🔄 Mastering Spot Trading: Strategies for Crypto Traders in 2025

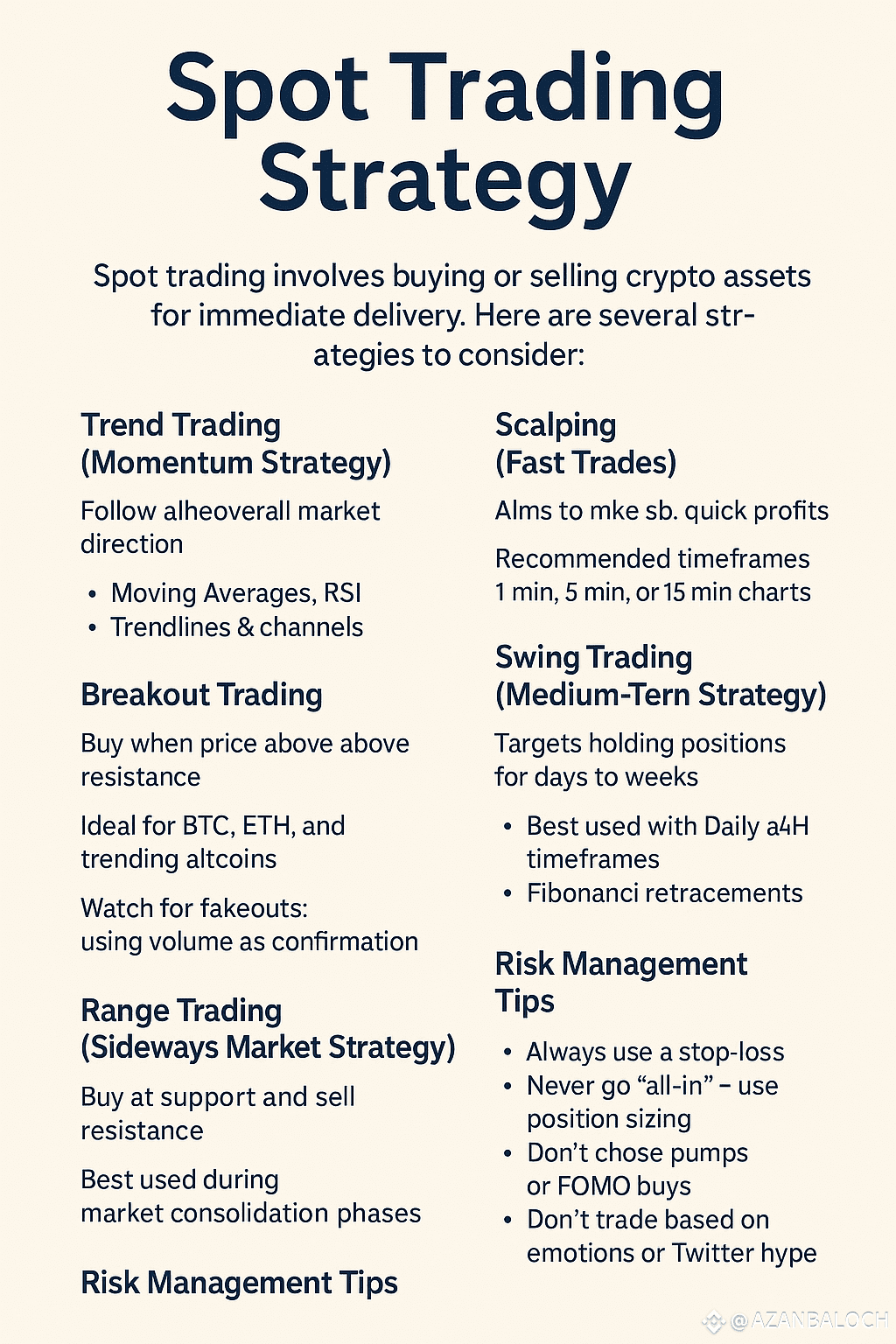

Spot trading is the simplest and most popular form of trading in the cryptocurrency market. It involves buying or selling digital assets for immediate delivery and ownership. Unlike futures or options, spot trading is direct — what you buy is what you own. But to be profitable, traders need a reliable strategy tailored to the dynamic crypto environment of 2025.

