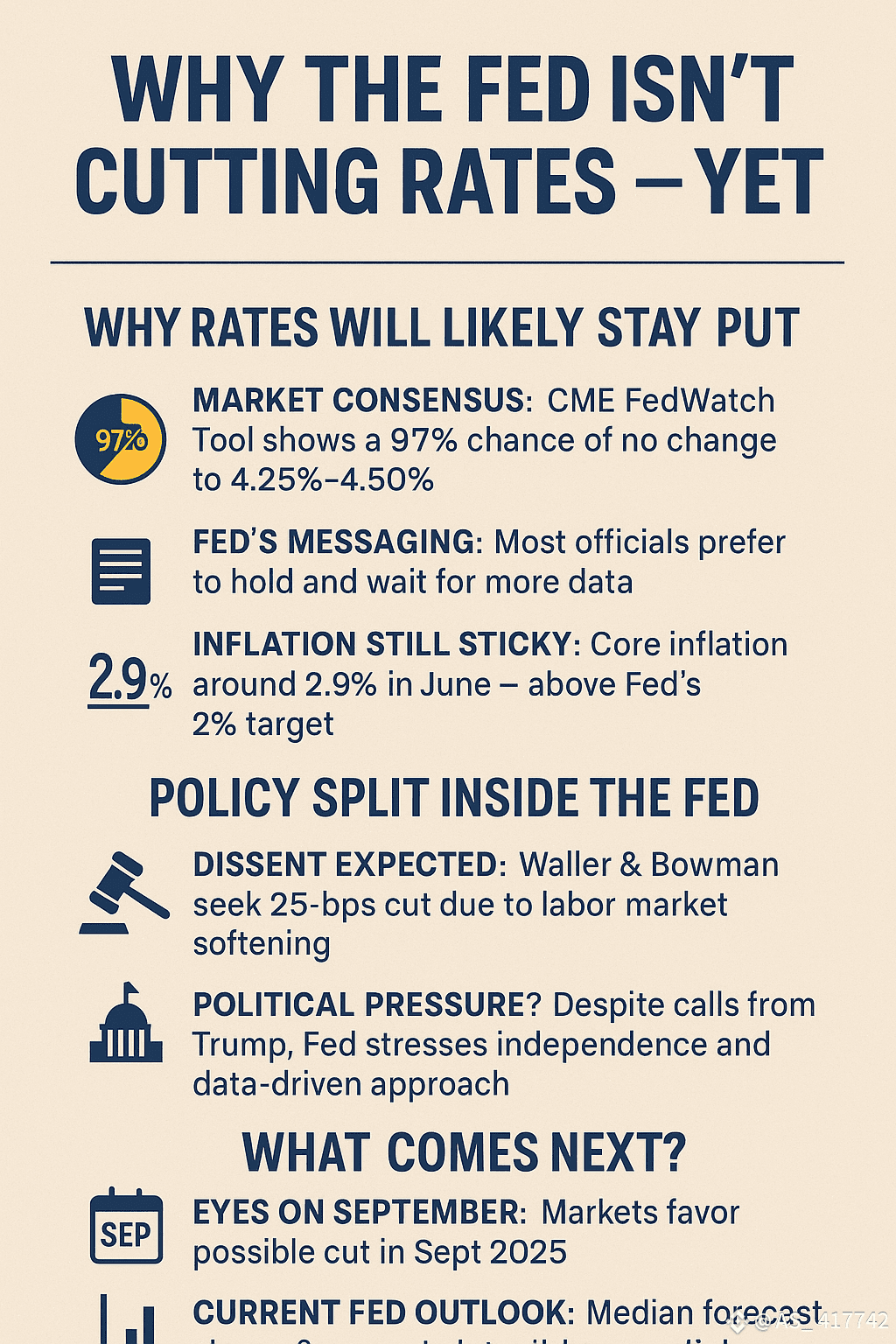

As the U.S. Federal Reserve prepares for today’s policy meeting, market watchers are nearly unanimous: a rate cut is not coming just yet.

🔍 Why Rates Will Likely Stay Put

Market Sentiment: According to the CME FedWatch Tool, there’s a 97% probability the Fed will keep interest rates unchanged at 4.25%–4.50%.

Fed’s Messaging: Officials, including Chair Jerome Powell, have consistently stated their preference to pause and assess more data before moving toward easing.

Inflation Still Sticky: Core inflation came in at around 2.9%$TRUMP

in June, still well above the Fed’s 2% target—a key reason policymakers remain cautious.

⚖️ Policy Split Inside the Fed

Dissent Expected: Fed Governors Christopher Waller and Michelle Bowman may push for a 25-basis-point cut, citing labor market softening—though they’re expected to remain in the minority.

Political Pressure?: Despite former President Trump’s repeated calls for a rate cut, the Fed continues to emphasize its independence and data-driven approach.

🔮 What Comes Next?

Eyes on September: Markets are now betting on a potential rate cut in September 2025, if inflation continues to decline and labor data shows further weakness.

Current Fed Outlook: The Fed's median forecast still includes two rate cuts by year-end, but only if inflation and employment data justify it.

🎙️ What to Watch in Powell’s Press Conference:

Will he hint at a September cut timeline?

How much weight will upcoming jobs, inflation, and GDP data carry?

Any shift in tone that suggests easing bias?

🧾 Final Takeaway

Decision Expected: 🟥 Hold rates at 4.25%–4.50%

Key Risks: Inflation resilience, Fed division

Next Watchpoint: September FOMc meeting

📌 Verify signals, not speculation. The Fed is data-first and politics-second.

#InflationWatch #MonetaryPolicy #FedUpdate