$ETH $

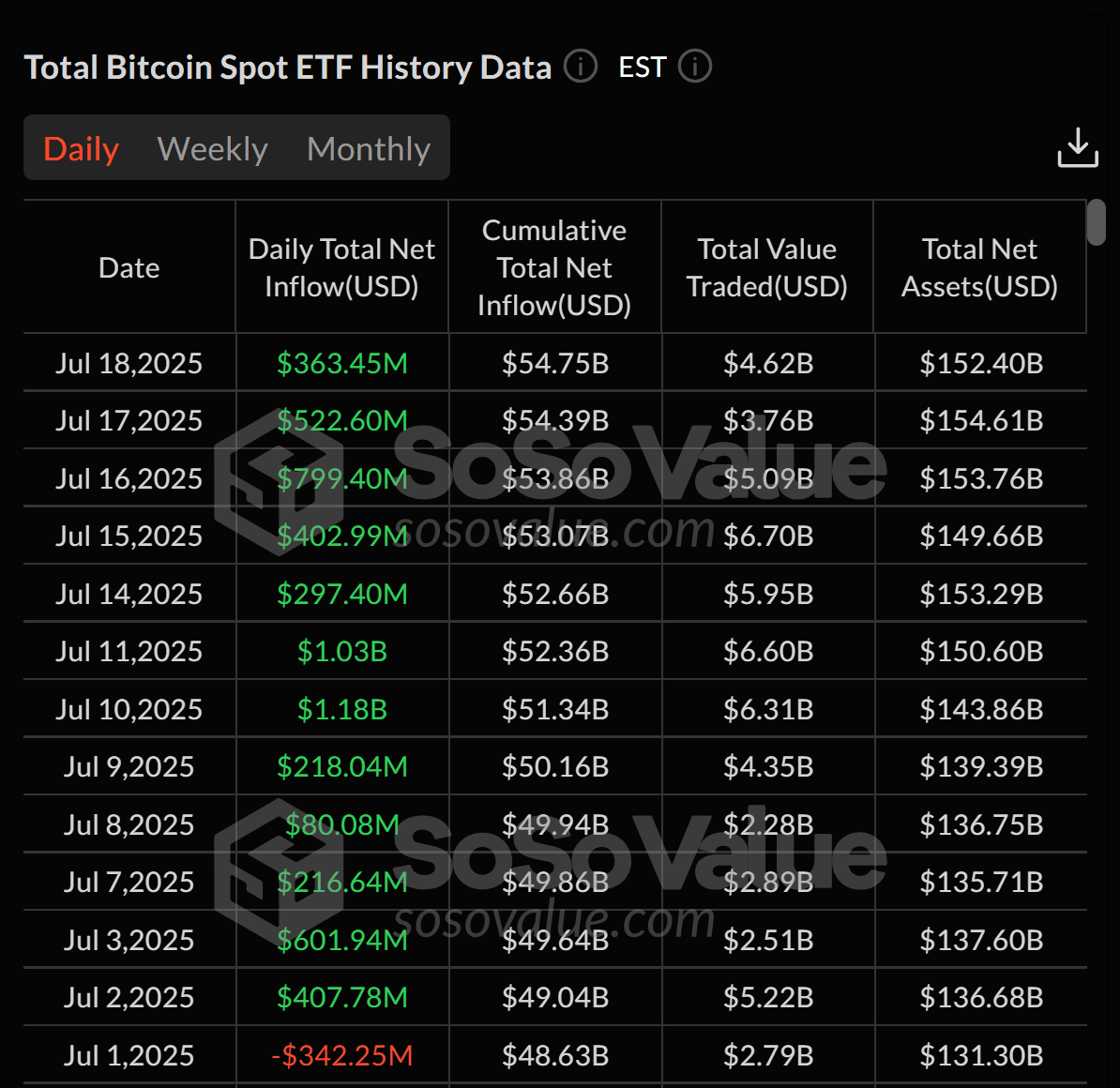

Spot Bitcoin ETFs recorded net cash inflows of $363 million on Friday, marking a streak of 12 consecutive days with positive cash flow, reflecting strong interest from investors.

BlackRock's iShares Bitcoin Trust (IBIT) continues to lead with net inflows of $496.75 million, reinforcing its position as the largest spot Bitcoin ETF, currently managing total assets worth $86.5 billion.

In contrast to IBIT, some other funds reported negative cash flow:

Fidelity's FBTC: net outflow of $17.94 million

Grayscale's GBTC: net outflow of $81.29 million while managing $21.45 billion

ARKB of Ark: net outflow of $33.61 million

Grayscale’s Bitcoin ETF (non-GBTC): no cash flow fluctuations, maintaining assets at $5.37 billion

Total trading value for the day reached approximately $4.62 billion.

Total net inflows reached $6.62 billion over 12 days

During the 12-day increase, spot Bitcoin ETFs attracted a total of $6.62 billion in net inflows.