In this article, we’ll explore proven spot trading strategies, tools you should use, and tips to manage your risks effectively.

🧠 What Is Spot Trading?

Spot trading means purchasing a crypto asset (like Bitcoin, Ethereum, or Solana) at the current market price and holding it in your wallet or exchange account. You make money by buying low and selling high — without leverage.

Example:

Buy BTC at $60,000 → Hold → Sell BTC at $68,000 → Profit: $8,000

📊 Top Spot Trading Strategies

1. Trend Trading (Momentum Strategy)

You follow the overall direction of the market. When BTC is in an uptrend, you buy dips and hold. In a downtrend, you either wait or trade other altcoins showing strength.

Tools:

Moving Averages (EMA 50 / EMA 200)

RSI (Relative Strength Index)

Trendlines & channels

Pro Tip: Combine moving average crossovers with price action confirmation before entering trades.

2. Breakout Trading

Buy when price breaks above resistance with strong volume — indicating a surge in interest. This works well in volatile markets like crypto.

Ideal for: BTC, ETH, and trending altcoins.

Watch for: Fakeouts — use volume as confirmation.

Tools:

Bollinger Bands

Volume indicators

Price zones (Support/Resistance)

3. Range Trading (Sideways Market Strategy)

This works when the price moves sideways in a channel. You buy near support and sell near resistance repeatedly.

Ideal during: Market consolidation phases.

Risk: Sudden breakouts can hit stop-losses.

Tools:

Horizontal zones

MACD

RSI for oversold/overbought conditions

4. Scalping (Fast Trades)

You aim to make many small profits within minutes or hours. Requires speed, discipline, and a clear plan.

Key Rules:

Always use stop-loss

Avoid revenge trading

Best done on high-liquidity pairs like BTC/USDT or ETH/USDT

Recommended Timeframes: 1min, 5min, or 15min charts

5. Swing Trading (Medium-Term Strategy)

Hold positions for days to weeks, aiming to capture larger price moves. Ideal for traders who don’t want to sit in front of the screen all day.

Best used with:

Daily and 4H timeframes

Fibonacci retracements for entry/exit points

🛠️ Must-Have Tools for Spot Traders

TradingView: For technical analysis and charting

Binance Popular spot exchanges

CoinMarketCap / CoinGecko: To track trends and news

Telegram/Discord Groups: Get sentiment and alerts

Google Sheets / Trading Journal: Track your trades and learn from them

🔐 Risk Management Tips

✅ Always use a stop-loss (1%–3% max loss per trade)

✅ Never go “all-in” — use position sizing

❌ Don’t chase pumps or FOMO buys

❌ Don’t trade based on emotions or Twitter hype

Golden Rule: Protect your capital first. Profits come second.

🧭 Example Strategy (For Beginners)

> Strategy Name: RSI + EMA Bounce

Timeframe: 15m or 1h

Buy Signal:

RSI below 30

Price touches 50 EMA

Bullish candle confirms

Sell Signal: RSI above 70 or price hits resistance

Stop-loss: 1.5–2% below entry

Take Profit: 2–4% above entry

Backtest this setup on BTC/USDT before using real money.

📌 Conclusion

Spot trading offers safer exposure to the crypto market without the risks of leverage. With the right strategy, mindset, and risk managem

ent, it can be a powerful way to grow your portfolio in 2025.

Focus on consistency, not perfection. Test one strategy at a time and refine it based on your results.

#SpotTrading. #BinanceHODLerTree #DELABSBinanceTGE #AmericaAIActionPlan #BNBATH