The listing of $AITECH on Binance Alpha on December 26, 2024, marked a pivotal moment for @AITECH and its supporters. A milestone many anticipated as a rocket launch, the post-listing trajectory has instead provided traders and investors with a sobering but instructive case study in crypto price behavior, market sentiment, and the long game of AI infrastructure tokens.

In a market fueled by narrative and timing, $AITECH now finds itself at the crossroads of emerging institutional interest and shifting retail momentum — a prime case within the evolving #CryptoMarket landscape. Whether this becomes a textbook #AltcoinBreakout or a prolonged accumulation cycle hinges on what we uncover next.

Let’s dive deep — to analyze the data, decode the trends, and explore what lies ahead for $AITECH

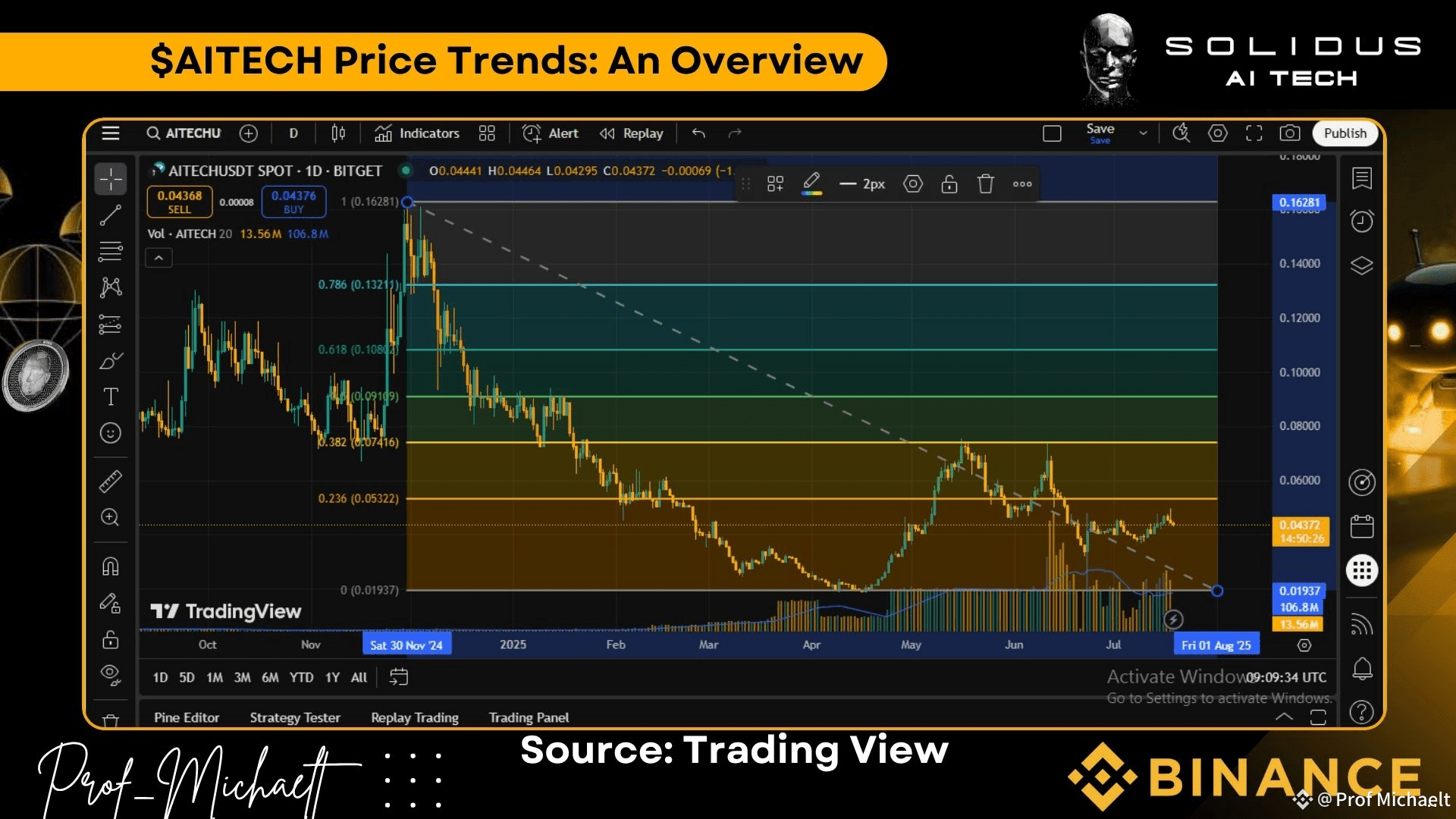

Price Action Before and After Binance Alpha Listing

To understand the true impact of the Binance Alpha listing, we examine the weekly opening prices surrounding the event:

Week $AITECH Price

Nov. 25 $0.11566

Dec. 2 $0.14270

Dec. 9 $0.13040

Dec. 16 $0.11175

Dec. 23 $0.09015

Dec. 26 (Binance Alpha listing)

