BNB briefly broke through 800 USD, resulting from multiple news and technical resonances. Combined with recent dynamics, the core driving factors for the surge are as follows:

I. Core growth drivers: DEX activity, stablecoin expansion, and deflationary mechanisms

Surge in DEX trading volume

BNB Chain processed 191 billion USD in DEX trading volume over the past 30 days, far exceeding Ethereum, Solana, and other public chains, dominating the market.

Top protocol PancakeSwap's weekly trading volume exceeded 40 billion USD for five consecutive weeks, with user activity reaching an all-time high.

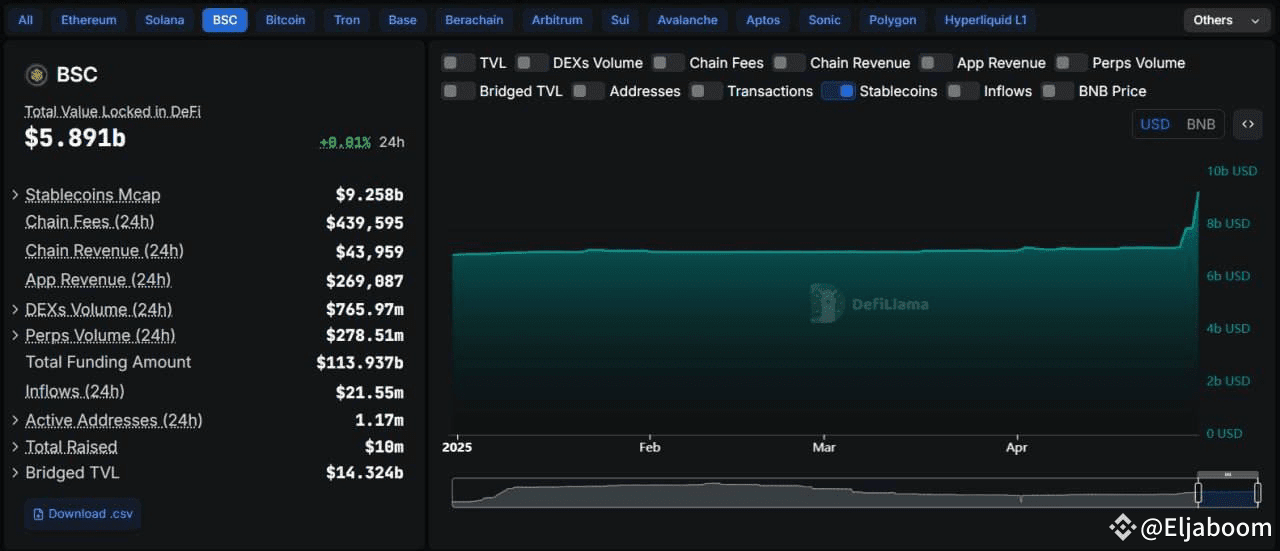

Explosive growth in the stablecoin ecosystem

BNB Chain stablecoin supply increased by 5% month-on-month, surpassing 11.1 billion USD, with on-chain addresses reaching 14.8 million (surpassing Tron), and cumulative transactions amounting to 295 billion USD.

The U.S. GENIUS Act provides a clear regulatory framework for stablecoins, attracting institutional funds into the BNB ecosystem.

Token burns strengthen deflationary expectations

Binance burns over 1 billion USD worth of BNB every month, aiming to reduce the total supply from 145 million to 100 million, with an annual deflation rate of approximately 4.77%.

The "real-time burn mechanism" (0.05% BNB burned per on-chain transaction) creates a positive cycle of "increased trading volume → accelerated burn → enhanced scarcity."

