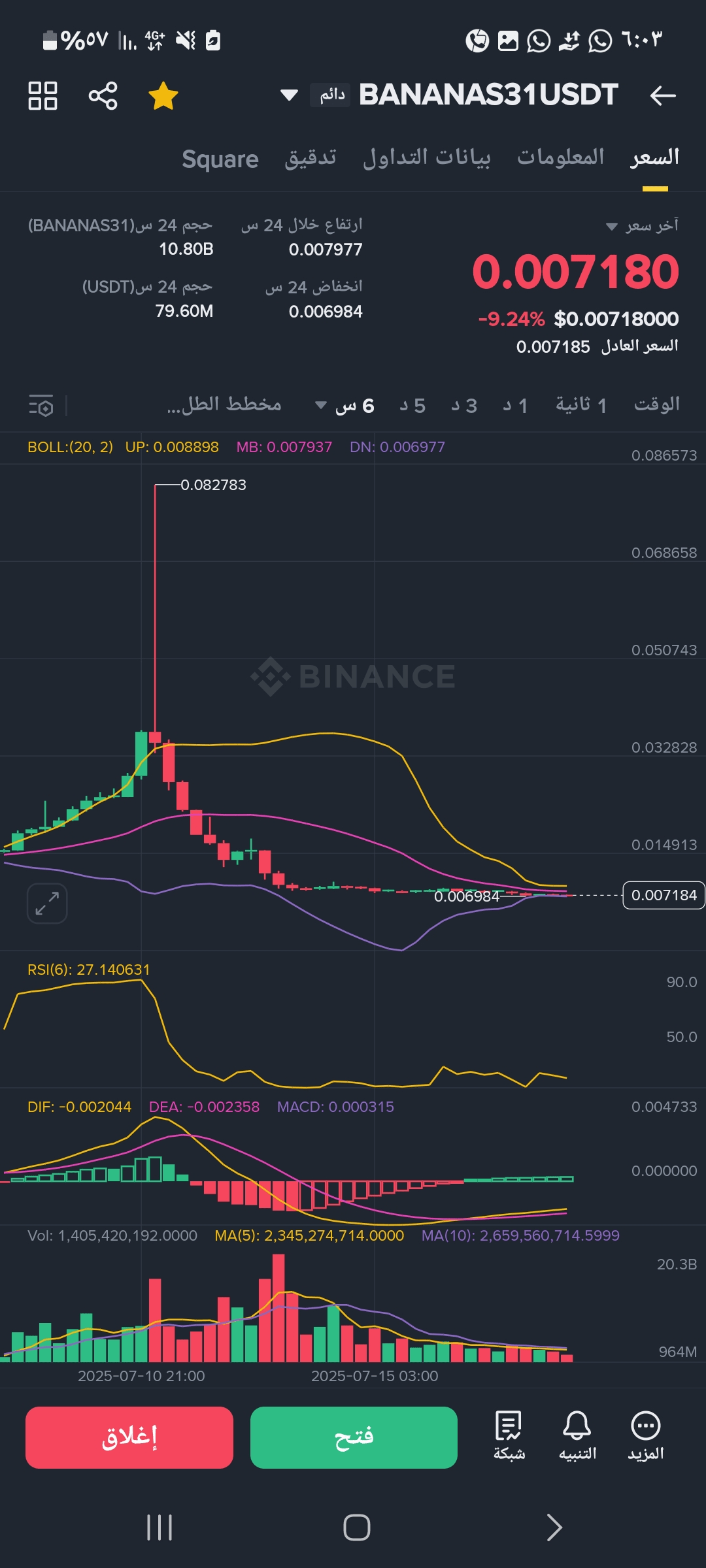

✅ First: A quick look at the overall condition

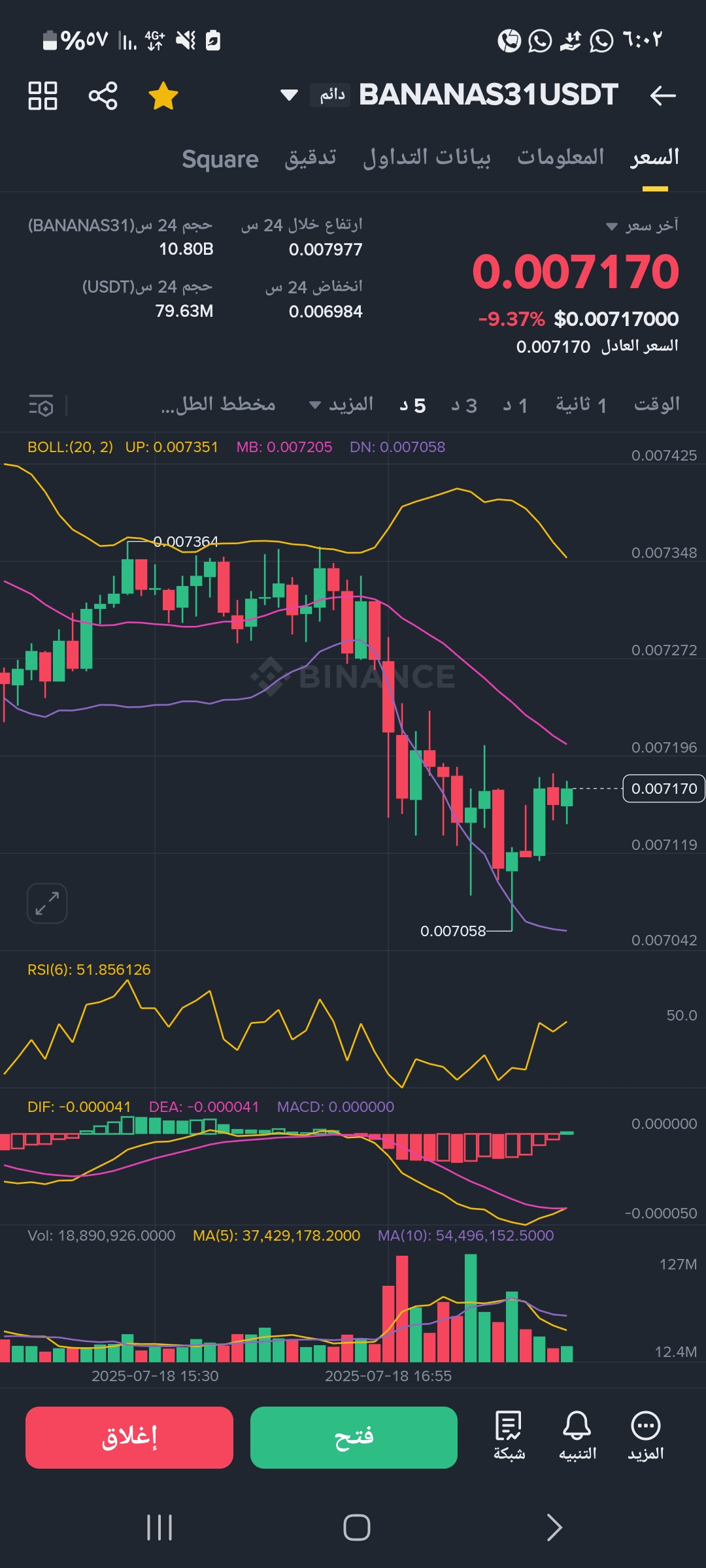

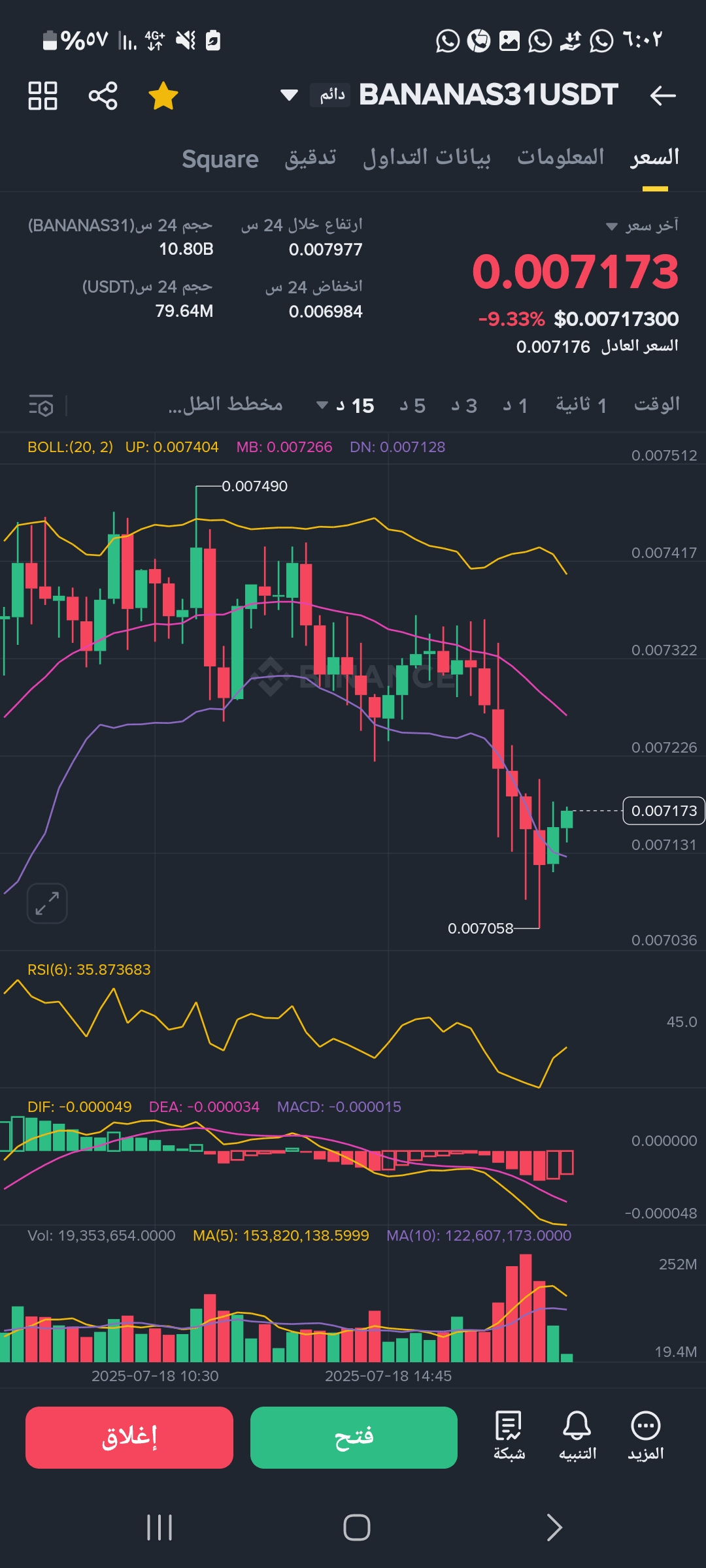

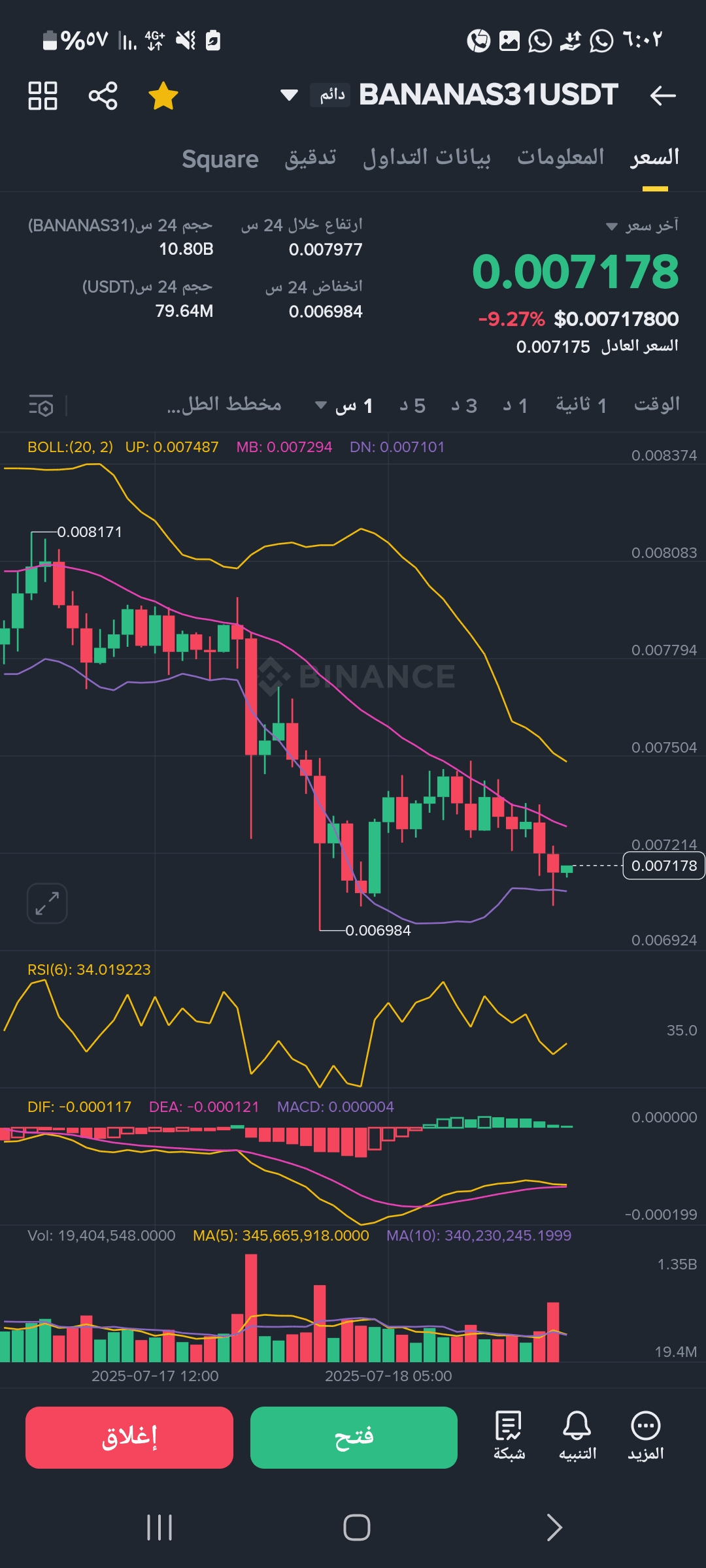

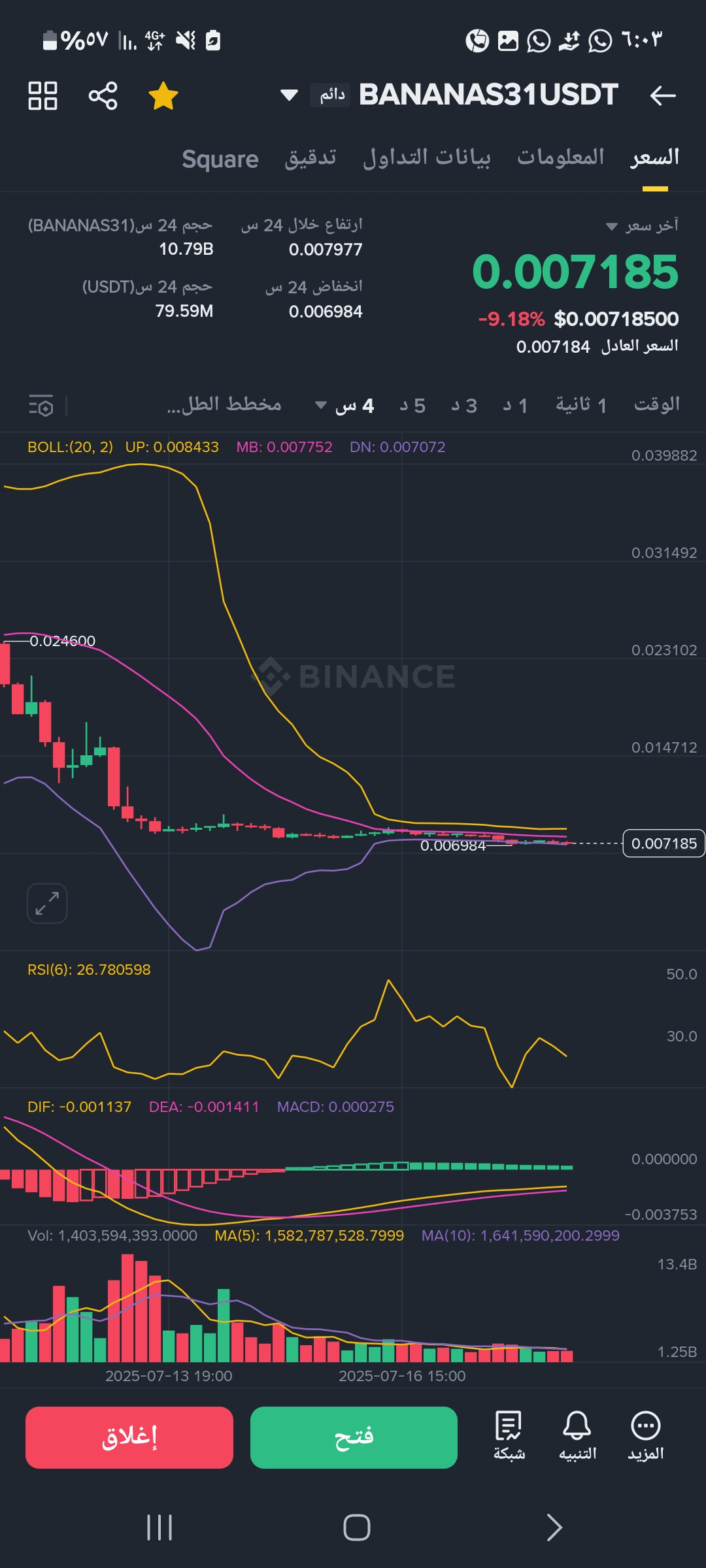

Current price: 0.00717 – 0.00718

Lowest price in 24 hours: 0.006984

Highest price in 24 hours: 0.007977

Daily drop: approximately -9.2%