Dec. 30 $0.08742

Jan. 6 $0.08319

Jan. 13 $0.09037

Jan. 20 $0.07256

Jan. 27 $0.06799

Feb. 3 $0.05209

June 30 $0.04153

July 7 $0.04006

July 14 $0.04316

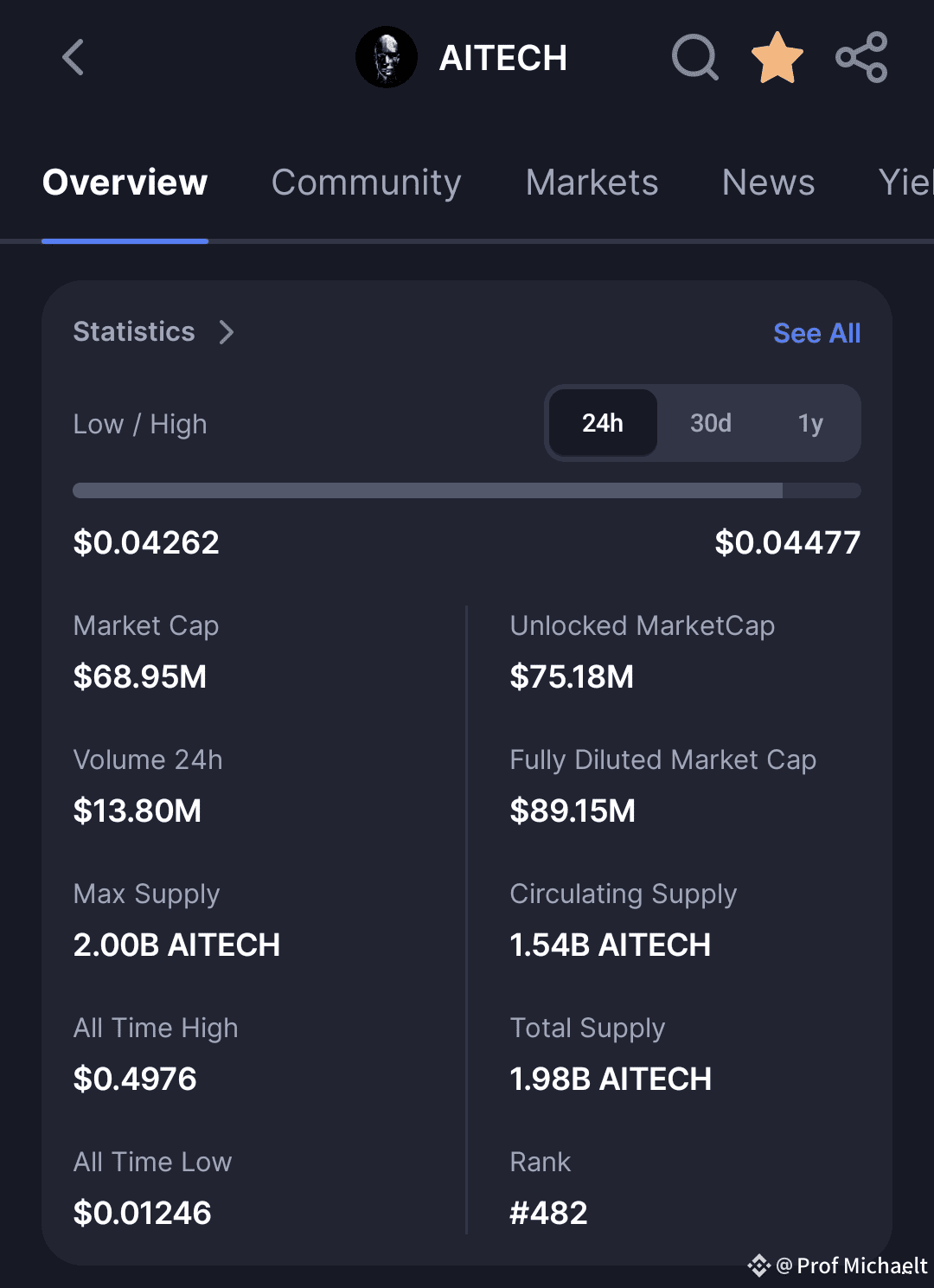

Statistics as at July 20th:

Pre-listing Surge:

Leading up to December, anticipation of the Binance Alpha listing drove a sharp run-up — peaking at $0.14270 on Dec. 2. This was followed by a gradual selloff as speculators began profit-taking.

Post-listing Drop:

Instead of an immediate pump, the market responded with a steep decline. From $0.09015 just before listing, $AITECH continued a downward slide, reaching a low of $0.04006 by July 2025 — a 71% drawdown from the November peak.