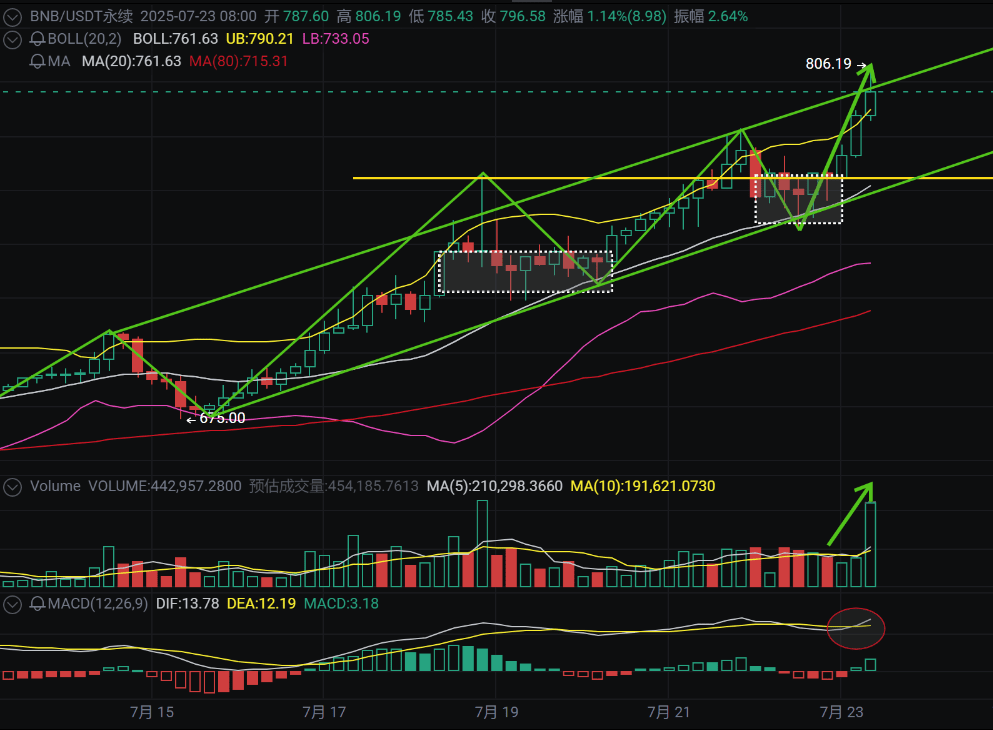

II. Technical breakout and market sentiment boost

Key resistance level breakthrough

Looking at the 4-hour chart, the index has begun ascending since mid-July, with a surge followed by a pullback and consolidation before breaking out for the next rally. This breakthrough occurred as the index touched the middle band of the Bollinger Band and broke through the consolidation range with consecutive bullish candles, accompanied by a MACD golden cross and increased volume.

III. Relaxation of regulations and capital trends support

SEC lawsuit pause alleviates regulatory pressure

The lawsuit against Binance is paused for 60 days, interpreted by the market as a short-term decrease in regulatory risk, boosting investor confidence.

Whales and institutional funds entering the market

On-chain monitoring shows that Binance's OTC dark pool has seen four large transactions exceeding 50 million USD in BNB, with buyers suspected to be Asian hedge funds and Middle Eastern sovereign funds.

Market makers Wintermute and Amber Group inject over 300 million USD in liquidity into the BNB Chain ecosystem, focusing on GameFi/SocialFi sectors.

IV. Short-term risk warning

Technical overbought: Daily RSI reached 83, indicating pullback pressure; attention should be paid to the support level of 730 USD (if it falls below, it may retrace to 685 USD).

Regulatory variables: If the execution details of the GENIUS Act become stricter, it may impact stablecoin activities.

Ecosystem competition: Public chains like Solana continue to optimize transaction speeds, which may divert BNB Chain users.

Tang Seng's conclusion

The surge of BNB is the result of a combination of "fundamental growth (DEX/stablecoins) + deflationary model + technical breakout + capital leverage." If DEX activity and burning intensity are maintained, coupled with the effectiveness of technical pattern breakthroughs, a mid-term target of 950–1200 USD has strong support at 310. It is recommended to continuously track on-chain trading volume (e.g., Dune Analytics) and Binance's monthly burn announcements, as these will be core indicators of future price trends.

Opportunities are fleeting; a pullback is imminent. Bottom-fishing is not a dream. If you are uncertain about buying and selling points and timing, follow me for insights into the bull market feast!#BNB走势