July 10: reached a peak of $1.18 billion

July 11: continued strongly at $1.03 billion, marking the first time these products recorded cash flow over $1 billion for two consecutive days

Other notable days include:

July 16: $799.4 million

July 3: $601.94 million

July 8: lowest in the series, at $80.08 million

Total net inflows from the beginning of the year have reached $54.75 billion, while total assets under management (AUM) of all spot Bitcoin ETFs now stand at $152.4 billion, equivalent to 6.51% of Bitcoin's market capitalization.

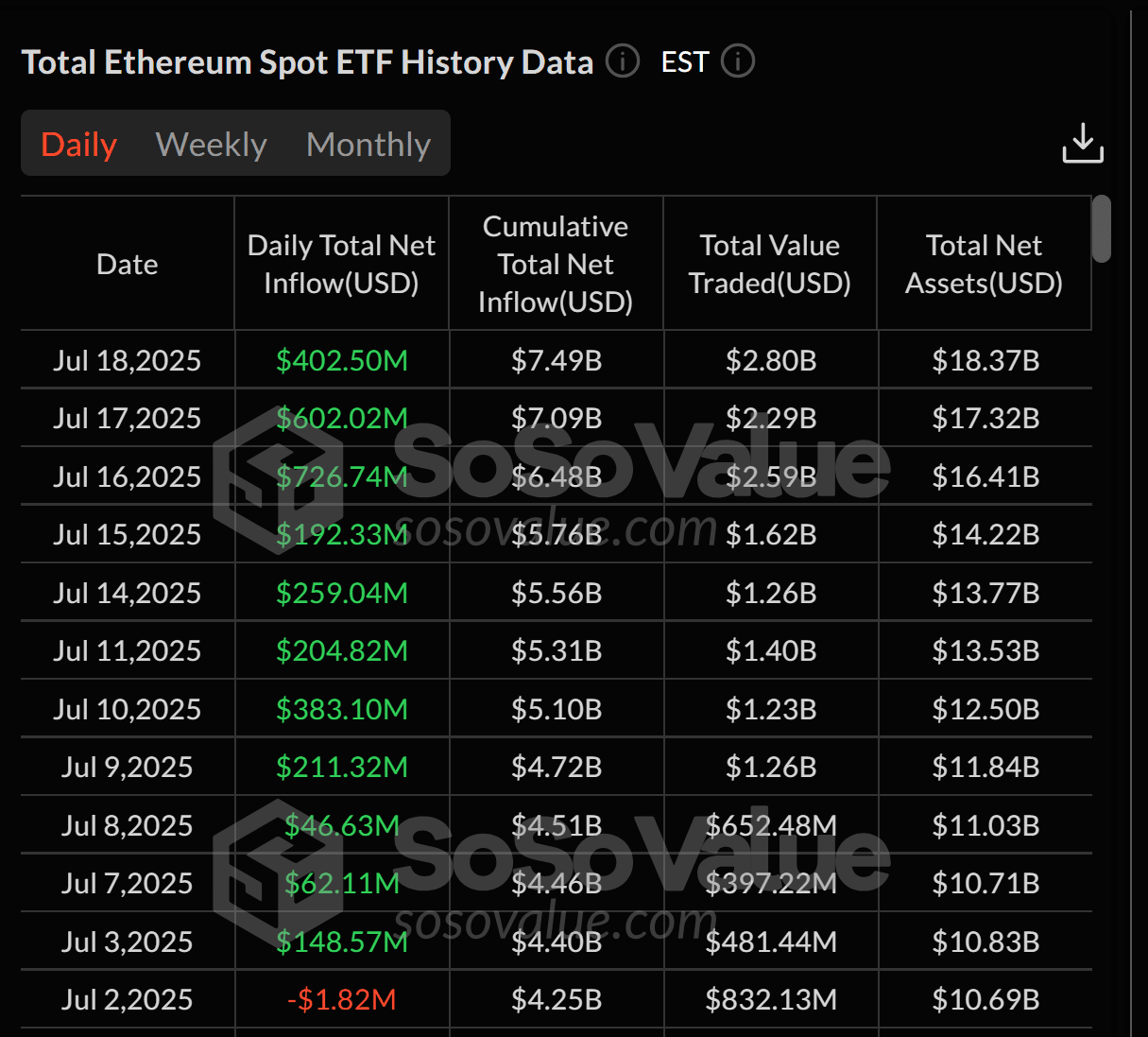

Spot Ethereum ETFs are also attracting strong capital

Not only Bitcoin, but spot Ethereum ETFs have also seen significant cash inflows in the past two weeks.

Friday: recorded net cash inflow of $402.5 million

In total: reached $7.49 billion in net inflows since these ETFs launched

In a streak of 11 consecutive days:

July 16: set a record with $726.74 million, the highest since its launch

July 17: continued strong growth with $602.02 million