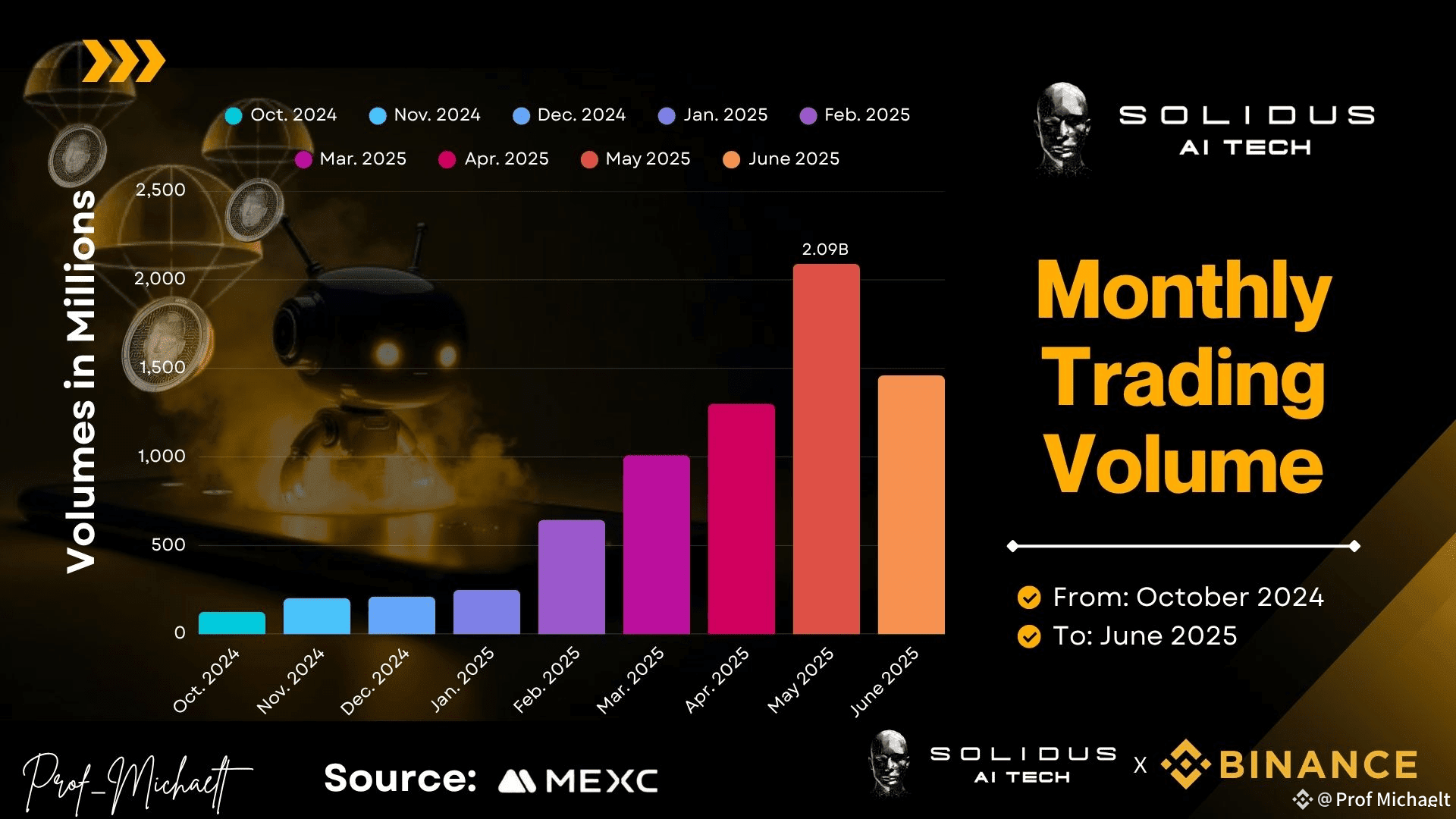

Volume Tells Another Story

Here’s where it gets interesting.

Despite the price decline, trading volume exploded after the Binance Alpha listing — suggesting increased market participation. February saw nearly 3x volume growth vs. December. By May, that number had surged 10x.

Interpretation:

This indicates that while short-term traders exited, new participants — including institutional or DePIN-aligned actors — entered the market. It supports the theory of capital rotation from speculators to longer-term holders and ecosystem integrators.

Future Projections: Bullish and Bearish Outlook

With price now consolidating near $0.043, we’re entering a key inflection zone. Let’s explore two major scenarios.