The market is in a clear selling pressure but with the beginning of a technical rebound from the bottom.

📉 Candles and support and resistance areas

There is a clear rebound from the bottom 0.006984 / 0.007058, indicating strong support in this area.

The recent green candles (on the 1-minute and 15-minute frames) give slight correction signals upwards but the averages have not been broken yet.

📊 Technical indicators:

✅ RSI (Relative Strength Index):

In most frames between 26 – 35 → oversold ➜ this supports the occurrence of a temporary rebound upwards.

✅ Bollinger Bands:

The price in all frames is moving near or outside the lower limit → also a possible rebound signal.

Bollinger convergence means a potential price explosion coming (up or down).

✅ MACD:

Convergence is shown in all frames with the beginning of a decline ➜ Initial positive signal but no strong bullish crossover has occurred yet.

✅ Volume (trading size):

We noticed an increase in buying volume at the bottom → this enhances the likelihood of a short-term rise.

🧭 Expected direction in the coming hours:

🔺 Positive scenario (closest currently):

Technical rebound towards areas:

🔹 0.00725 (closest resistance)

🔹 Then 0.00735 - 0.00745 (medium resistance)

🔹 And if 0.00750 is strongly broken, we start targeting 0.00785 – 0.0080

🔻 Negative scenario (if the rise fails):

Breaking the level of 0.006984 will lead to a sharp drop towards:

🔻 0.00680 – 0.00660

🔻 Then 0.00620 (danger zone)

🎯 Recommendation for day traders:

If you are in the trade from the bottom, you can hold with a strict stop loss below 0.00695.

If we close above 0.00735 positively, it gives a strong boost for the rise.

Monitor the volume and closing above the middle Bollinger (the purple line) carefully.#BinanceSquareFamily