By Nicky, Foresight News

As one of the most outstanding trading platforms in this cycle, Hyperliquid has a daily trading volume of over $15 billion, accounting for over 74% of the Perps share on the chain, and its native token HYPE currently ranks 12th in the cryptocurrency market capitalization ranking. Hyperliquid's ambition is not only to become a single on-chain trading platform, but to build an ecological network with itself as the core, Hyper EVM.

Recently, a new project Project X in the Hyper EVM ecosystem has attracted community attention. The TVL of this DEX has exceeded 40 million US dollars in just three days since its launch. As an emerging project, Project X's ecological position and team background are worthy of attention.

To understand the birth of Project X, we cannot avoid the "previous work" of its founding team - Pacmoon.

As a social meme project on the Blast chain, Pacmoon relied on the "Yap model" (driving token value through social fission and community consensus) and its FDV reached over 200 million USD, becoming a representative project of the Blast ecosystem at the time. However, the FDV of the project's token PAC is currently only 35,000 USD, close to zero. On the one hand, this is due to the gradual demise of the Blast network, and on the other hand, it also shows that the project is short-lived.

According to official documents, the identity of the project founder has not yet been determined, but the team consists of seven main members, including Lamboland in charge of growth, BOBBY in charge of product operations, hisho in charge of product design, and Ali in charge of creative guidance. In addition, there is a CTO with a YC background and two DeFi native backend developers.

Among the four people whose nicknames have been made public, judging from the tweets they have posted, all four have participated in the construction of Pacmoon or Blast networks to varying degrees. Lamboland and BOBBY are the founders of Pacmoon.

Today, the team has turned its attention to DeFi infrastructure: AMM DEX (Automated Market Maker Decentralized Exchange). In the planning of Project X, the team hopes to jump out of the framework of "imitating Uniswap" and change the competitive logic of trading platforms through "distribution mechanism, incentive design and user experience". As the official website says: "Technology is converging, and the winner of the next round of DeFi will be how to distribute value more efficiently, design incentives, and make users willing to stay."

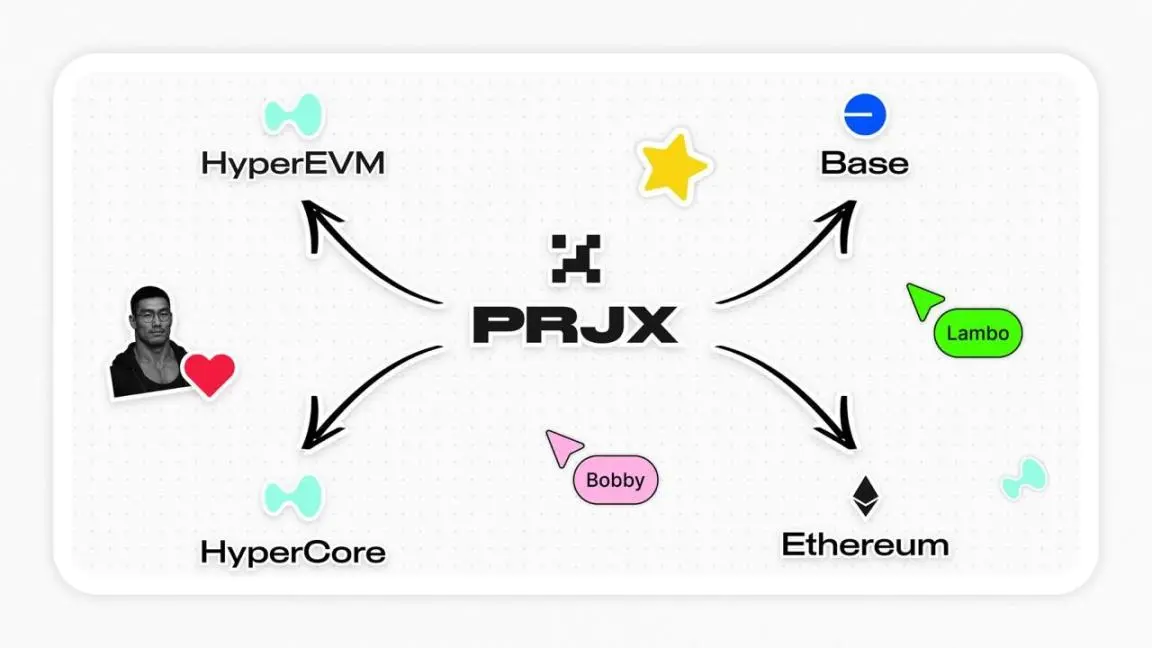

The development of Project X adopts a phased advancement strategy, currently focusing on the first phase "HyperEVM DEX", which will be gradually expanded to "EVM Aggregator" and the undisclosed third phase. The ultimate goal is to become "the preferred trading platform for crypto traders."