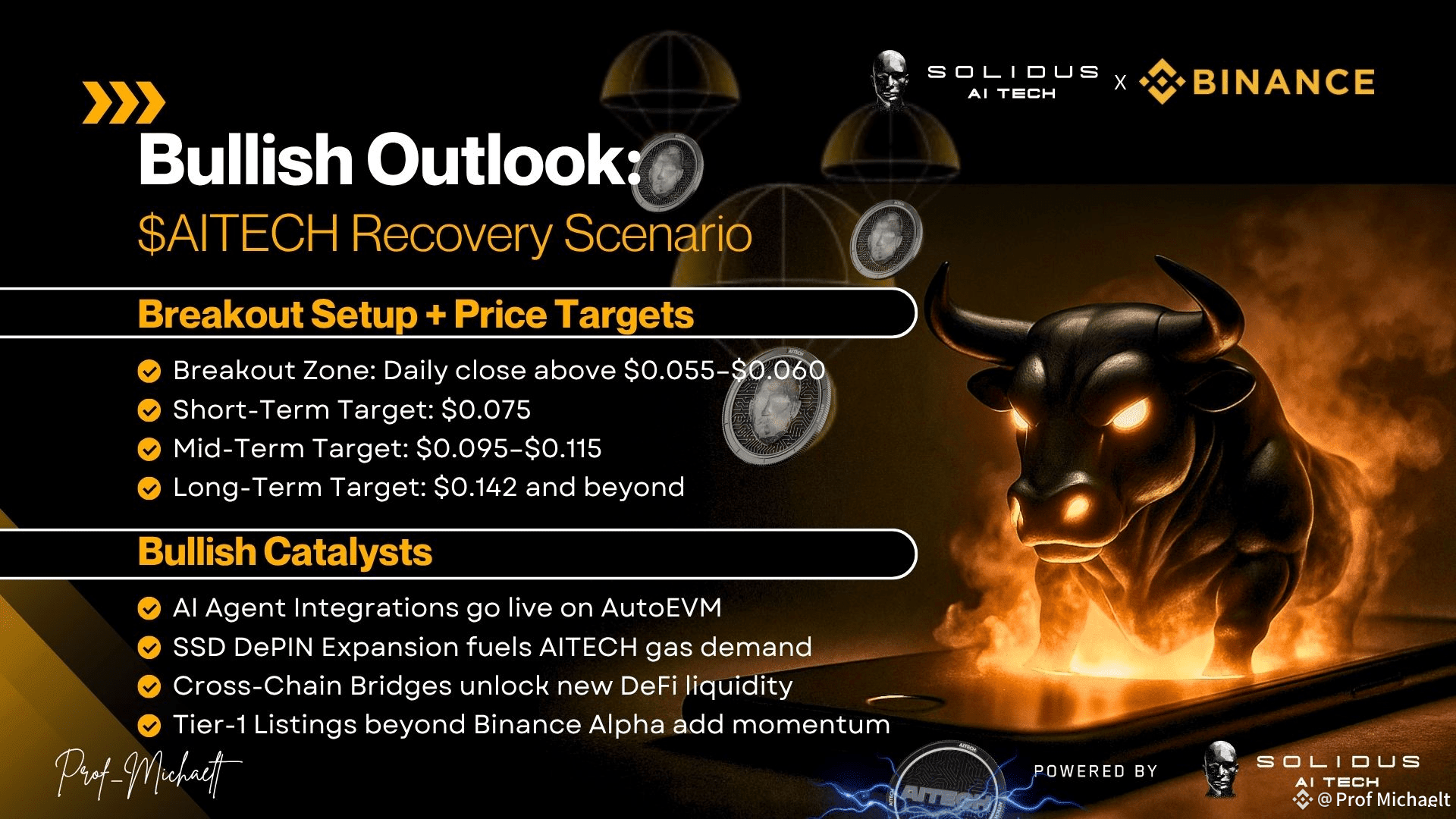

Bullish Case: Recovery to Accumulation Zone

Breakout Trigger: A daily close above $0.055–$0.060 backed by rising volume

Targets:

Short-term: $0.075 (minor resistance)

Mid-term: $0.095–$0.115 (former support & volume cluster)

Long-term: $0.142 (December 2024 peak) and beyond

Catalysts:

