Bitcoin (BTC) and Ethereum (ETH) are the two largest cryptocurrencies, but they serve different purposes and have distinct technical features:

Bitcoin (BTC) and Ethereum (ETH) are the two largest cryptocurrencies, but they serve different purposes and have distinct technical features:

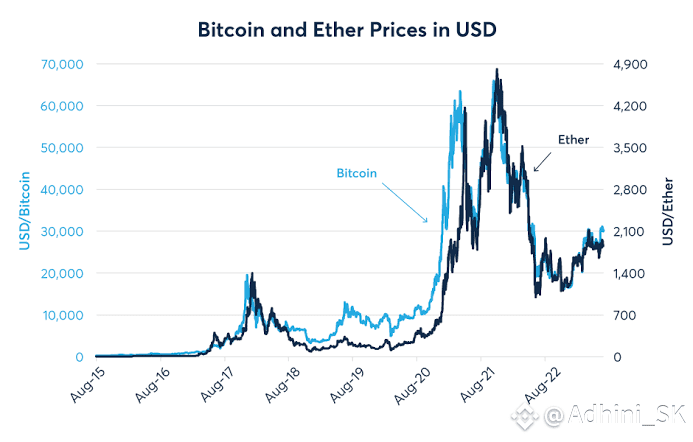

Current Price & Market Capitalization

Bitcoin (BTC):

Price: $118,406.80

Market Cap: $2.34 trillion

Ethereum (ETH):

Price: $3,818.73

Market Cap: $459.39 billion

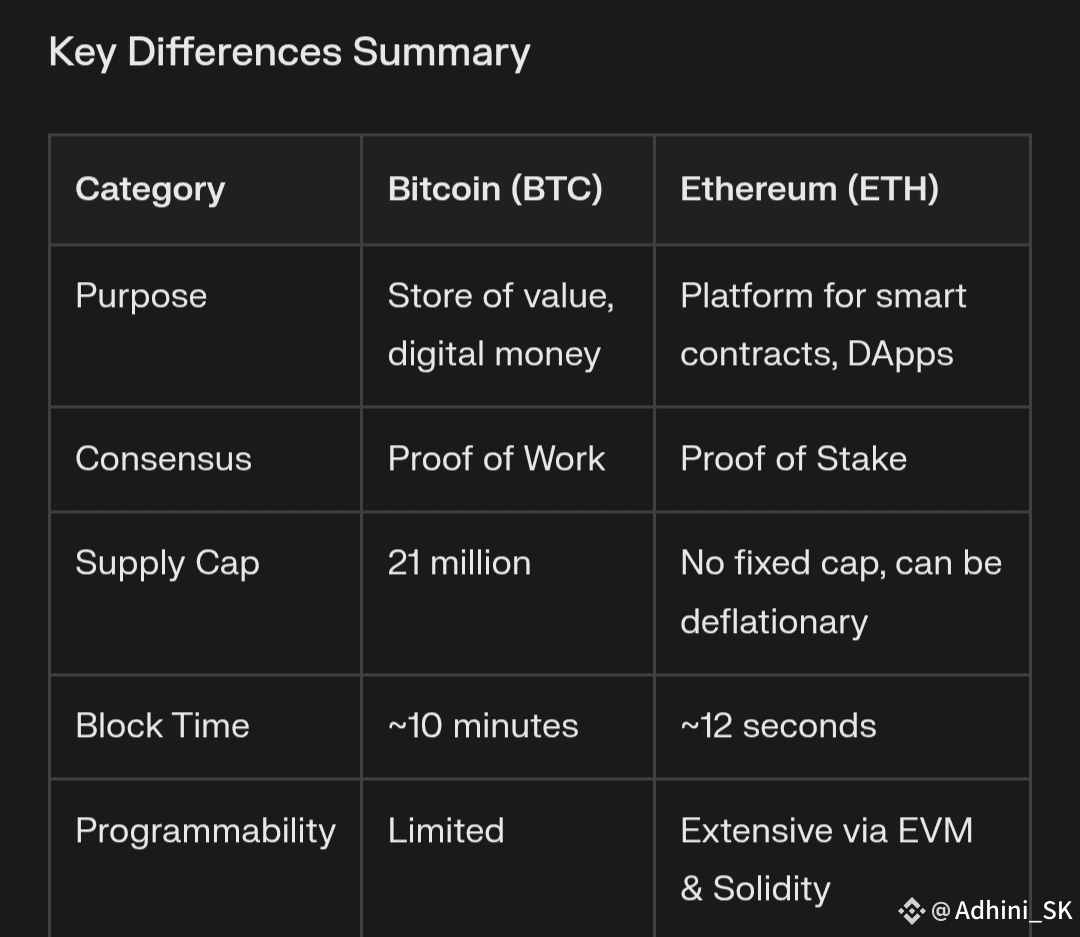

Purpose & Use Case

Purpose & Use Case

Bitcoin: Designed as a decentralized store of value and alternative to traditional currency. Often called "digital gold," it is primarily used for secure, peer-to-peer transfers and to hedge against inflation.

Ethereum: Functions as a programmable platform supporting smart contracts and decentralized applications (DApps). Uses Ether (ETH) to power these operations, making it more versatile for development in Web3, DeFi, and NFTs.

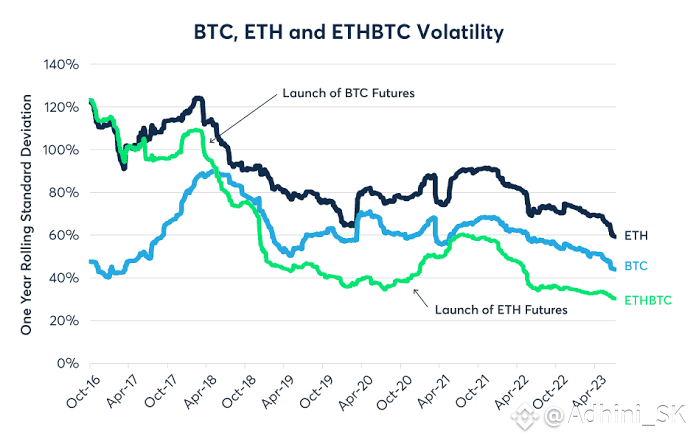

Consensus Mechanism

Bitcoin: Uses Proof of Work (PoW), which is energy-intensive but highly secure; block time is about 10 minutes.

Ethereum: Transitioned to Proof of Stake (PoS) in 2022, making it more energy efficient and allowing faster block times (~12 seconds).

Supply & Issuance

Bitcoin: Fixed supply of 21 million coins, making it a disinflationary asset.

Ethereum: No hard cap, but since recent upgrades, a portion of ETH is "burned" in every transaction, which can occasionally make ETH deflationary during periods of high network usage.

Programmability & Ecosystem

Bitcoin: Limited scripting for transactions, prioritizes security, and does not natively support complex applications.

Ethereum: Fully programmable via the Ethereum Virtual Machine (EVM), supports a wide array of decentralized apps, and forms the backbone of the DeFi and NFT sectors.

Common Analogies

Bitcoin: Digital gold (scarce, value-focused)

Ethereum: Digital silver (more versatile, adaptable, used for building applications)