As the current core product, it is positioned as a "Uniswap-style AMM DEX", but it has made differentiated designs in user experience and incentive mechanisms:

Fee allocation: In the V3 version, 86% of the transaction fees are directly allocated to liquidity providers (LPs), and the rest is used for protocol operations. This ratio belongs to the "high LP return" echelon among similar AMMs, and the official website bluntly stated that "LPs should earn more income in Project X";

V2 pool preparation: Although the V2 version has not yet been launched, the team has released signals that it will further increase LP returns in the future through more complex market-making strategies (such as dynamic fees and cross-chain liquidity aggregation).

After completing the construction of the first phase of HyperEVM DEX, the second phase of "EVM Aggregator" will focus on cross-chain transaction aggregation. Users can access the liquidity of multiple EVM chains with one click through Project X, solving the current pain point of "multi-chain DEX fragmentation".

How to participate

Project X’s points mechanism is the key to activating user growth. Currently, points are the core credentials for users to participate in the ecosystem, and in the future they may be directly linked to token airdrops or ecosystem rights.

The current path to obtaining points clearly points to "user contribution":

Liquidity provider (LP): Users can deposit assets into the liquidity pool of HyperEVM DEX (such as the currently promoted kHYPE pool) and earn points based on the transaction fees generated. The official website specifically emphasizes that "most of the points will go to LP" and that the point calculation is strongly related to "fee output" - for example, a user who deposits $1 million in a liquidity pool and generates $100 in fees will have lower points than a user who deposits $10,000 but generates $1,000 in fees;

Trading: Users complete spot transactions on the platform (subject to payment of handling fees) and earn points based on the size and frequency of transactions;

Invite friends: By sharing the exclusive invitation code, users can get double rewards: first, earn 10% of the points generated by friends as a referral reward; second, the basic points acquisition efficiency of friends is increased by 10% (for example, a friend can originally get 100 points per day, and can get 110 points after inviting).

At the same time, in order to quickly cold-start the ecosystem, Project X set up short-term incentives:

1 million points pool per day: At the current stage, the platform releases 1 million points every day, and all users' points are obtained from this pool;

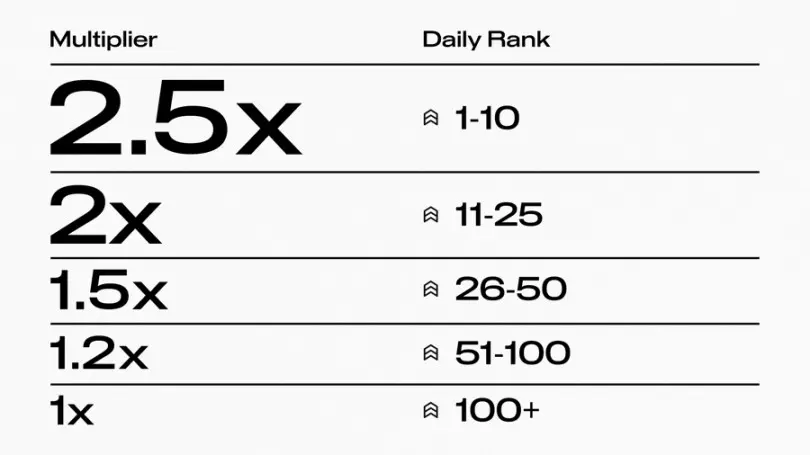

First month points multiplier: In the first 30 days, the top 100 users with the highest daily points will receive a points multiplier reward of at least 1x.

It should be noted that the project has recently adjusted the points system UI, and the current points acquisition has been reflected in the user interface in real time, but the specific airdrop rules (such as the exchange ratio of points to tokens, and the airdrop time) have not yet been announced and are subject to subsequent official announcements.

Risk Warning

Unlike most DeFi projects that rely on VC financing, Project X's funding source appears to be more "grassroots": the official website clearly states "100% self-raised funds, no VC, no angel investment, no private placement." The advantage of this model is that the team has greater control over the project and is more inclined to "long-termism."

However, it also comes with potential risks. The lack of external financing means that the project's risk resistance is weak. If it encounters extreme market conditions or smart contract loopholes, it may face the dilemma of "unable to compensate users for losses."