AI agent integrations go live on AutoEVM

DePIN SSD expansion drives usage of AITECH gas token

Cross-chain liquidity bridges boost DeFi exposure

Listings on Tier-1 CEXs beyond Binance Alpha

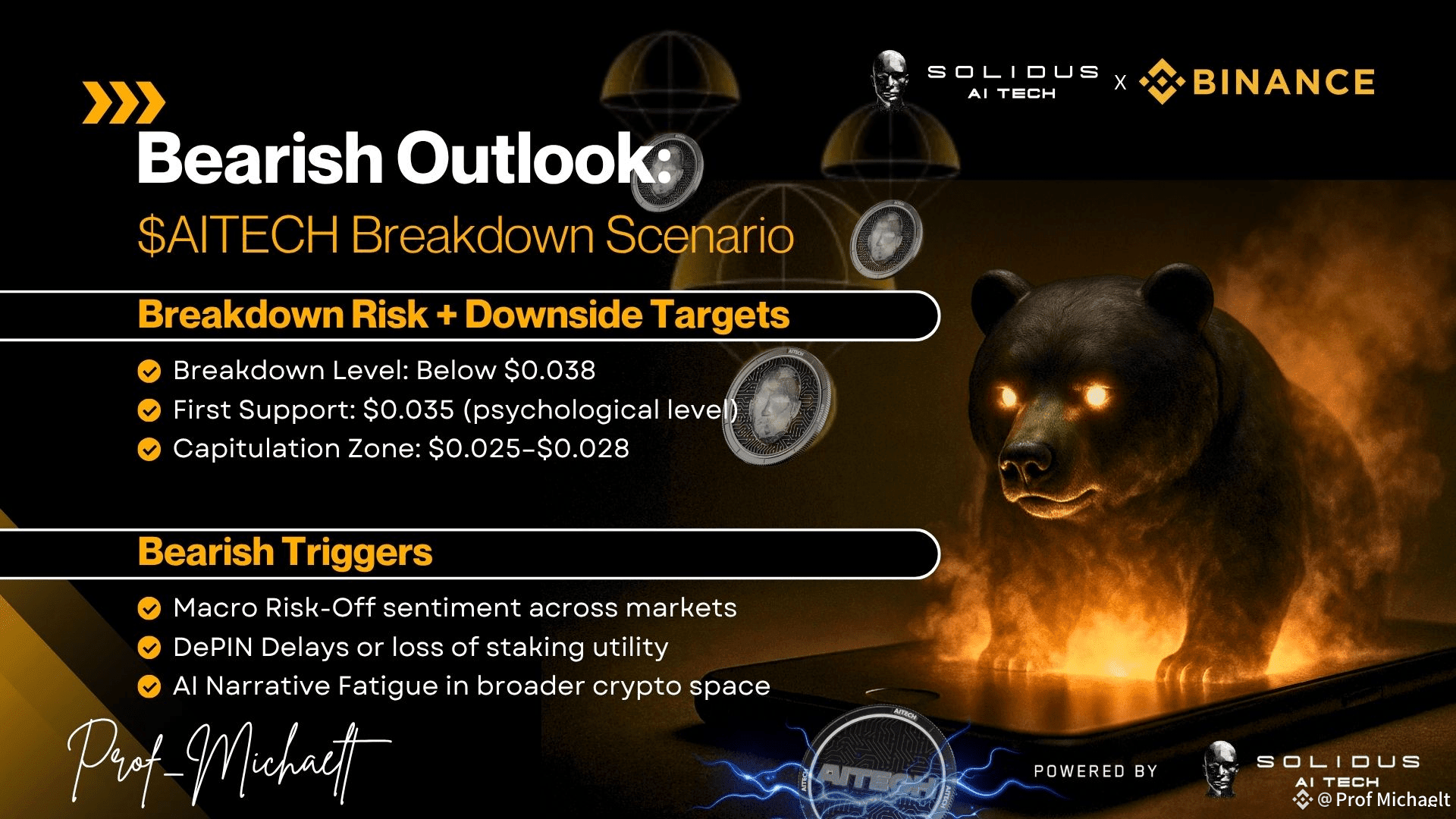

Bearish Case: Breakdown to Oversold Territory

Risk Zone: Breakdown below $0.038

Targets:

Support: $0.035 psychological floor

Capitulation zone: $0.025–$0.028 if volume dries up

Bearish Triggers:

