In crypto trading, a well-planned strategy is often what separates winners from losers. Whether you're a day trader or a swing trader, understanding how market behavior unfolds can drastically improve your success rate. Here are three essential trade setups that can help you navigate the market more efficiently.

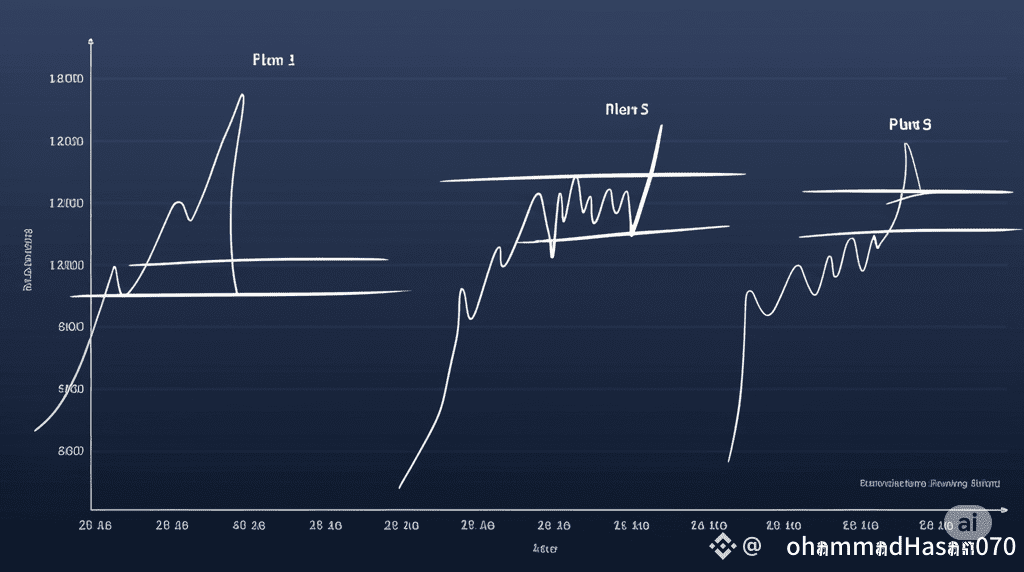

🚀 Plan 1: Sharp Move Up Followed by Reversal (FOMO Trap)

🔍 What It Looks Like:

A rapid price rally followed by a sudden spike, and then an equally steep decline.

🧠 Why It Happens:

FOMO (Fear of Missing Out) triggers panic buying, pushing prices vertically.

Smart money (experienced traders/institutions) use this moment to offload their holdings.

Once the supply overcomes demand, price reverses sharply, breaking below key support levels.

🛠️ How to Trade It:

Don’t chase the pump. Avoid buying into the emotional spike

Wait for confirmation. Watch for price to drop back to previous demand zones.

Buy the dip — but only at well-established support levels where buyers previously stepped in.

📈 Plan 2: Consolidation Then Breakout

🔍 What It Looks Like:

A strong upward move stalls into sideways consolidation, then resumes upward with a breakout.

🧠 Why It Happens:

The market "rests" after a strong move, allowing positions to accumulate.

Weak hands get shaken out, and a range is established.

Breakout signifies new momentum and stronger conviction from buyers.

🛠️ How to Trade It:

Monitor the consolidation range. A tight range often signals a powerful breakout ahead.

Buy the breakout or wait for a retest of the breakout zone.

Ideal setup for trend continuation trades.

🔁 Plan 3: Breakout and Retest

🔍 What It Looks Like:

Price breaks out of a resistance level, pulls back, and then retests the breakout zone as new support.

🧠 Why It Happens:

Traders take profit after the breakout, leading to a natural pullback.

Smart buyers step in to defend the breakout level.

If the level holds, it confirms a shift from resistance to support.

🛠️ How to Trade It:

Don’t rush into the breakout.

Wait for the retest and ensure it holds.

Enter on the bounce — this is a safer entry with clear risk management.

Often leads to a strong upward continuation.

Final Thoughts:

Successful trading is not just about reacting — it's about anticipating. By understanding these setups, you’ll be better prepared to:

Avoid emotional trades.

Time your entries with precision.

Ride trends with confidence.

Remember, discipline beats hype. Stay patient, analyze clearly, and keep learning every day.

🔔 Follow for more crypto insights, trading setups, and market strategies on Binance Square!