In the past 24 hours, XRP has recorded a strong increase of 8–10%, trading in the range of $3.36 to $3.52. Continuous closes above the $3 threshold are seen as a positive technical signal, as this level is now acting as strong support.

📈 Technical Analysis Summary

XRP has just completed a 'W' (double bottom) pattern on both the daily and weekly charts – a pattern that typically signals a continuing uptrend.

Important resistance levels:

$3.85

$4.00

$4.10

$4.50

If the price continues to close above $3.20, the short-term target will be in the range of $3.40 – $3.60, followed by $4.00.

🐋 Cash Flow from Whales & Institutional Investors

The Open Interest volume in the futures market has reached the highest level since 2021, at $9.98 billion – indicating strong interest from professional investors.

The amount of XRP held by whale wallets is also at a record high, reflecting significant cash inflow into the market.

🌍 Legal Developments & Global Progress

The US Congress recently passed a bill creating a legal framework for stablecoins – a significant step with positive implications for the entire cryptocurrency market, including XRP.

Legally, Ripple gained a significant advantage in the lawsuit with the SEC in July 2023, when the court determined that selling XRP to the public does not constitute a security. However, some restrictions still apply to sales to institutional investors.

🔭 Medium – Long Term Expectations

According to experts like Hawks and Bitget, if legal factors continue to progress and institutional capital flows in, the price of XRP may break out even further.

⚠️ Risks to Consider

Profit-taking: Many investors may take profits in the price range of $3.60 – $3.80.

Market adjustment: If BTC or the entire altcoin market adjusts, XRP may also be pulled down. Support levels to watch: $2.98 and $2.85.

Legal risks: The Ripple – SEC lawsuit is not yet fully resolved. Any new ruling could significantly impact the price of XRP.

📌 Suggested Trading Strategy

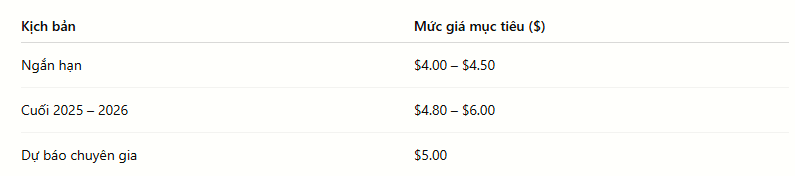

In the short term: XRP is in a clear uptrend, supported by technical charts, volume, and whale cash flow. Short-term target: $4.00 – $4.50.

Medium term (6–12 months): If the upward momentum continues, the price range of $5 – $6 is feasible.

Long term ($6 and above or $10): Clear legal progress and factors such as ETFs or participation from government funds are needed.

Risk management:

Set a stop-loss level if the price falls below $3.20 – $3.00. At the same time, diversify your portfolio with BTC or ETH to mitigate risks from a single coin.

✅ Conclusion

XRP is currently in a clear uptrend, supported by technical signals and institutional cash flow. However, the potential for short-term adjustments and profit-taking should be considered.

👉 If you are considering investing, adjust your position accordingly and always set a stop-loss level that matches your risk appetite.