Macro risk-off events

Prolonged DePIN delays or loss of staking incentives

AI narratives losing steam in broader crypto markets

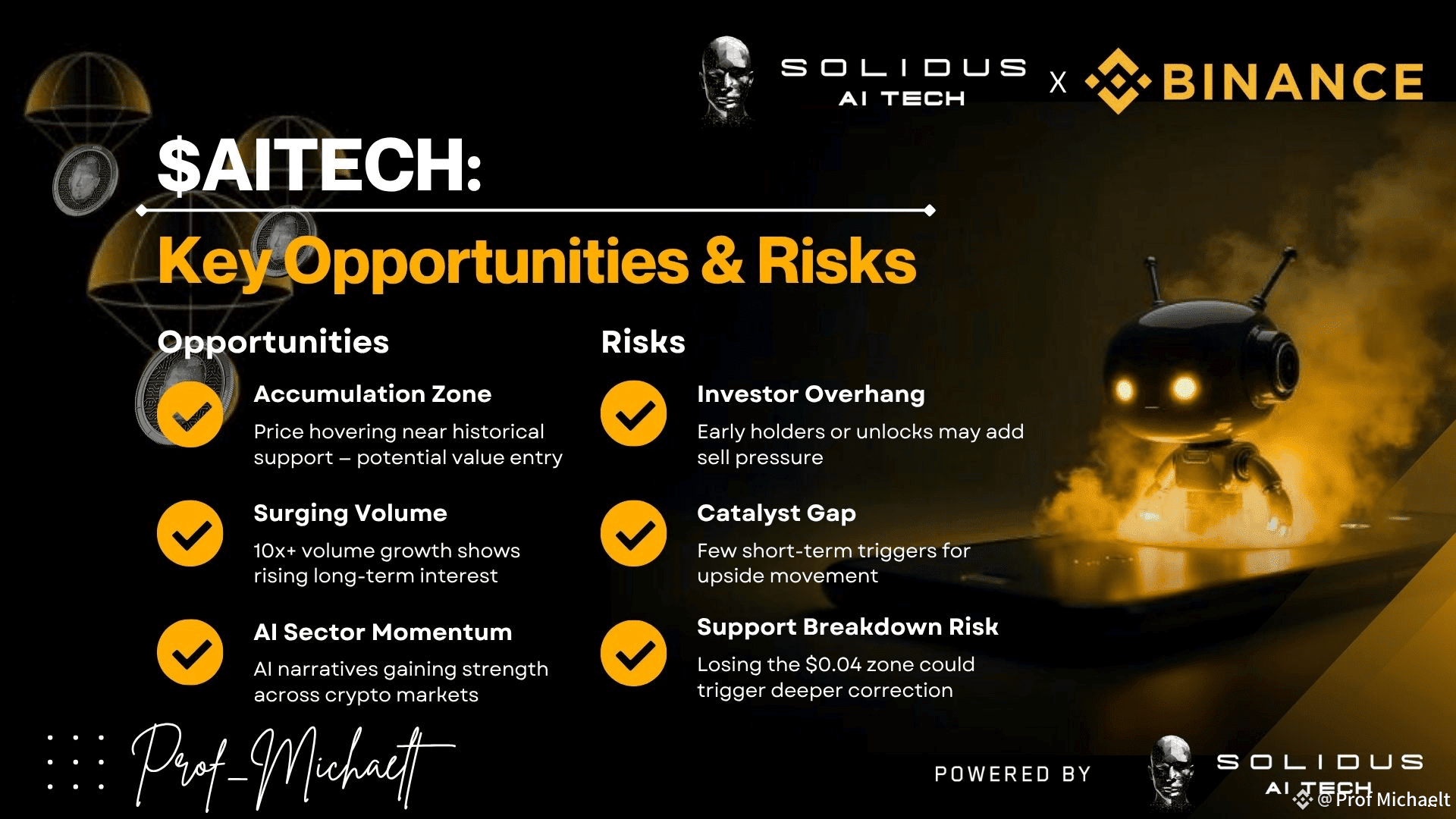

Opportunities and Risks

Opportunities for Traders

Accumulate during sideways consolidation in the $0.040–$0.050 zone

Use deep dips as entry points for medium-term rebounds

Volatility-driven swing trades around volume events or ecosystem launches

Opportunities for Investors

Position ahead of bullish AI narrative cycles (e.g. ETH ETF approvals, Nvidia rallies)

Long-term upside as AutoEVM and SSD DePIN scale up utility for $AITECH

Exposure to both infrastructure (AI compute) and agent-based Web3 applications

Risks to Watch

Delays in real-world usage of $AITECH gas

Concentrated token unlocks or excessive VC sell pressure

Competition from newer AI-DePIN hybrids or zk-infused L2s

Final Thoughts

The Binance Alpha listing wasn’t a final destination — it was a checkpoint. The correction that followed was steep, but volume patterns show that conviction is building under the surface.

For those watching closely, @AITECH is quietly transitioning from a speculative play to a long-term digital infrastructure asset. One that powers AI agents, rewards DePIN storage providers, and soon bridges across multiple chains via AutoEVM.

The market may have looked away. But builders haven’t stopped.

Explore $AITECH on Binance

Ready to make your move?

Discover $AITECH on Binance Alpha

Follow the data, watch the volume, and position accordingly. The next breakout may not wait for consensus.