Date: July 21, 2025

Exchange: Binance

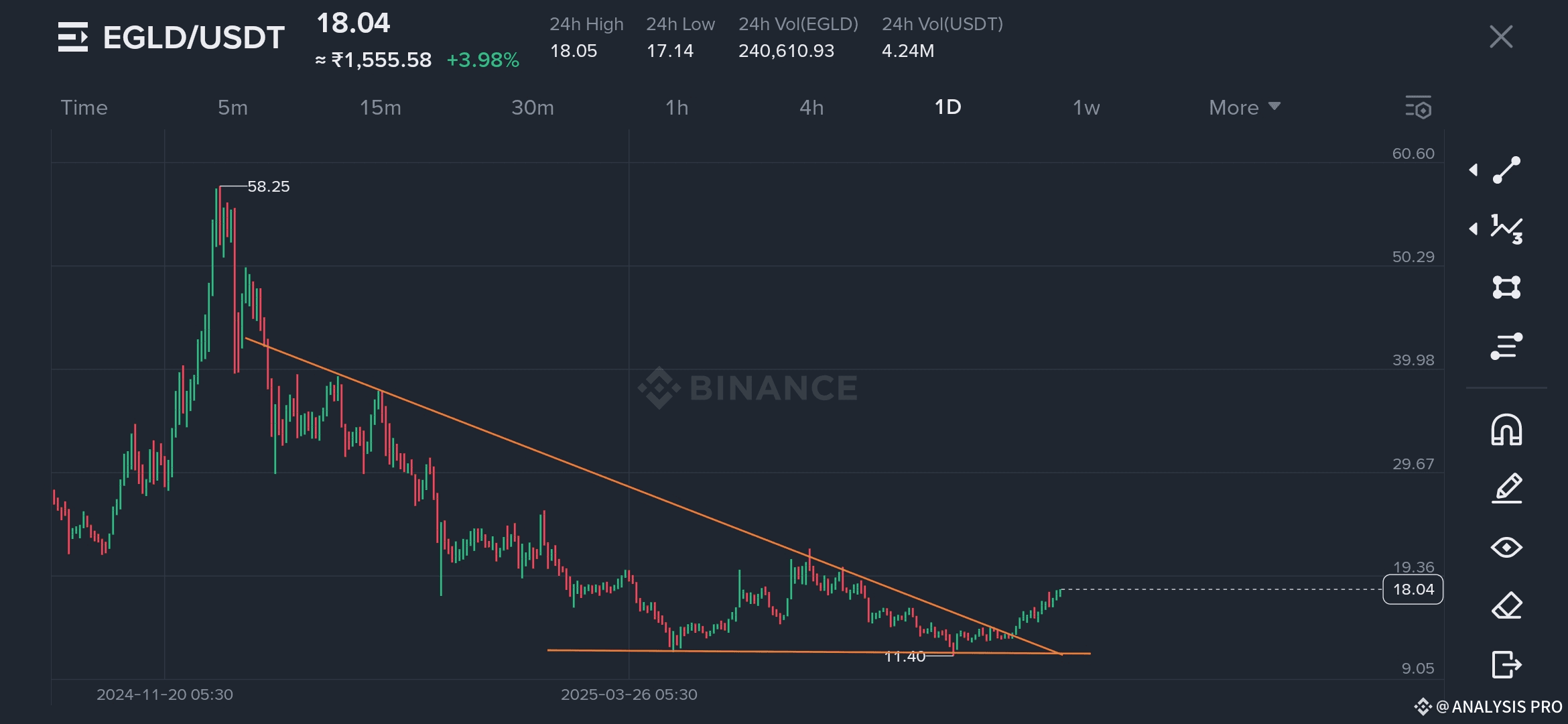

Pair: EGLD/USDT

Current Price: $18.04 (+3.98% in 24h)

Overview

EGLD, the native token of the MultiversX (formerly Elrond) blockchain, has finally broken free from a long-term downtrend. After months of price compression within a falling wedge pattern, EGLD has confirmed a bullish breakout and is currently showing early signs of trend reversal. This move could mark the beginning of a broader recovery phase for the asset.

Technical Pattern: Falling Wedge Breakout

Pattern Type: Falling wedge (bullish reversal)

Downtrend Duration: From the November 2024 high of $58.25 to the bottom at $11.40 in mid-2025

Breakout Confirmation: Price has broken above the upper resistance line of the wedge with a clean daily close and momentum pushing price toward $18

Falling wedges typically signify exhaustion in bearish momentum, especially when combined with a strong support base — in this case, around the $11.40 level.

Volume & Momentum

24h Volume (EGLD): ~240,610 EGLD

24h Volume (USDT): $4.24M

Price Action: +3.98% gain in 24 hours

Momentum: Strengthening post-breakout, with continued green candles indicating healthy buyer interest

The breakout is occurring with increasing volume — a critical confirmation signal for traders watching for sustainable upward movement.

Key Price Levels to Watch

Immediate Resistance: $19.36

Medium-Term Resistance Zones: $29.67 and $39.98

Major Resistance (Long-Term): $50.29 to $58.25

Support Level: $11.40 (strong base of wedge)

A daily close above $19.36 would mark a strong continuation signal and potentially trigger more buying pressure from swing traders and institutions.

Market Outlook

Short-Term (Bullish):

The wedge breakout and increased bullish activity suggest EGLD could soon test the $19.36 level. A successful move above that may open the door toward $29.67 — a psychologically and technically significant zone.

Medium to Long-Term (Recovery Phase Possible):

With the wedge spanning nearly 8 months and the downtrend likely exhausted, this breakout could evolve into a medium-term recovery if the broader market sentiment remains supportive. Targets include $30–40 and possibly a reattempt at the $50+ range later in the year.

Conclusion

After an extended decline, EGLD has broken out of a classic falling wedge pattern, setting the stage for a potential reversal. The confluence of long-term support at $11.40, increasing volume, and a bullish structure points to renewed market interest. While some resistance lies ahead, the current setup strongly favors the bulls.