In a powerful nod to its growing institutional relevance, Ripple is now being spotlighted as a systemic solution for fixing the cracks in the global financial system exposed by the 2008 crisis.

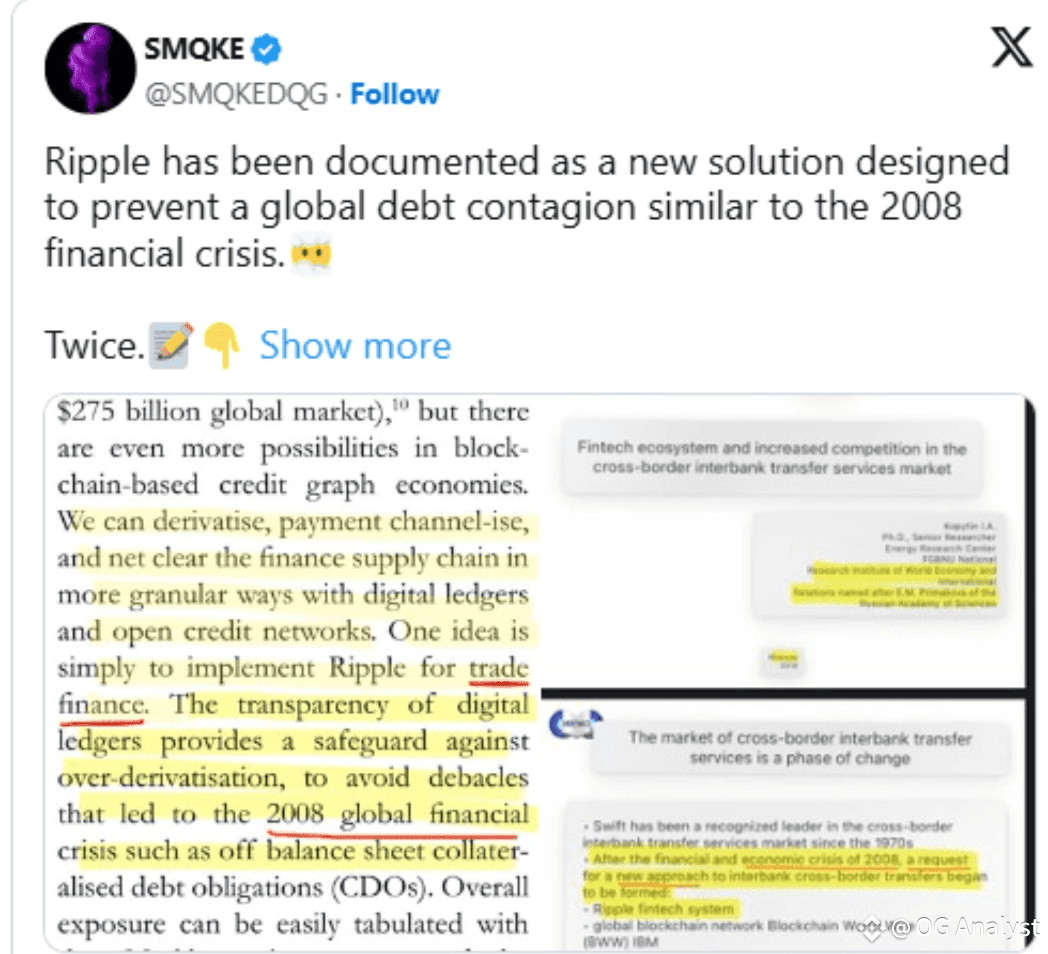

📚 In a recent tweet, crypto researcher SMQKE unveiled documents from a high-level academic event—The Fourth International Scientific and Practical Conference, hosted by the Russian Academy of Sciences (IMEMO RAS). The event tackled the theme: “The Era of Cryptocurrency: New Challenges and Regtech in This Sphere”—where Ripple wasn’t just mentioned but featured as a key component in future-ready financial infrastructure.

🔍 Ripple in the Eyes of Global Economists

Dr. IA Kopytin, a senior analyst at the Energy Research Center, presented a paper titled “The Financial Technology Ecosystem and Increased Competition in Cross-Border Interbank Money Transfer Services”. He outlined how Ripple emerged post-2008 as one of the few standout technologies addressing systemic inefficiencies in interbank transfers.

According to Kopytin, Ripple joins names like IBM’s Blockchain World Wire and JPMorgan’s Interbank Information Network in redefining global financial architecture. The conference stressed that the collapse of outdated systems like SWIFT created a ripe opportunity for blockchain-driven innovation—and Ripple is at the forefront of that wave.

💼 More Than a Coin — A Technological Backbone

What sets Ripple apart isn’t just XRP or crypto trading hype—it’s its real-world utility. SMQKE highlighted multiple mentions of Ripple in academic documents as not only a post-crisis solution but a modern alternative to legacy systems that once triggered catastrophic failures.

These documents describe Ripple as a transparent, programmable, and scalable system, offering crucial safeguards against excessive financial complexity—like that which spiraled out of control with CDOs before 2008.

📊 Blockchain as a Guardian Against Systemic Risk

Another document shared by SMQKE dives into Ripple’s role in trade finance, emphasizing how its distributed ledger boosts transparency and discourages “excessive derivativeization”—a major factor behind the 2008 meltdown.

By making transaction flows auditable and reducing reliance on opaque financial instruments, Ripple’s tech could serve as a watchdog in modern finance, offering regulators and institutions a clearer, tamper-resistant window into global flows.

🏛️ Ripple’s Recognition Beyond Crypto

This isn’t just bullish for Ripple holders—this is validation at the institutional level. Academic literature now views Ripple as more than a payment rail—it’s part of a blueprint for financial resilience.

💬 SMQKE summed it up: Ripple is now firmly planted in the narrative of global financial evolution. From regulatory clarity to trade finance to real-time payments, Ripple’s influence stretches far beyond the XRP community—and the world is starting to catch on.

#Ripple #XRP #BlockchainReform #FinancialSystem #PostCrisisSolution #GlobalPayments #CryptoResearch